European VLSFO prices are worth watching

Recent uptick in oil prices; but for temporary reasons

There are mixed signals driving the absolute price of oil at the moment, with a slightly more bullish push over the past two weeks. But, to put it in context, this recent uptick followed a sharp drop in prices at the end of January and into the first few days of February, when Brent crude fell from $82/bbl to $77/bbl. The ‘bullish’ push in the past two weeks has only brought Brent back to $82/bbl.

Looking at very low sulphur fuel oil (VLSFO) prices in Singapore and Fujairah, these have traded in a narrow $25/mt range so far this month and are still lower than their end January levels (and $35-40/mt lower than average November prices). This is not the case in Rotterdam.

Source: Integr8 Fuels

Source: Integr8 Fuels

Behind these price movements there have been some temporary bullish factors in the oil industry so far this year. Arctic weather conditions in North America shut in around 0.9 million b/d of oil production and halted around 1.7 million b/d refinery operations. At the same time, there have been planned, heavy maintenance programs in the Atlantic Basin refining industry running through January and into February. This again has restricted product availabilities and led to lower stock levels. But these are temporary issues!

On the bearish side, in recent reports we have focused on the weak prospects for oil demand this year, and this is still in play, especially when you look at the International Energy Agency’s (IEA) latest forecast for 2024. Also, gains in non-OPEC production look as though they will be high this year, and the recent cuts in OPEC+ production have been limited to only 0.2-0.3 million b/d from December levels. Therefore, the fundamentals for this year would indicate a ‘lid’ on prices. This, plus the ability of the industry to work around the attacks on Red Sea shipping, has so far superseded the heightened political events and risks in the Middle East region.

European VLSFO prices are ‘more exposed’

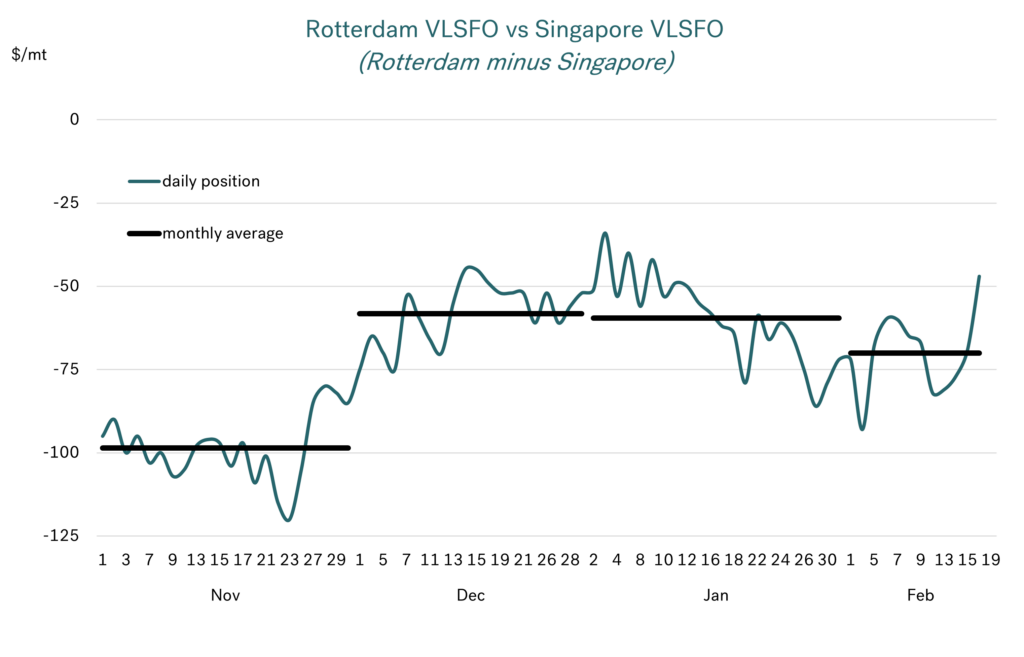

From the chart above, Rotterdam VLSFO prices have risen more steeply than in Singapore and Fujairah over the past two weeks. Rotterdam VLSFO prices are around $50/mt higher than in early February, and unlike the other major bunkering hubs, Rotterdam prices are higher than we have seen so far this year, and some $10/mt above their November average.

Back in November, Rotterdam VLSFO was priced at around $580/mt and Singapore at around $680/mt, i.e. a differential of $100/mt. Between then and now Singapore prices have fallen by $40, but Rotterdam prices have gone in the opposite direction and are around $10 higher. The net result is that the differential between the two markets has narrowed from $100- to $50/mt.

Source: Integr8 Fuels

Source: Integr8 Fuels

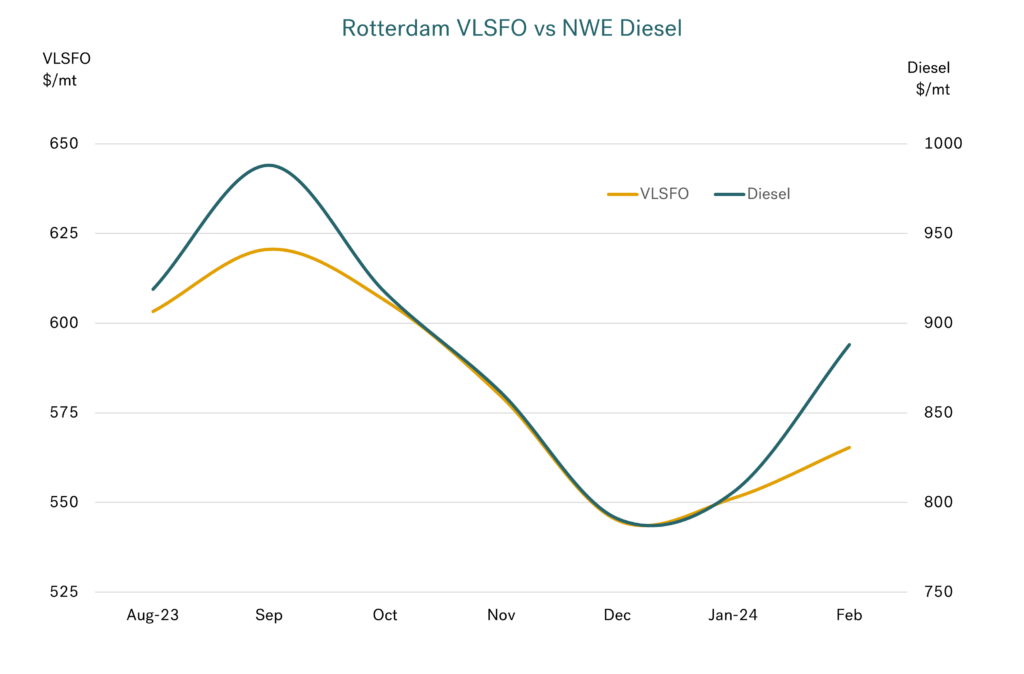

VLSFO pricing related to middle distillate pricing

The nature of VLSFO means supply and price movements are closely related to what is happening in other products. The chart below shows the close relationship between Rotterdam VLSFO and NW European diesel prices.

Source: Integr8 Fuels

Source: Integr8 Fuels

The European VLSFO market looks like it will only get tighter

Europe is naturally short in the middle distillates of jet, diesel, and gasoil and so highly dependent on imports. The European sector had already been under pressure since the embargo on Russian supplies. However, the situation has tightened even further with the attacks on shipping in the Red Sea. These latest developments have hit diesel and jet shipments from the Middle East and India to Europe, with a leap in freight costs, longer voyage times via the Cape of Good Hope and tighter market conditions in Europe.

This loss of these supplies from east to west has partly been made up by an increase in diesel exports from the US to Europe. However, this may be short-lived as US refinery turnarounds in the first quarter cut availabilities and potentially limit diesel exports. Hence, European diesel (and so VLSFO) prices are likely to rise relative to VLSFO markets elsewhere in the world. To compound this even more, Ukraine drone attacks on Russian refineries may have affected operations and so diesel exports from the country. Although this will not have a direct impact on the European diesel position, there is an indirect consequence, with other buyers of Russian products left short and having to source supplies from elsewhere, which will be in direct competition with European buyers.

Add to this a number of major European refineries going into turnaround in the north and Med regions, and the market is potentially even tighter!

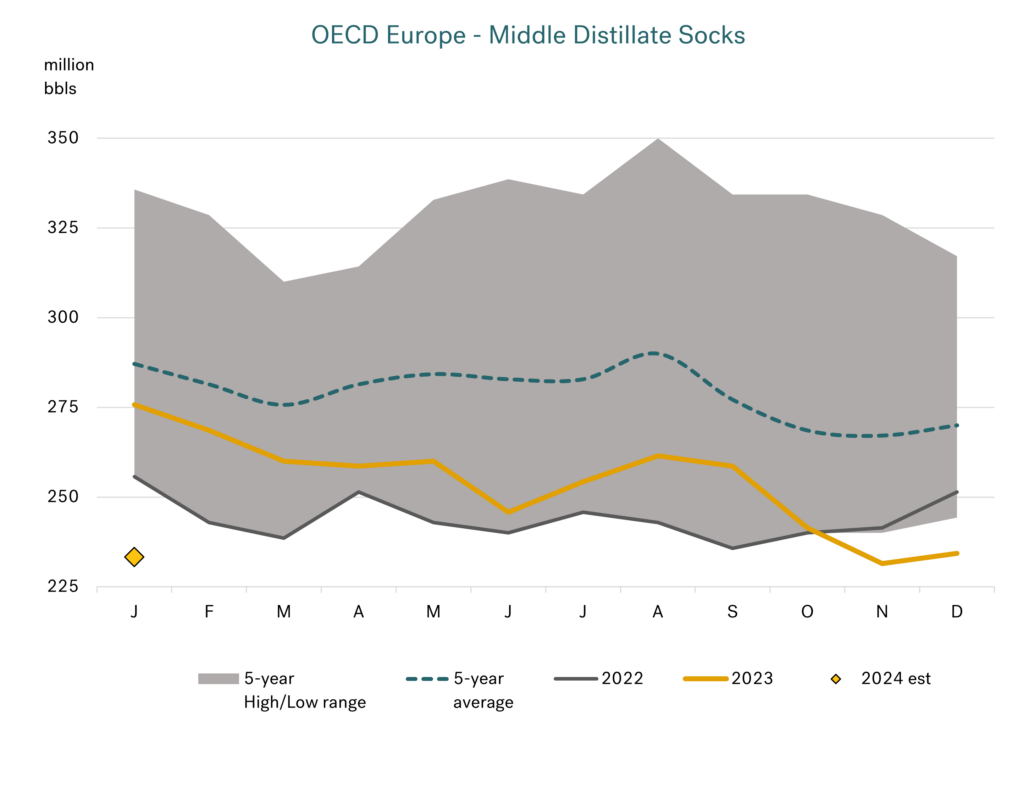

If this isn’t enough, then there is a further layer to add to the argument; and that is the current exceptionally low distillate stock levels in Europe. The graph below shows the five year high/low range for middle distillate stocks in Europe, and that for the past two years stocks have been well below their five year average. More importantly, over the past three months stocks have been below their previous five year lows, and this is at a stage when we expect the market to tighten even further.

Source: Integr8 Fuels

Source: Integr8 Fuels

Whatever happens, Rotterdam VLSFO prices are likely to be relatively high

All else being equal (it never is!), the fundamentals point towards a more bearish oil market, but with this relative strengthening in European VLSFO prices.

Beyond the fundamentals, the geopolitical risks at the moment clearly lie in the Israel/Gaza position and developments surrounding Iran. But there are also a number of elections this year that will contribute to more uncertainty, not least in the US.

However, as things pan out, the European distillate market does look tight going forward and this would mean relatively higher VLSFO prices in Rotterdam, and Europe generally.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.