Bunker Buyers Haven’t Seen Prices This Good for Almost Five Years

VLSFO prices slide to their lowest levels since early 2021 – and could go even lower.

Thankfully, the short-term oil market analysis looks easier than unravelling the current challenges within the International Maritime Organisation (IMO). So, sticking to the market analysis, we continue to look towards lower bunker prices, and are picking up from the themes of last month’s report, which were:

- September bunker prices had fallen sharply, despite crude prices remaining near flat.

- All the pointers were for crude prices to fall in Q4, which would lead to even lower VLSFO prices.

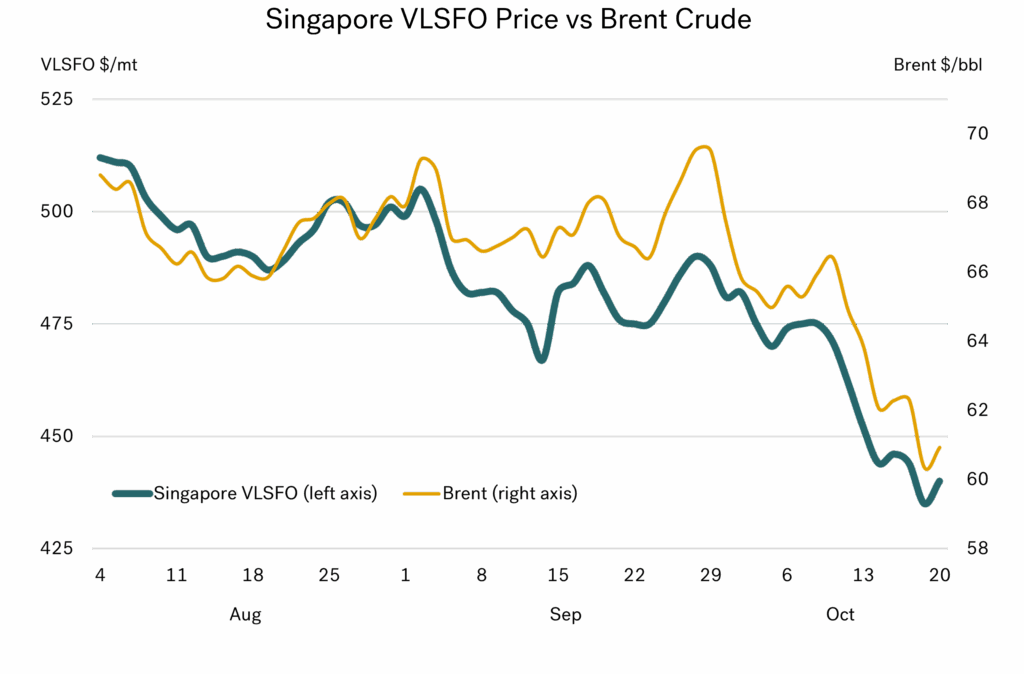

The Q4 pointers have already started to play out, with crude and VLSFO prices falling sharply over the first three weeks of October. As a result, Brent front month futures are now just above $60/bbl, compared with close to $70/bbl at end September, and Singapore VLSFO is around $440/mt, compared with a high of $490/mt towards the end of September.

The graph below illustrates these Brent and Singapore VLSFO price movements since August, and the significant drop that has taken place in October.

Source: Integr8 Fuels

Source: Integr8 Fuels

As a note, Rotterdam VLSFO prices have generally tracked Singapore prices, but been around $25-30/mt below Singapore.

Bunker buyers haven’t had it this good for almost 5 years

In a number of this year’s monthly market reports we have highlighted the weakening fundamentals in the oil sector, and that these would drive prices lower. At times this ‘fundamentals story’ has been outweighed by heightened geopolitical tensions and US trade strategies. Consequently, we have seen periods where prices have risen against what looks like a growing surplus of oil emerging.

However, the general price trend this year has been downwards, and in October the price fall has been even more extreme. We are currently in a phase where analysts and industry reports are all focusing on the growing oil surplus; the fundamentals are driving the market.

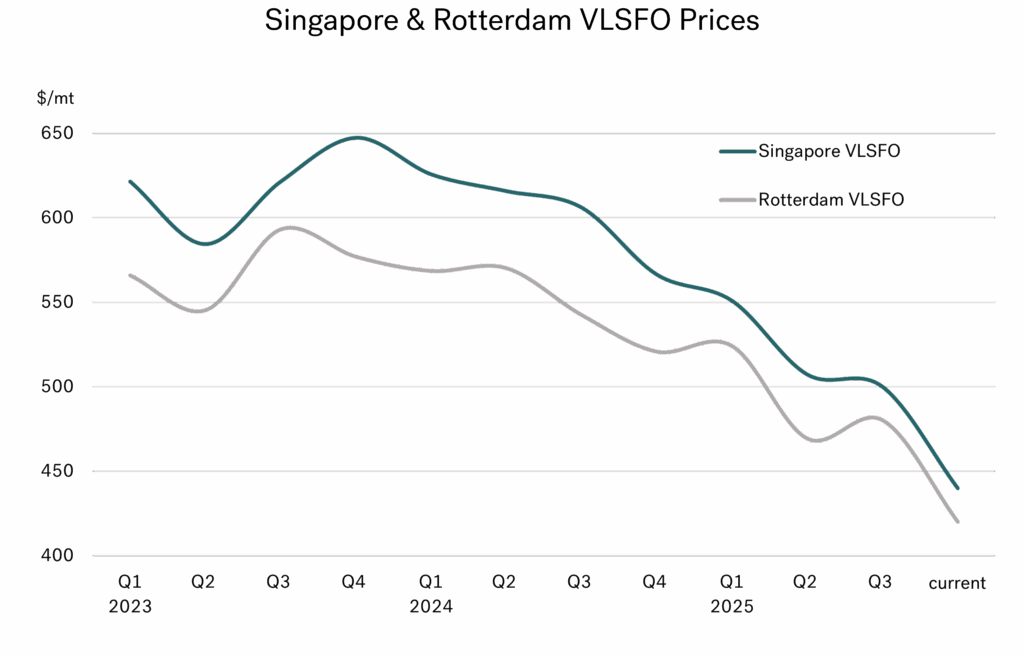

So, based on bunker buyers’ preferences for lower prices, the graph below must be a pleasing one. It illustrates quarterly average VLSFO prices and the slide that has taken place seen since the start of 2024, along with the more recent sharp decline that we have seen this month.

Source: Integr8 Fuels

Source: Integr8 Fuels

It’s a good story if you like low prices

Current VLSFO prices are around $100/mt lower than the average for Q1 this year, and some $175-200/mt lower than the quarterly highs seen in 2023. That’s a 30% drop in two years! In fact, we are at the lowest price levels for almost 5 years (since Jan 2021). Bunker buyers are in the ‘best of times’.

A repeat of the basic oil fundamentals for next year?

Without going into the detail outlined in our recent reports, the market is still looking at limited increases in oil demand next year, against substantial increases in oil supply. A general view is that the oil surplus (supply higher than demand) was running at around 1.5 million b/d over the first half of this year, but could rise to 3 million b/d over the second half of this year, and then to a massive 4.5 million b/d in the first half of 2026. Based on this, and a perceived easing in geopolitical risks, it is not surprising that most analysts are forecasting oil prices to fall even further from what are current ‘low’ levels.

Almost all forecasters put 2026 Brent prices below current levels

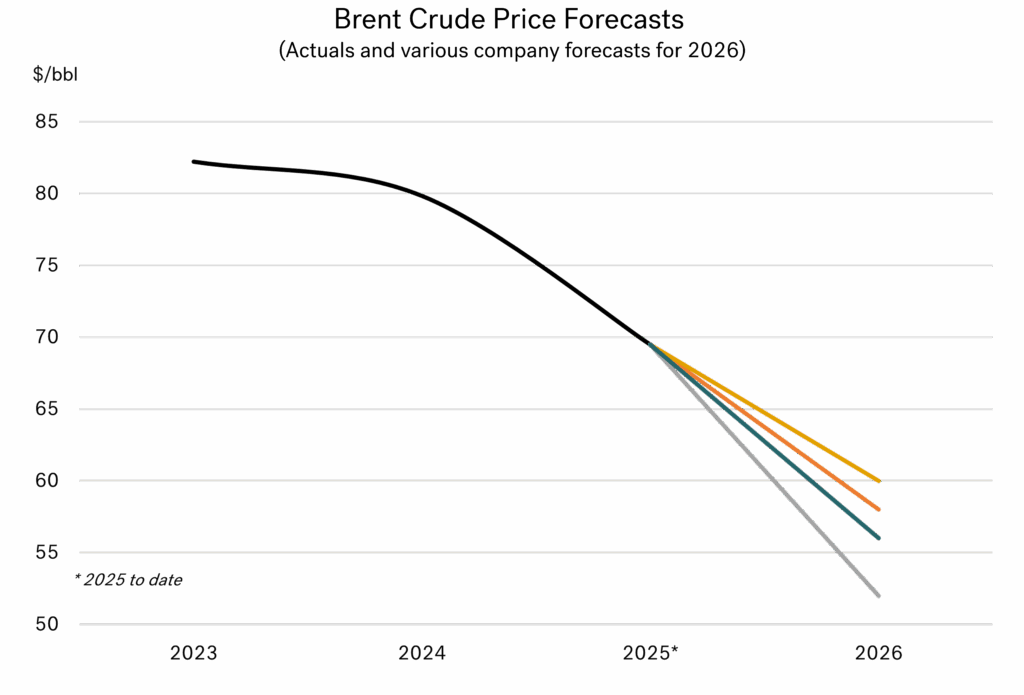

The graph below illustrates annual average Brent crude prices since 2023 (when prices stabilised post-Covid), together with a selection of recent, independent forecasts for 2026. Of these forecasts, only one is equal to the current Brent price of $60/bbl, all the rest are lower than today’s price. Out of interest, the US Energy Information Administration (EIA) is at the lowest of all these, putting a $52/bbl average price for Brent next year.

Source: Integr8 Fuels

Source: Integr8 Fuels

All this means more good news for bunker buyers

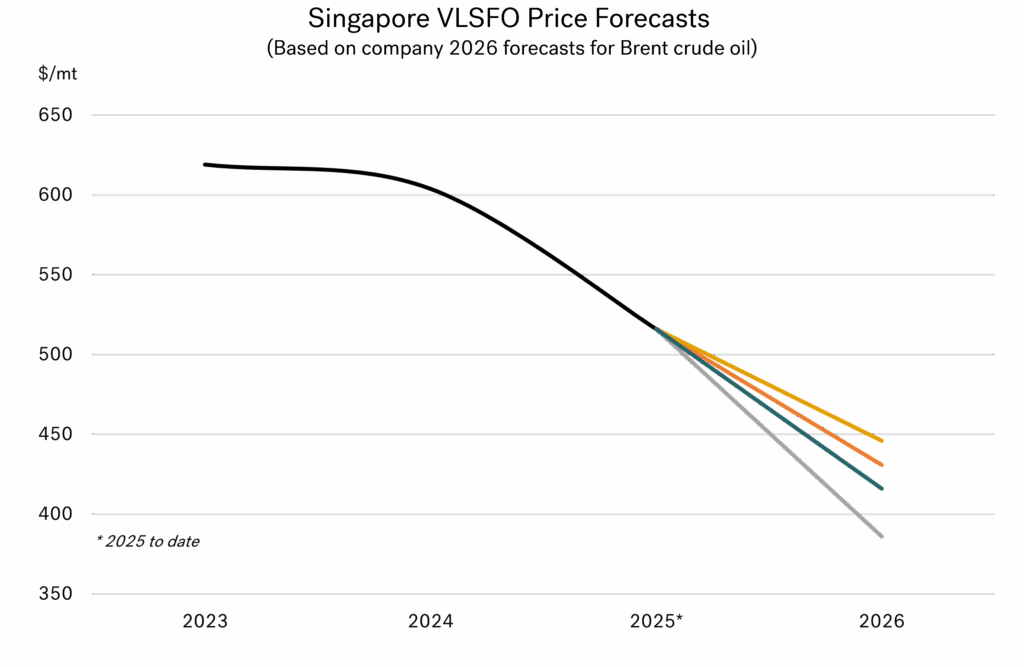

Taking all the above into account, we have extrapolated the analysis to look at Singapore VLSFO pricing for 2026. This is based on the crude price forecasts, and suggests an average Singapore VLSFO price in the range of $400-450/mt for next year.

Source: Integr8 Fuels

Source: Integr8 Fuels

On this basis, Singapore VLSFO bunker buyers will pay around $100/mt less this year than in 2023 and 2024, and a further $50-100/mt less next year than this year.

Declining prices are a rarity in any industry

There are not many markets where prices have fallen this year, and are forecast to fall again next year, but we are potentially in that position in the bunker market.

What can upset us?

As always, there is a word of warning. Many things can happen to upset a forecast, and in our case there are two obvious areas which could push prices higher. Firstly, the highly uncertain geopolitical risks, and secondly, if OPEC+ respond to what they see as ‘too low prices’ and make another round of production cutbacks. However, if there is peace in Ukraine and Russia is allowed back into the international oil market, then there will be even more downwards pressure on oil prices.

It is easy to keep an eye on all these factors, but it is still the case that we could be looking at even lower VLSFO prices next year, with Singapore in the $400-450/mt range, and Rotterdam at around $375-425/mt.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.