Brent rally pauses amid lockdowns and virus mutations

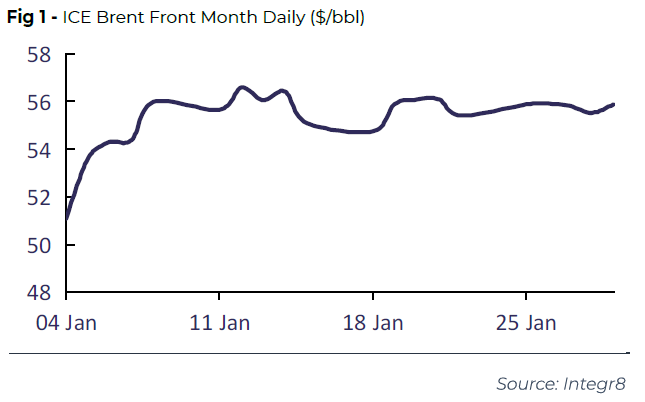

The price of Brent crude increased in the first half of January, rising from a low of $51 at the start of the month to reach a high of $56 on 12th January, as supply constraints came into focus. Oil prices then remained rangebound in the second half of the month, with the price of Brent holding at around $55 as the near-term demand outlook came under pressure.

Oil prices rose to an 11-month high in early January, following Saudi Arabia’s announcement of a unilateral cut of 1 million b/d to crude production in February and March, draws to US crude stockpiles and a weaker US dollar. However, gains were capped by concerns over near-term oil demand amid lockdowns and the emergence of virus mutations that could prompt tighter mobility restrictions. Restrictions were expanded or extended in the US and Europe amid rising COVID-19 cases and hospitalizations. Meanwhile, the UK and South Africa imposed strict lockdowns to combat new highly transmissible virus variants. Restrictions were also introduced or extended in Asia, the region which has led the global oil demand recovery. In the second half of the month oil prices found some support from a proposed $1.9 trillion US stimulus package announced before the 20th January inauguration of US President Biden, and as US crude stockpiles plunged 9.9 million bbls in the week to 22nd January to reach their lowest level since March 2020 .

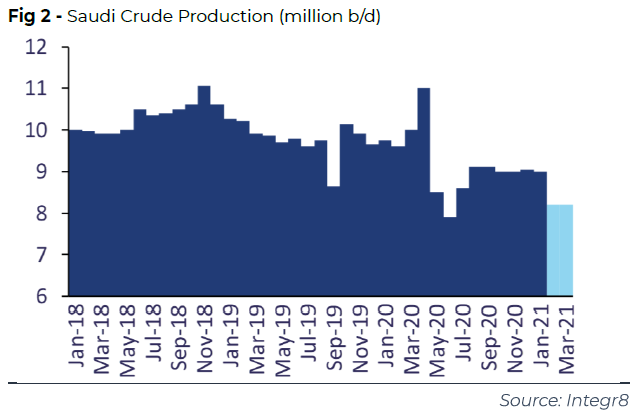

Saudi Arabia commits to extra supply cut

On 5th January, Saudi Arabia unexpectedly committed to a unilateral cut of 1 million b/d to crude production in February and March, helping to offset worries that rising COVID-19 cases globally and new variants would curtail fuel demand. This is in addition to its existing January quota and gives the Kingdom a target crude supply of 8.12 million b/d for February and March. Meanwhile, most other OPEC+ producers agreed to hold production steady over February and March in the face of new coronavirus restrictions, although Russia and Kazakhstan are allowed to raise output by a combined 75,000 b/d in February and a further 75,000 b/d in March. Higher quotas for Russia and Kazakhstan came as cuts to operations of their mature wells and fields would create lasting damage to production capacity. Overall, this means OPEC+ production cuts are set at 8.13 million b/d for February and 8.05 million b/d for March, instead of the January level of 7.2 million b/d. The group will reconvene in early March to discuss April output.

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.