Europe & Africa Market Update 6 Feb

Most fuel prices across European and African ports have edged lower, and VLSFO has limited offer capacity in Piraeus.

IMAGE: The Port of Piraeus in Athens, Greece. Getty Images

IMAGE: The Port of Piraeus in Athens, Greece. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($3/mt), Rotterdam and Gibraltar ($1/mt)

- LSMGO prices down in Gibraltar ($3/mt) and Rotterdam ($2/mt)

- HSFO prices up in Rotterdam ($1/mt), and down in Gibraltar ($5/mt) and Durban ($3/mt)

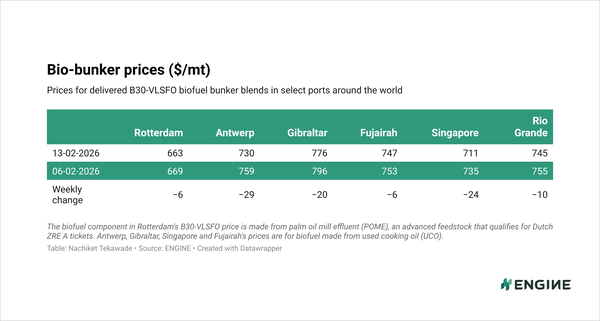

- B30-VLSFO prices down in Rotterdam ($3/mt) and Gibraltar ($2/mt)

Piraeus’ LSMGO price has gained $11/mt over the past session, most likely supported by a higher-priced 150-500 mt stem, fixed at $751/mt. Piraeus’ LSMGO price is now at a $4/mt discount to Gibraltar, compared to the $18/mt discount observed yesterday.

The Greek port is seeing HSFO priced around $15/mt cheaper than at Gibraltar, while its VLSFO price is at a premium of around $66/mt to the Mediterranean port.

The Hi5 spread at Piraeus stands at $129/mt, offering stronger economic incentives for scrubber-equipped vessels to bunker HSFO at the port.

VLSFO has limited offer capacity in Piraeus, a source told ENGINE.

For other grades, buyers are advised to give a notice of around five days to get competitive offers, a trader said.

Brent

The front-month ICE Brent contract has remained unchanged on the day, to trade at $68.24/bbl at 09.00 GMT.

Upward pressure:

Brentcrude's price has found support after the US Energy Information Administration (EIA) released its latest weekly oil inventory data.

US commercial crude stocks fell by 3.5 million bbls to 420.3 million bbls in the week ending 30 January, a decline that is commonly seen as a sign of stronger demand.

Brent futures have also been buoyed by a trade agreement between the US and India, under which India has agreed to increase purchases of US oil while cutting imports of Russian crude.

If the agreement is implemented, it could prompt Moscow to curb production, tightening global oil supply, according to two analysts at ING Bank.

Downward pressure:

Oil prices have come under downward pressure as supply concerns eased and market attention shifted to the outcome of US–Iran talks expected later in the day.

Crude futures faced downward pressure “amid signs of easing supply risks. Iran confirmed that it would hold negotiations with the US, allaying concerns of US military action which could threaten oil exports from the OPEC member,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“Aside from the US–Iran talks, there is little else on the market radar to sway price sentiment, and some mixed signals in the physical market, effectively cancelling each other out,” added Vandana Hari, founder of VANDA Insights.

By Nachiket Tekawade and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.