Fuel Switch Snapshot: B100 and LBM mostly stable across key ports

Rotterdam's B100 at $143-362/mt discounts to conventional fuels

LBM cheapest for low-methane-slip engines

LNG at $165-169/mt premiums over LBM in Rotterdam

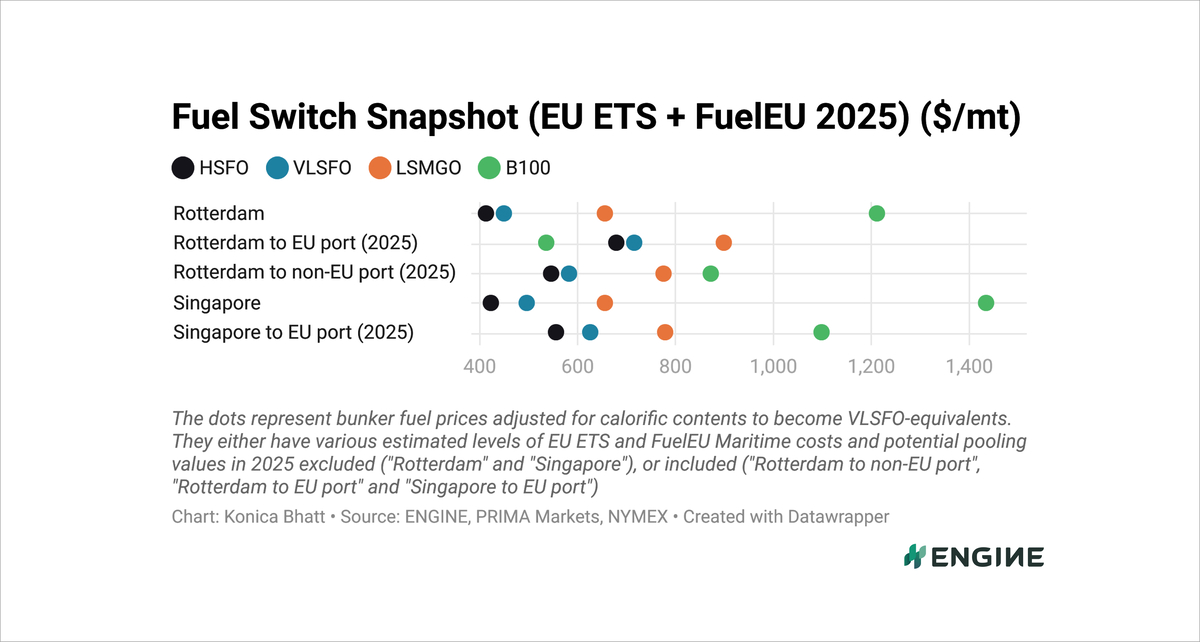

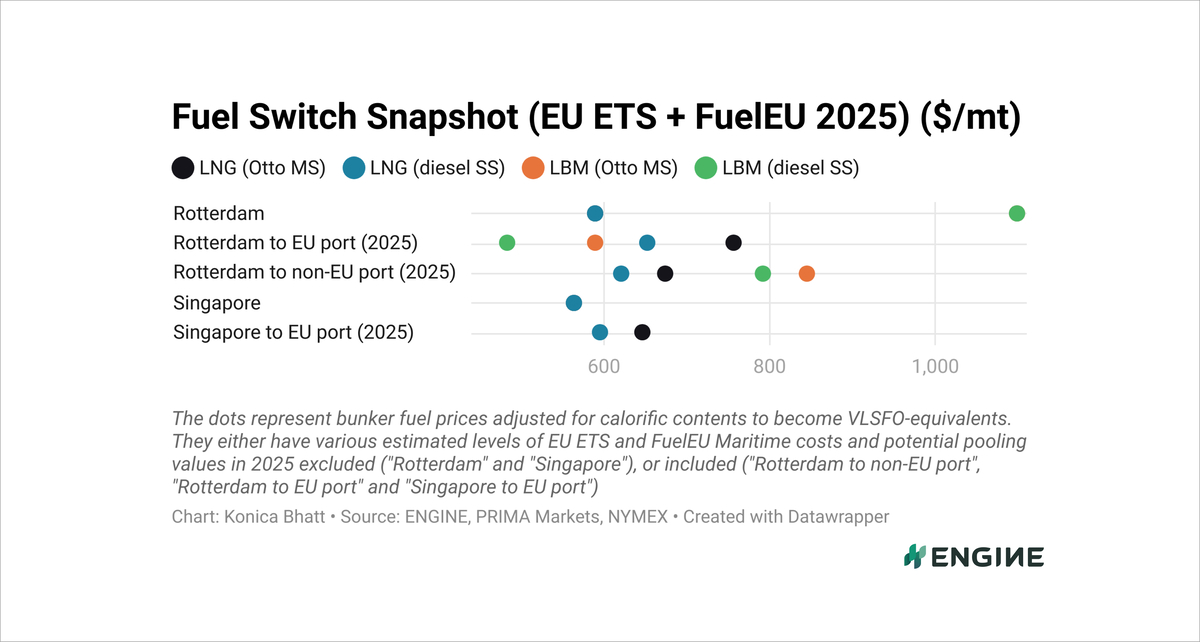

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

EU regulations mean that B100 can make sense on EU-EU voyages, but not so much on Singapore-EU voyages.

Rotterdam's HBE-rebated B100 stands at discounts of $143/mt to HSFO, $179/mt to VLSFO and a sharp $362/mt to LSMGO.

Singapore’s B100, meanwhile, is priced $469/mt over its VLSFO even after factoring in biofuel benefits for a voyage between Singapore an an EU port.

For dual-fuel ships with Otto medium-speed (Otto MS) engines, LNG sits at a $39/mt premium over VLSFO in Rotterdam, and a $20/mt premium in Singapore.

But for vessels with diesel slow-speed (diesel SS) engines, LNG shifts to discounts of $64/mt in Rotterdam and $32/mt in Singapore.

Liquefied biomethane (LBM) is the cheapest option for vessels with diesel slow-speed engines. It is even priced $54/mt below B100 in Rotterdam, though it flips to a $53/mt premium over B100 for vessels with Otto MS engines.

Rotterdam’s LBM is priced $126–230/mt below its VLSFO, depending on engine type.

Liquid fuels

Rotterdam’s VLSFO price has edged $4/mt lower in the past week. Availability of all conventional bunker grades in the wider ARA region remains stable, a trader said.

Rotterdam’s B100 benchmark has inched up by $3/mt over the same period, mainly driven by a $6/mt decline in Dutch HBE rebates for marine B100. The Prima Markets-assessed B100 rebate has paused its recent rise and eased over the past week.

Singapore’s VLSFO has also remained almost steady, rising $6/mt in the past week. Availability of the grade remains steady in the port, with traders recommending lead times of 7–10 days. The port’s B100 price has gained $8/mt in the past week.

Liquid gases

Rotterdam’s LNG bunker price has lost $6/mt in the past week, while its LBM benchmark has inched slightly lower by $2/mt.

LNG prices have been under some downward pressure in Rotterdam. The LNG bunker delivery premium has come off slightly to $136/mt, while front-month TTF has held steady at $579/mt. Lower temperatures have stimulated more gas demand in Europe, while steady Norwegian gas supply has contributed to keep prices in check.

Singapore’s LNG price has remained almost unchanged, with only a $1/mt decline in the past week. A near $5/mt rise in Singapore's LNG bunker delivery premium has been countered by a $4/mt decline in the front-month JKM contract.

Northeast Asian LNG demand remains weak, and inventories are well-stocked, says JOGMEC. Steady fundamentals have kept prices in check, it argues.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.