Fuel Switch Snapshot: B100 slides further on stronger Dutch incentives

B100 HBE rebate nearly at $600/mt

Singapore’s B100 sales climbed to 4,800 mt in Aug

ENGINE's FuelEU pooling values for B100, LBM rise

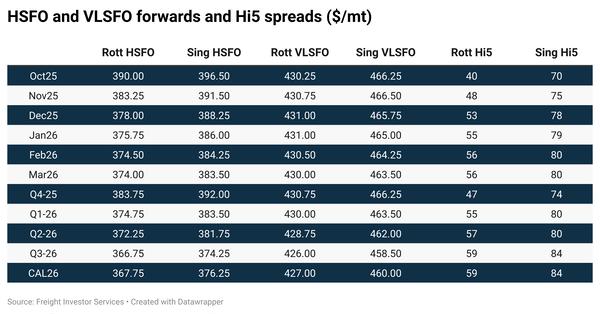

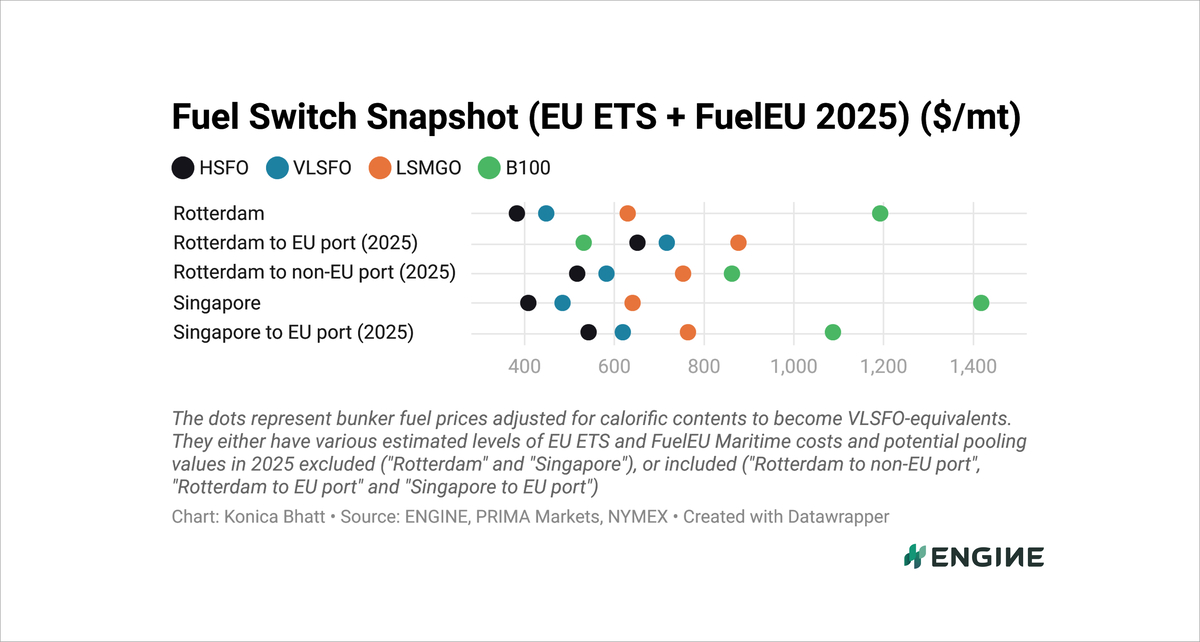

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

A steady rise in Dutch HBE ticket prices for B100 marine fuel has pulled Rotterdam’s B100 price lower this month.

The Prima-assessed Dutch rebate for B100 has risen by $50/mt this month to $593/mt. Over the same period, ENGINE’s HBE-rebated B100 price in Rotterdam has dropped by $57/mt to $1,090/mt, reflecting the downward pressure from higher rebates.

B100’s discount to VLSFO in Rotterdam has widened by $5/mt to $184/mt, and its discount to LSMGO has widened by $19/mt to $344/mt. B100 has also dropped $16/mt further below LNG, to $126–234/mt discounts depending on the vessel’s LNG engine type.

ENGINE-assessed FuelEU pooling values have increased modestly for both B100 and liquefied biomethane (LBM) over the past week.

The theoretical pooling benefit for vessels sailing between EU ports and selling compliance surpluses from Dutch-rebated B100 has increased by $2/mt to around $660/mt.

LBM’s pooling value has risen by $3-4/mt over the week to $491–613/mt, depending on engine type.

Liquid fuels

Rotterdam's VLSFO price has decreased by $9/mt over the past week. Fuel availability has remained stable in the ARA bunkering hub, a trader has told ENGINE, with lead times of 5-7 days advised for both VLSFO and HSFO.

Rotterdam’s B100 benchmark has declined by $14/mt in the past week, mainly driven by a further $3/mt rise in Dutch HBE rebates for marine B100.

In Singapore, VLSFO has increased by $7/mt over the past week. Bunker demand for conventional fuels has been “soft” so far this week, a source said. Availability has improved, with recommended lead times now at 7-10 days.

Singapore’s B100 price has gained $14/mt. The port’s B100 bunker sales nearly doubled in August, rising from 2,600 mt to 4,800 mt.

Liquid gases

Rotterdam’s LNG and LBM bunker prices have remained mostly stable in the past week. The port’s LNG price has inched up by $2/mt, while its LBM benchmark has edged lower by $2/mt.

Singapore’s LNG price has remained unchanged. LNG bunker sales in the Asian port went up from 42,000 mt in July to 67,000 mt in August.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.