Americas Market Update 3 Sept 2025

Fuel prices have declined across all ports in the Americas, and Tropical Storm Lorena has strengthened into a hurricane in the Eastern Pacific.

IMAGE: Cargo ships in the Port of Los Angeles. Getty Images

IMAGE: Cargo ships in the Port of Los Angeles. Getty Images

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices down in Houston ($15/mt), Balboa ($13/mt), New York ($12/mt), Los Angeles and Zona Comun ($3/mt)

- LSMGO prices down in Houston ($17/mt), New York ($14/mt), Balboa ($11/mt) and Los Angeles ($4/mt)

- HSFO prices down in Houston ($13/mt), New York ($12/mt), Balboa ($5/mt) and Los Angeles ($2/mt)

Houston has recorded the steepest decline in prices across all three grades. The port is experiencing congestion around its terminals, resulting in delays in bunkering operations.

However, weather at the port has remained normal and conducive for bunkering, a trader told ENGINE.

Off the Eastern Pacific coast, Tropical Storm Loreno has strengthened into a hurricane, joining Hurricane Kiko, which is itself currently active in both the Eastern Pacific and Central Pacific regions.

"It’s very active on the Pacific side with hurricanes, but there are no prime bunker delivery locations out there besides Hawaii, which is mostly delivered by truck. So far, nothing has reached the US Gulf to cause disruptions," a source said.

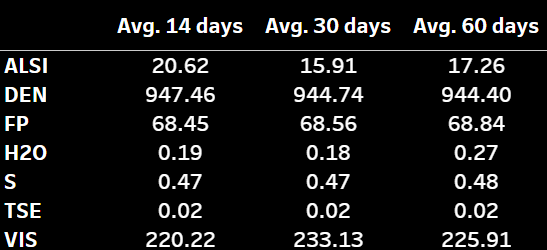

Los Angeles has seen the smallest decline in prices across all fuel grades, and its LSMGO continues to be at premiums of $37/mt over New York and $76/mt over Houston.

The West Coast port’s HSFO is now at par with New York, wiping out the $32/mt premium New York held over Los Angeles a month ago on 3 August.

Brent

The front-month ICE Brent contract has lost $0.07/bbl, to trade at $68.04/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Brent’s price has found some support as geopolitical tensions remain in focus.

The US has imposed sanctions on a network of shipping companies and nine vessels for allegedly smuggling Iranian oil disguised as Iraqi oil.

By tightening sanctions, the Trump-led US administration aims to reinforce its push to cut the OPEC producer’s oil exports to zero.

Besides, risks to oil supply have intensified as Russia and Ukraine continue cross-border shelling. “This [attacks] comes as the US looks to increase sanctions on Russia to force it to the negotiating table,” remarked ANZ Bank’s senior commodity strategist Daniel Hynes.

Over the weekend, Ukraine struck two major oil refineries in Russia while Moscow carried out a massive attack on 14 regions of Ukraine, according to media reports.

“US Treasury Secretary Scott Bessent said that US would examine possible penalties against Moscow this week,” Hynes added.

Downward pressure:

Brent futures came under downward pressure as market analysts turned their focus to the upcoming OPEC+ meeting on Sunday.

The group is “expected to keep output levels unchanged,” according to two analysts from ING Bank.

The global oil market is bracing for a potential surplus as the Vienna-based group has accelerated the rollback of 2.2 million b/d in voluntary output cuts over the past six months, moving faster than originally planned.

“The bigger risk is OPEC+ deciding to reinstate supply cuts, given concerns about a surplus,” the two analysts added.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.