East of Suez Market Update 28 Aug 2025

Prices in East of Suez ports have moved up, and bunker demand is low in Zhoushan.

IMAGE: Industrial cargo ships in Busan port area, South Korea. Getty Images

IMAGE: Industrial cargo ships in Busan port area, South Korea. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($6/mt), Fujairah ($4/mt) and Singapore ($2/mt)

- LSMGO prices up in Zhoushan, Fujairah ($7/mt) and Singapore ($5/mt)

- HSFO prices up in Fujairah ($4/mt), Singapore and Zhoushan ($3/mt)

- B24-VLSFO at a $218/mt premium over VLSFO in Singapore

- B24-VLSFO at a $237/mt premium over VLSFO in Fujairah

VLSFO prices across the three major Asian bunker hubs have remained broadly rangebound over the past day, with no significant changes. Zhoushan’s VLSFO premiums over Fujairah and Singapore are currently at $24/mt and $21/mt, respectively.

In Zhoushan, VLSFO availability has improved amid sluggish demand, with lead times easing to 5–7 days from 6–10 days last week. HSFO supply remains steady at 5–7 days, while LSMGO availability has tightened, with lead times stretching to 5–7 days from the previous 2–4 days.

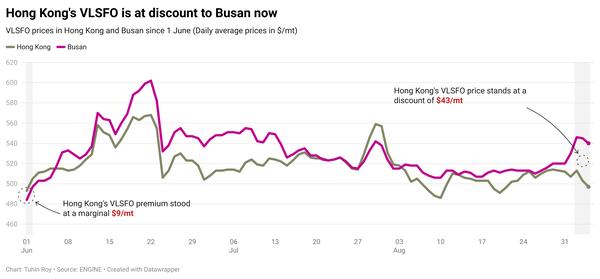

In South Korea, Busan’s VLSFO discount to Zhoushan stands at $8/mt. Demand has been strong over the past two weeks but is expected to weaken as Brent prices rise. Lead times vary between 3–8 days across all grades, as several suppliers face low stock levels and limited bunker barge availability, a trader noted.

Last week, VLSFO and HSFO required around 5 days, while LSMGO needed 3–5 days.

Brent

The front-month ICE Brent contract has gained by $0.62/bbl on the day, to trade at $67.57/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has shed the previous day’s losses after the US Energy Information Administration (EIA) reported a drawdown in US crude stocks.

Commercial US crude oil inventories have dropped by 2.4 million bbls to touch 418 million bbls for the week ending 22 August, according to data from the EIA.

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

“[Brent] crude futures found support… from the Energy Information Administration report, which showed sizeable inventory declines across crude and refined products,” remarked VANDA Insights’ founder Vandana Hari.

Downward pressure:

Brent’s price gains were capped after US tariffs on imports of Indian goods came into effect yesterday.

US President Donald Trump has imposed 25% secondary tariffs against India, taking the total levy on US imports from India to 50%.

New Delhi currently faces tariffs on all exports to the US because of its continued purchases of Russian crude oil, according to market analysts.

“US tariffs on imports of Indian goods rose to 50% on Wednesday to punish the exporter for buying Russian crude,” remarked ANZ Bank’s senior commodity strategist Daniel Hynes.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.