East of Suez Fuel Availability Outlook 26 Aug 2025

Bunker demand low in Singapore

Prompt VLSFO supply tight across several Japanese port

LSMGO supply good across Omani ports

IMAGE: Aerial daytime view of Tokyo port, Japan. Getty Images

IMAGE: Aerial daytime view of Tokyo port, Japan. Getty Images

Singapore and Malaysia

Bunker demand in Singapore has stayed subdued so far this week, a source said. VLSFO deliveries still require 7–10 days, unchanged from last week, while HSFO supply remains steady with lead times of 7–10 days, nearly the same week-on-week. LSMGO availability has tightened slightly, with lead times rising to 4–5 days from 3–6 days previously.

Residual fuel oil stocks in Singapore have averaged 2% higher this month compared to July, according to Enterprise Singapore. Fuel oil inventories have climbed above 24 million bbls, reaching multi-year highs, even as net fuel oil imports in August fell by 3%. Both imports and exports declined, with imports dropping by 185,000 bbls — more than double the 79,000-bbl decrease in exports.

Middle distillate inventories at the port also strengthened, averaging 5% above last month’s levels.

Meanwhile, in Malaysia’s Port Klang, prompt VLSFO and LSMGO deliveries remain readily available, though HSFO continues to face tight supply.

East Asia

In Zhoushan, VLSFO availability has improved on the back of sluggish demand, with lead times easing to 5–7 days from 6–10 days last week. HSFO supply remains steady at 5–7 days, while LSMGO has tightened, with lead times extending to 5–7 days from the previous 2–4 days.

Fuel availability across northern China is uneven. Dalian and Qingdao are well supplied with both VLSFO and LSMGO, though Qingdao continues to face limited HSFO availability. Tianjin, by contrast, remains tight across all three grades.

In Shanghai, supply remains under pressure for VLSFO and HSFO, while LSMGO availability is comparatively stable. Further south, conditions vary by port: Fuzhou is short on both VLSFO and LSMGO, whereas Xiamen has ample VLSFO but restricted LSMGO. Delivery options for both grades remain constrained at Yangpu and Guangzhou.

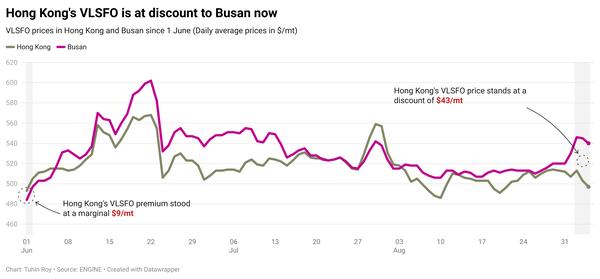

In Hong Kong, lead times are stable at around seven days across all fuel types, unchanged from recent weeks.

Taiwan continues to maintain steady supply, with lead times of about two days for VLSFO and LSMGO at Taichung, Hualien, Keelung, and Kaohsiung.

In South Korea, demand has been good over the past two weeks but is expected to wane as Brent prices has been rising. Lead times vary widely between 3-8 days across all grades as several suppliers are running low on stocks and tight bunker barge availability, according to a trader. Last week, VLSFO and HSFO required around five days, while LSMGO needed about 3-5 days.

Japan continues to face tight prompt VLSFO availability at several key ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Mizushima, Nagoya, and Yokkaichi. LSMGO stocks are generally sufficient nationwide, though prompt deliveries in Mizushima may still encounter delays.

Supply of B24-VLSFO in Tokyo, Chiba, Kawasaki, and Yokohama remains subject to enquiry.

HSFO availability is steady across most ports, but Oita is currently experiencing shortages across all grades — VLSFO, LSMGO, and HSFO.

Meanwhile, Typhoon Kajiki — which struck China’s Hainan Island and parts of Guangdong province on Sunday evening — made landfall in Vietnam’s coastal provinces of Nghe An and Ha Tinh on Monday before weakening into a tropical storm, according to Vietnam’s National Center for Hydro-Meteorological Forecasting.

Kajiki is also expected to impact Laos, northern Thailand, eastern Cambodia, and central Myanmar, the World Meteorological Centre Beijing reports. The system was further downgraded to a tropical depression as it entered Laos on Tuesday, with potential to disrupt bunkering operations in affected regions.

Oceania

In Western Australia, VLSFO and LSMGO are well supplied at Kwinana, Fremantle, and Port Kembla, with most suppliers indicating lead times of 7–8 days. In New South Wales, LSMGO availability remains steady in Sydney, but prompt HSFO deliveries continue to be difficult to secure.

Victoria’s ports of Melbourne and Geelong are well stocked with VLSFO and LSMGO, though HSFO availability remains limited, particularly for prompt demand. Further north in Queensland, both Brisbane and Gladstone report healthy VLSFO and LSMGO availability, with average lead times of around seven days. HSFO, however, is still constrained in Brisbane.

In New Zealand, VLSFO supply is stable at Tauranga and Auckland, ensuring consistent availability at both ports.

South Asia

VLSFO availability remains tight at several Indian ports — including Mundra, Kandla, Mumbai, Chennai, Visakhapatnam, Cochin, and Paradip — continuing the trend seen in recent weeks. LSMGO supply is also constrained across most locations, with deliveries largely dependent on enquiry. In Tuticorin and Haldia, one supplier is nearly out of both grades, a shortage that has persisted for months.

In contrast, Sri Lanka presents a more stable picture. A supplier covering both Colombo and Hambantota reports good availability across all fuel grades, with prompt delivery options in place.

Middle East

Prompt bunker supply remains tight across all grades in Fujairah, with lead times steady at 5–7 days. Some suppliers can still accommodate urgent orders, though at premium prices. Similar conditions are seen in nearby Khor Fakkan.

In Iraq’s Basrah, VLSFO and LSMGO remain readily available, but HSFO supply is constrained. Saudi Arabia’s Jeddah continues to face restricted availability of both VLSFO and LSMGO.

Egypt’s Port Suez is seeing severe shortages, with stocks of VLSFO, LSMGO, and HSFO nearly depleted. Qatar’s Ras Laffan is also struggling, with tight supply of VLSFO and LSMGO. Djibouti is experiencing acute shortage, with VLSFO and HSFO almost exhausted and LSMGO also scarce.

By contrast, Oman’s ports — including Sohar, Salalah, Muscat, and Duqm — maintain stable LSMGO supply.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.