Europe & Africa Market Update 22 Aug 2025

Bunker benchmarks in European and African ports have been mostly stable, and VLSFO and HSFO supply is normal in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices unchanged in Gibraltar, and down in Rotterdam and Durban ($2/mt)

- LSMGO prices up in Rotterdam ($2/mt), and down in Gibraltar ($1/mt)

- HSFO prices down in Gibraltar ($5/mt), Rotterdam ($3/mt) and Durban ($1/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $4/mt to $272/mt

- Gibraltar B30-VLSFO premium over VLSFO up by $1/mt to $318/mt

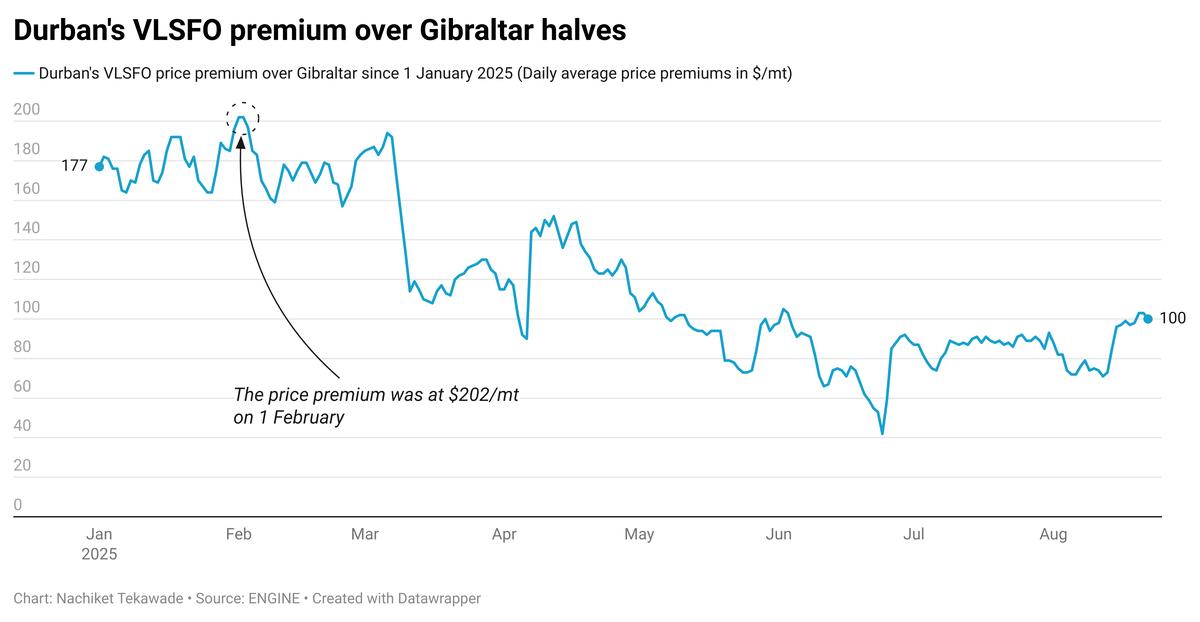

Durban’s VLSFO daily average price premium over Gibraltar has nearly halved to around $100/mt, from $202/mt recorded on 1 February this year.

Availability of VLSFO and HSFO at Durban remains normal, with 2-4 days of notice enough for delivery of both grades, while LSMGO remains out of supply, a trader said.

Meanwhile, there are four vessels awaiting bunkers at the port of Gibraltar, up from two yesterday, port agent MH Bland said. All suppliers are running on schedule, the port agent added. Eleven vessels are expected to call at the port for bunkers, shipping agent A. Mateos & Sons said.

The HSFO price in Las Palmas has slipped by $9/mt to $460/mt in the past session. This has widened the port’s Hi5 spread to $47/mt, from $37/mt yesterday. A lower-priced 500-1500 mt HSFO stem was fixed at $458/mt at the port, which may have pressured the price.

Bad weather is forecast at Las Palmas between 26 August – 1 September, which could disrupt bunkering operations.

Brent

The front-month ICE Brent contract has gained by $0.12/bbl on the day, to trade at $67.54/bbl at 09.00 GMT.

Upward pressure:

Oil prices rose as hopes for a peace deal between Russia and Ukraine faded. The three-and-a-half-year war continued on Thursday, with Russia launching an air strike near Ukraine’s border with the European Union, while Ukraine reported it had hit a Russian oil refinery. At the same time, US and European planners said allied national security advisers have developed military options, according to Reuters.

“Oil prices are on the rise, supported by … ongoing uncertainty about the prospects for peace between Russia and Ukraine,” said Phil Flynn, senior market analyst at Price Futures Group.

“Oil prices moved higher … as the initial enthusiasm over progress towards a ceasefire between Russia and Ukraine continues to fade,” analysts at ING Bank added.

Brent futures also gained support from a larger-than-expected drawdown in US crude inventories, signalling strong demand.

Commercial US crude oil stockpiles fell by 6 million barrels to 421 million barrels for the week ending 15 August, according to the EIA.

Market participants are closely watching the Jackson Hole economic conference in Wyoming for clues on whether the Federal Reserve might cut interest rates next month. Lower rates can stimulate economic growth and drive-up oil demand, which in turn could lift prices.

The annual meeting of central bankers began on Thursday, according to Reuters.

Downward pressure:

Brent prices came under some pressure after the US imposed a 25% tariff on Indian goods starting 27 August, in response to India’s continued imports of Russian oil. The move has raised concerns about possible trade disruptions and weaker demand growth, analysts said.

By Nachiket Tekawade and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.