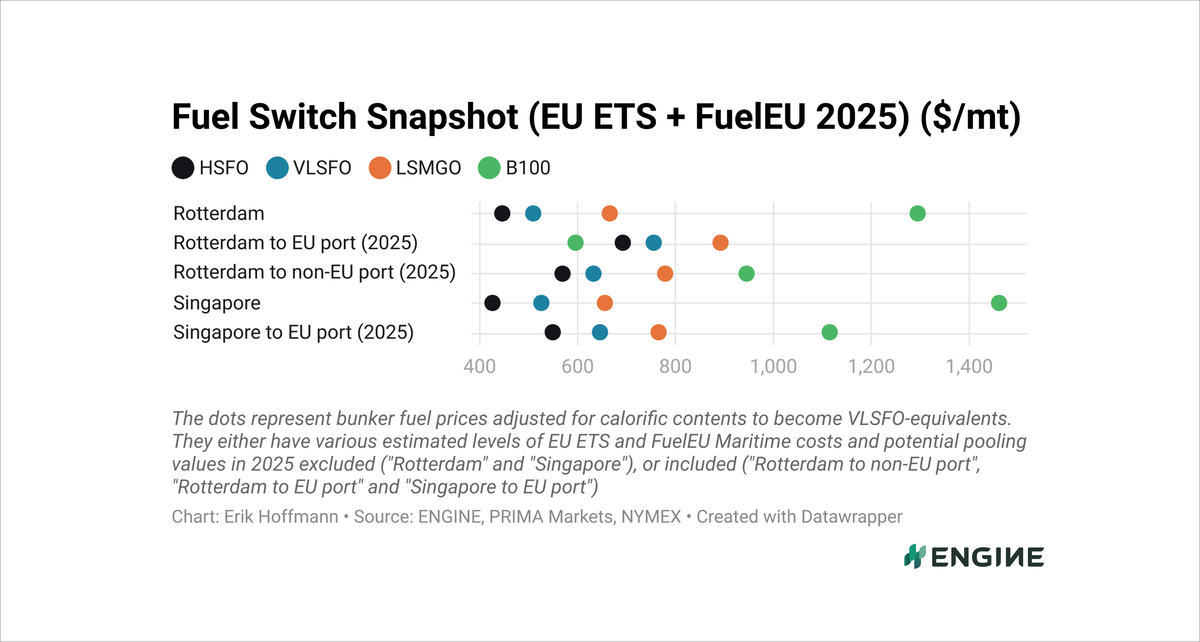

Fuel Switch Snapshot: B100 only makes sense between EU ports

Rotterdam’s regulation-adjusted B100 remains attractive

B100 continues to be priced out in Singapore

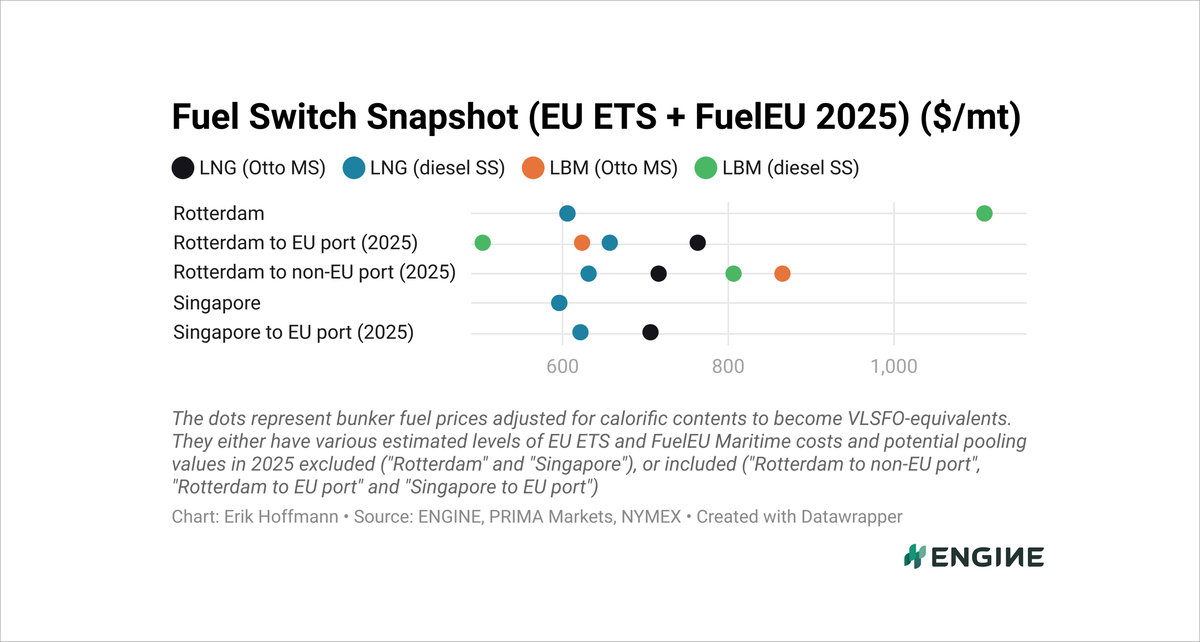

LBM a top choice for dual-fuel vessels

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

At $597/mt, Rotterdam’s regulation-adjusted B100 price is attractive for shipowners selling or transferring the compliance surplus generated by B100 into a FuelEU pool. With pooling, B100 costs $95/mt less than HSFO, $158/mt less than VLSFO and $293/mt less than LSMGO.

Vessels that swap LSMGO for B100 in 0.10% sulphur-capped Emission Control Areas (ECA) will therefore benefit the most from bunkering B100 in Rotterdam.

Rotterdam’s B100 is also cost-effective compared to most liquefied natural gas (LNG) and liquefied biomethane (LBM) alternatives. Only LBM consumed in a diesel slow speed (diesel SS) engine has a lower overall cost and comes in at a $95/mt discount to B100.

In Singapore, B100 is still far from affordable. That is partly because it is only offered by a few suppliers with chemical tankers, which renders it disproportionately expensive against the port’s more typical B24 and B30 grades. Another more structural reason is that B100 buyers can only count 50% of their emissions towards EU ETS and 50% of their energy consumed towards FuelEU for their voyages from Singapore (a non-EU port) to an EU port.

Adjusted for EU ETS and FuelEU, Singapore’s B100 is priced at $1,113/mt for voyages to an EU port. That is $563/mt over HSFO, $465/mt over VLSFO and $346/mt over LSMGO.

B100’s uncompetitive total cost can help explain why only 7,000 mt was supplied in Singapore in the first half of the year.

Liquid fuels

Rotterdam’s B100 price has gained $6/mt on the week, to $597/mt for vessels sailing between EU ports.

Conventional bunker fuel grades have moved in mixed directions in the past week. VLSFO has gained by $4/mt in Rotterdam, while HSFO has shed $6/mt and LSMGO has slumped $29/mt lower.

Several LSMGO stems have been fixed below ENGINE’s benchmark to pull it down in the past week. Stem levels have ranged between $673-718/mt.

Availability of VLSFO, HSFO and LSMGO has been good in the ARA, but securing prompt supplies can be difficult, a trader told ENGINE. Lead times of 5-7 days are advised for all grades.

Singapore’s prices for these three grades have moved in a narrower range, with $2-4/mt declines for VLSFO and LSMGO and a $5/mt gain for HSFO.

VLSFO and HSFO availability has improved in Singapore amid low demand and better supply. Lead times for both grades range between 9-11 days. In contrast, LSMGO delivery times have increased, with several suppliers offering deliveries with 5–7 days of lead time as their earliest, up from 2–6 days a week earlier.

Singapore’s B100 price has moved $15/mt higher in the past week and, as mentioned, it remains unattractive compared to other fuel grades even after being regulation-adjusted.

Liquid gases

Rotterdam’s LBM prices have gained $10-12/mt on the week, depending on the engine type. That has just about outpaced LNG’s $6-9/mt increases and narrowed LNG’s price premiums to $140/mt for Otto medium speed (Otto MS) engines and $154/mt for diesel SS engines.

Rotterdam’s LNG bunker price has climbed on the back of higher bunker premiums, while Singapore’s price has risen amid broader gas demand growth driven by soaring temperatures across East Asia.

Rotterdam’s LNG bunker price rise has primarily been driven by a $14/mt increase in the assessed LNG bunker premium, which climbed to $133/mt.

“Japanese and South Korean power generators have been active in the market as power demand surges due to higher summer temperatures,” ANZ Bank senior commodity strategist Daniel Hynes commented on rising LNG prices in Asia.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.