East of Suez Market Update 21 Mar 2025

Most prices in East of Suez ports have moved up, and LSMGO availability is good in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($10/mt), Fujairah and Zhoushan ($6/mt)

- LSMGO prices up in Fujairah and Zhoushan ($9/mt), and down in Singapore ($3/mt)

- HSFO prices up in Fujairah and Zhoushan ($5/mt), and down in Singapore ($12/mt)

- B24-VLSFO at a $149/mt premium over VLSFO in Singapore

- B24-VLSFO at a $228/mt premium over VLSFO in Fujairah

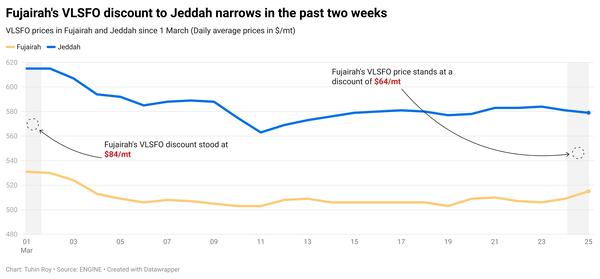

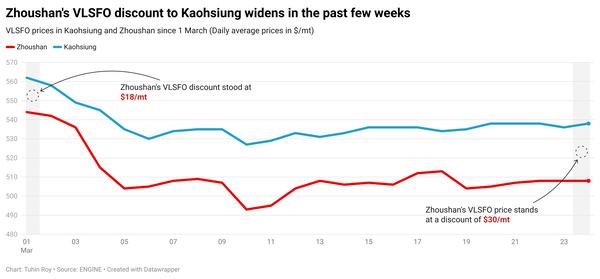

VLSFO prices at the three major Asian bunker ports have increased by $6–10/mt in the past day. In Singapore, VLSFO carries a premium of $15/mt over Zhoushan and $9/mt over Fujairah.

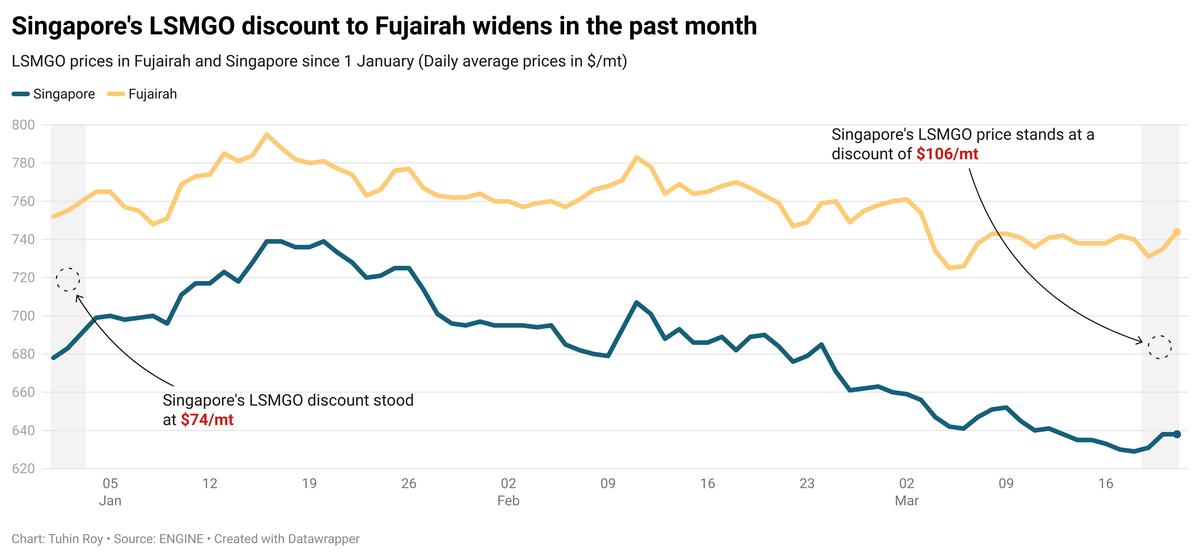

Singapore’s LSMGO price has dipped slightly, while prices in Fujairah and Zhoushan have risen. Three lower-priced LSMGO stems fixed in Singapore within a range of $15/mt have influenced the benchmark price. The port's LSMGO discounts to Fujairah and Zhoushan stand at $46/mt and $106/mt, respectively.

VLSFO lead times in Singapore now range from 2–10 days, narrowing from last week’s 3–12 days. HSFO and LSMGO supply remains stable, with lead times at 2–4 days and 6–9 days, respectively, nearly unchanged from last week.

In Fujairah, bunker availability remains tight, with lead times for all grades steady at 5–7 days, consistent with last week. Khor Fakkan has similar lead time recommendations.

Brent

The front-month ICE Brent contract has moved $0.78/bbl higher on the day, to trade at $72.08/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price moved higher after the US administration tightened its stance on Iran, aiming to drive the country’s oil exports to zero.

US President Donald Trump has imposed another set of strict sanctions on 19 entities and vessels involved in shipping “millions of barrels” of Iranian crude oil. The news has supported supply-related concerns in the global oil market, according to analysts.

“Crude oil gained as the US ramped up efforts to curtail Iranian oil exports,” ANZ Bank’s senior commodity strategist Daniel Hynes said. “We expect Iran's oil exports to fall by around 1mb/d [1 million b/d],” he added.

Besides, OPEC+ members who breached production quotas in the previous months announced new plans yesterday to compensate for the overproduction. Brent’s price gains were “spurred by an unexpected OPEC/non-OPEC plan to rein in its production and the US announcing yet another wave of sanctions against Iranian oil,” VANDA Insights’ founder and analyst Vandana Hari said.

Downward pressure:

Brent’s price felt some downward pressure following a rise in US crude stocks.

Commercial US crude oil inventories increased by 1.7 million bbls to touch 437 million bbls for the week ending 14 March, according to data from the US Energy Information Administration (EIA).

A build in inventories typically signals weaker oil demand, which can put downward pressure on Brent’s price.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.