Americas Fuel Availability Outlook 20 Mar 2025

New York bunker supply is steady

Fog season across the US Gulf Coast

VLSFO availability in Zona Comun remains volatile

PHOTO: Afternoon aerial view of the ports of Long Beach and Los Angeles in southern California, US. Getty Images

PHOTO: Afternoon aerial view of the ports of Long Beach and Los Angeles in southern California, US. Getty Images

North America

Bunker fuel availability across all grades in Houston remains tight through 21 March, with lead times extending beyond seven days.

Weather conditions at the East Coast port are currently stable, but high wind gusts are expected to pick up by the end of the week.

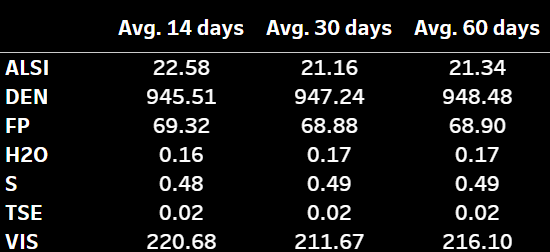

The US Gulf Coast is in the midst of its fog season, leading to reduced visibility across the region. Bunkering operations at ports such as Houston, Galveston, Lake Charles, Pascagoula, Mobile, Port Arthur, Freeport and Corpus Christi could face further delays due to fog, a source said.

Bunker fuel availability in New York and across the East Coast is steady. In New York, suppliers can offer prompt deliveries with expected lead times of 3-4 days.

Strong wind gusts between 20-23 March could lead to possible delays at New York and affect the availability of bunker barges. However, there are no reported backlogs.

On the West Coast, in the ports of Los Angeles and Long Beach, demand has been quiet so far this week, and prompt availability across all fuel grades is good. Suppliers recommend lead times of 6-7 days.

Bunker deliveries in the Galveston Offshore Lightering Area (GOLA) are currently in progress and are expected to fully resume this afternoon.

However, operations may face further disruptions until 20 March due to strong wind gusts, a source said.

In Canada’s Montreal, bunker operations could face disruptions from 20-24 March due to high wind gusts. Barge activity remains limited to daylight hours, contributing to backlog congestion. High winds may also cause delays.

Caribbean and Latin America

Bunker demand in Panama has been relatively slow this week, a source says.

HSFO availability in Cristobal requires a lead time of at least seven days for prompt deliveries, while in Balboa, lead times are shorter due to a higher number of barges operating on that side of the canal, allowing for quicker deliveries.

For VLSFO and LSMGO, supply is available in both Balboa and Cristobal within a week.

“It is best to book bunkers only after the vessel's transit slot is confirmed to ensure timely delivery, and secure the most cost-effective refueling option,” the source added.

VLSFO availability at the Zona Comun anchorage remains volatile, with lower prices indicating a drop in demand. Lead times are currently around 10-12 days.

Strong wind gusts exceeding 20 knots are forecast at the anchorage through 23 March, potentially disrupting operations until next Tuesday. These conditions may cause delays in bunker deliveries and could lead to prolonged interruptions.

In Argentina, Bahía Blanca port, a key hub for wheat exports operations, are gradually returning to normal after being severely impacted by a strong gale on 7 March.

The storm caused widespread flooding, power outages, and brought all transport to a halt in the city and port area.

The last berths to resume operations include a grain export facility at Puerto Galván, a key terminal in Bahía Blanca that handles agricultural and industrial cargo, and a urea production facility.

Both suffered significant power supply damage, leading to extended repair work.

Bunker fuel availability in the Brazilian port of Santos was very tight earlier in March, but the situation is getting better now, a source said.

Availability across all grades is good in Santa Marta, Barranquilla, and Cartagena, with recommended lead times of 2-3 days, another source said.

By Gautamee Hazarika

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.