Europe & Africa Market Update 13 Feb 2025

Bunker prices in key European and African locations have declined, and bunker availability has improved in Las Palmas.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($13/mt), Gibraltar ($10/mt) and Rotterdam ($6/mt)

- LSMGO prices down in Rotterdam and Gibraltar ($6/mt)

- HSFO prices down in Gibraltar ($7/mt) and Rotterdam ($5/mt)

- Rotterdam B30-VLSFO at a $189/mt premium over VLSFO

HSFO and VLSFO remain tight for prompt deliveries in the ARA hub. Lead times for both grades are 5-7 days, unchanged from last week. LSMGO availability is comparatively better, requiring lead times of 3-5 days.

Bunker supply has improved in the Canary Islands’ port of Las Palmas. Suppliers can now offer prompt deliveries across all three grades. Lead times of 3-5 days are advised for optimal coverage. Bunker operations are currently running normally in Las Palmas amid conducive weather conditions.

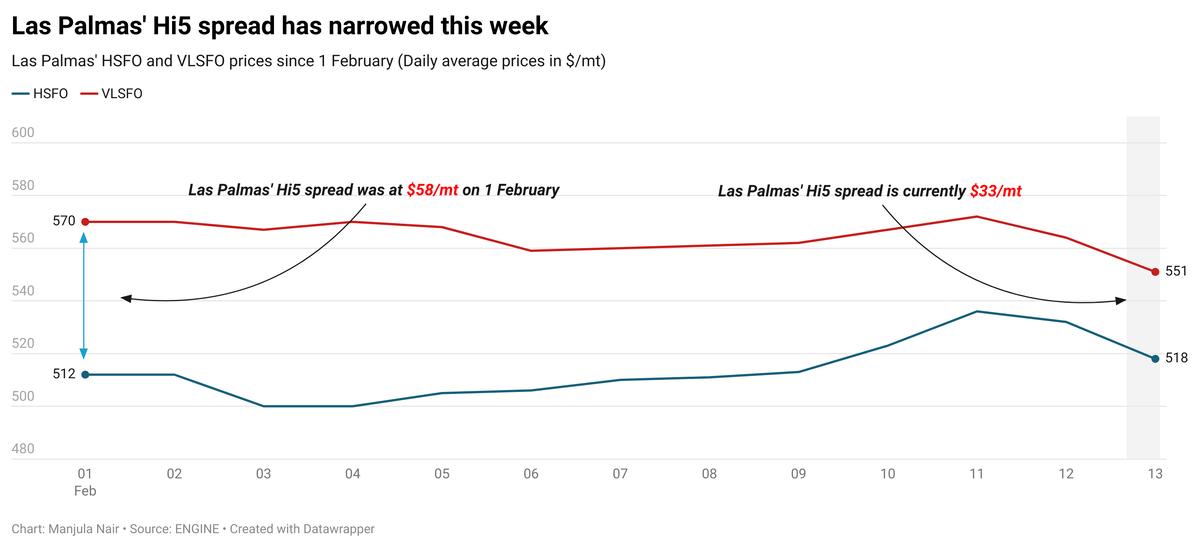

Bunker prices across all grades have come down in Las Palmas. Two lower priced non-prompt VLSFO stems booked in Las Palmas in the past day have contributed to drag the benchmark down. The port's HSFO price has fallen by a steep $15/mt, influenced by a lower priced non-prompt stem fixed in the past day.

Las Palmas' Hi5 spread has narrowed in the past one week, currently standing at around $33/mt.

Brent

The front-month ICE Brent contract has moved $1.49/bbl lower on the day, to trade at $74.81/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support after the Organization of the Petroleum Exporting Countries (OPEC), in its latest monthly oil market report (MOMR), maintained its oil demand growth forecast at 1.4 million b/d for 2025 and 2026.

The Saudi Arabia-led oil producers’ group has raised demand growth forecast for its crude by 100,000 b/d from January’s assessment to stand at 42.6 million b/d in 2025 and by 200,000 b/d to reach around 42.9 million b/d in 2026.

OPEC has announced plans to gradually start unwinding its ongoing 2.2 million b/d output cut from April. However, it may change the strategy and continue output cuts, depending on market conditions, the group said earlier.

Downward pressure:

Oil supply disruption concerns have eased following reports of upcoming talks between the US and Russia to end the 36-month long conflict in Ukraine.

US President Donald Trump and Russian counterpart Vladimir Putin have agreed to start the negotiations, “sparking optimism that risks to crude oil supplies would ease,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Besides, oil prices took a hit after the US Energy Information Administration (EIA) reported a notable surge in US crude stockpiles.

Commercial US crude oil inventories increased by 4.1 million bbls to touch 428 million bbls for the week ending 7 February, according to data from the EIA. A surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise.

“The EIA’s data on Wednesday showing a third consecutive weekly jump in US crude stockpiles also added downward pressure on crude,” VANDA Insights’ founder and analyst Vandana Hari said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.