Europe & Africa Market Update 12 Feb 2025

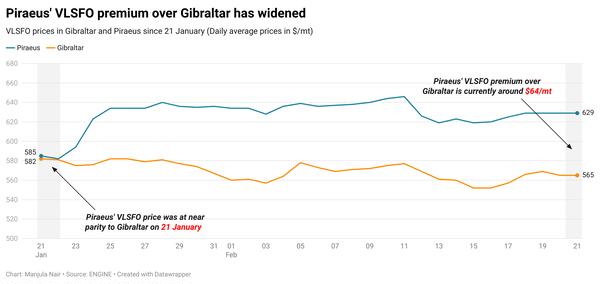

European and African bunker benchmarks have mostly declined with Brent, and bunker supply has improved in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($13/mt), Gibraltar ($8/mt) and Rotterdam ($7/mt)

- LSMGO prices unchanged in Gibraltar, and down in Rotterdam ($12/mt)

- HSFO prices unchanged in Rotterdam, and down in Gibraltar ($3/mt)

- Rotterdam B30-VLSFO at a $197/mt premium over VLSFO

Rotterdam’s LSMGO price has registered a steep fall, while Gibraltar’s LSMGO price has remained unchanged. These price moves have widened Rotterdam’s LSMGO price discount to Gibraltar by $12/mt, to $76/mt now.

VLSFO and LSMGO supply has improved in Gibraltar. According to a trader, recommended lead times for both grades have come down from 7-8 days last week to 3-5 days now.

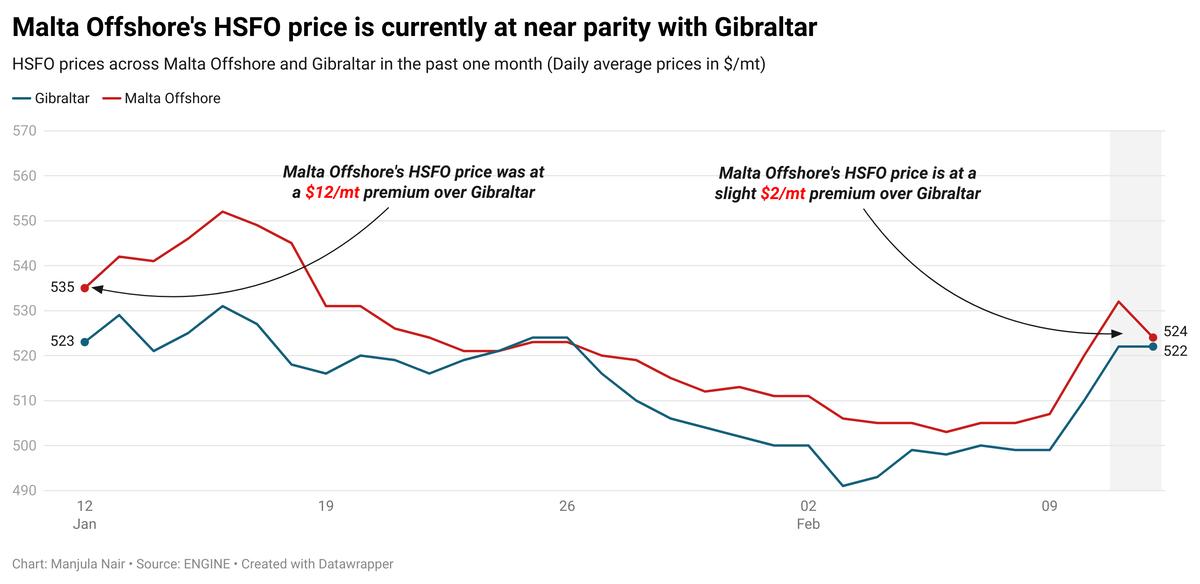

Bunker demand is very low off Malta, a trader told ENGINE. Bunker availability is normal across all three grades, with lead times of 3-5 days recommended for full coverage from suppliers. Malta Offshore's HSFO price has fallen by a sharp $16/mt in the past day. The price drop has narrowed Malta Offshore’s HSFO premium over Gibraltar to just $2/mt today from $11/mt in the previous session.

In the South African ports of Durban and Richards Bay, VLSFO availability is tight for prompt delivery, a trader said. Lead times are consistent from last week at 7-10 days. Suppliers have run dry of LSMGO in Durban, a trader said

Brent

The front-month ICE Brent contract has lost $0.42/bbl on the day, to trade at $76.30/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil and energy sanctions against Russia and Iran have raised supply concerns in the global oil market and have provided some support to Brent’s price in recent days.

“Approximately 6.3 million barrels of Pacific crude from Russian platforms at the Sakhalin Island project are stranded after the tankers hauling them to China were blacklisted,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Besides, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned several shipping companies and vessels last week, for transporting illicit Iranian crude oil to China.

“Oil prices are on the rise as the Trump Administration starts to crack down on Iranian oil exports,” Price Futures Group’s senior market analyst Phil Flynn said.

Downward pressure:

Brent futures erased the previous day’s gains following a significant surge in US crude stocks.

Crude oil inventories in the US surged by 9.04 million bbls in the week that ended 7 February, according to the American Petroleum Institute (API) estimates.

A surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise. “The oil market traded under pressure… as the latest inventory numbers from the American Petroleum Institute (API) remain largely bearish,” two analysts from ING Bank said.

Oil prices felt more downward pressure after the US Federal Reserve (Fed) chairman Jerome Powell commented that the US central bank is not considering any immediate interest rate cuts.

Higher interest rates can dampen global oil demand as it makes dollar-denominated commodities like oil costlier for holders of other currencies.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.