Americas Market Update 4 Feb 2025

Bunker prices across the Americas have moved in mixed directions, and high wind gusts in New York may delay bunker operations this week.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Los Angeles ($13/mt) and Balboa ($1/mt), and down in New York ($7/mt) and Houston ($2/mt)

- LSMGO prices up in Balboa ($12/mt) and Houston ($10/mt), and down in Los Angeles ($20/mt) and New York ($9/mt)

- HSFO prices up in Balboa ($10/mt) and Los Angeles ($9/mt), and down in New York ($4/mt) and Houston ($2/mt)

Bunker operations around US Gulf Coast ports are facing extended delays from reduced visibility. “Dense fog has been reported and observed throughout Houston Ship Channel and Galveston Bay. A National Weather Service Dense Fog Advisory is extended until 12pm today,” a source says.

Fog conditions in the area depend heavily on wind directions. Southerly winds from the Gulf typically result in fog in the Houston area, while colder, northerly winds can keep visibility clearer.

Bunker deliveries in the Galveston Offshore Lightering Area (GOLA) are currently underway, although delays are expected. Operations may face further disruptions this week due to high wind gusts, a source says.

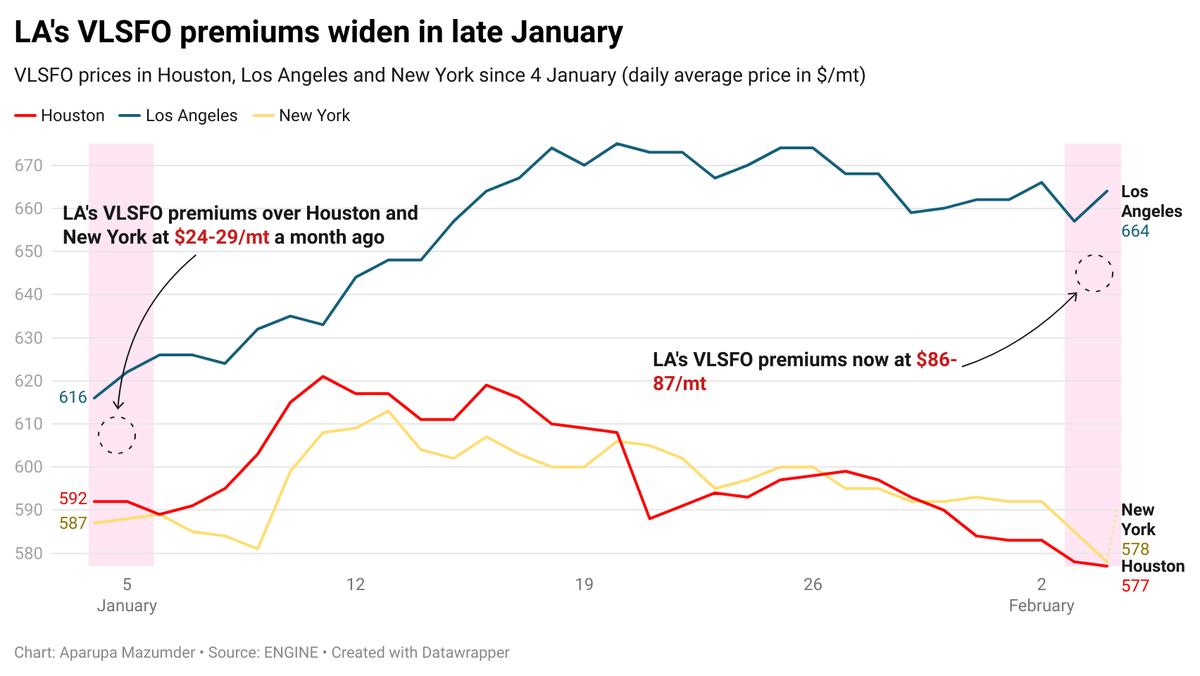

Los Angeles’ VLSFO price has gained sharply in the past session, while prices have dipped in New York and Houston. Los Angeles’ VLSFO price has moved sharply above New York and Houston’s in the past month and is currently at premiums of $86-87/mt.

Los Angeles and Long Beach have seen improved availability across all fuel grades, with suppliers recommending lead times of less than seven days. Meanwhile, suppliers in New York can offer VLSFO and LSMGO for prompt deliveries, a source says.

Brent

The front-month ICE Brent contract has moved $0.71/bbl lower on the day, to trade at $75.16/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price found some support after OPEC+ announced yesterday to stick to its current production policy of gradually raising oil output from April.

At the previous ministerial gathering in December, the group decided to delay the unwinding of the 2.2 million b/d production cut to April 2025, from January 2025.

The unwinding of the group's voluntary production cut will take place on a monthly basis until the end of September 2026.

“OPEC+ held its Joint Ministerial Monitoring Committee (JMMC) meeting yesterday, and as widely expected the group recommended no change to its output policy,” two analysts from ING Bank said.

The decision to extend production cuts into 2025 signals that OPEC+ believes demand growth might not be robust enough to accommodate the full return of supply anticipated in 2025.

Downward pressure:

Brent’s price moved lower after Canada and Mexico came to a last-minute deal with the US, which will see tariffs postponed by at least a month.

Both Mexico and Canada agreed to put more resources on the shared US border to combat the fentanyl drug flow into the US. The delay has put some downward pressure on Brent’s price.

“The oil market gave back a lot of its gains yesterday after Mexico and Canada came to a deal with the US, which saw a delay in the implementation of tariffs,” ING Bank’s analysts said.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.