East of Suez Market Update 9 Jan 2025

Most prices in East of Suez ports have moved down, and bunker operations in Zhoushan’s OPL area have been suspended by bad weather since Tuesday.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Singapore ($11/mt), Fujairah and Zhoushan ($7/mt)

- LSMGO prices up in Fujairah ($1/mt), and down in Singapore ($14/mt) and Zhoushan ($13/mt)

- HSFO prices down in Singapore ($11/mt), Fujairah and Zhoushan ($9/mt)

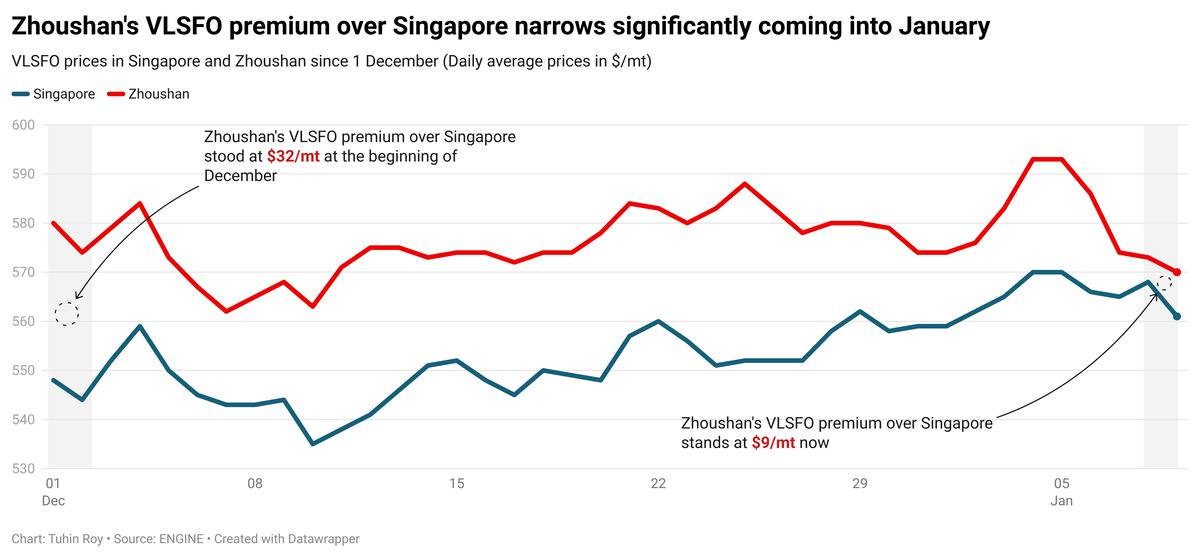

Singapore’s VLSFO price has dropped by $11/mt, the sharpest decline among the three major Asian bunker ports. Four VLSFO stems have been fixed in Singapore within a wide $60/mt range, with lower-priced stems contributing to the benchmark’s decline. Despite this drop, Singapore’s VLSFO retains a $12/mt premium over Fujairah, while it is at a $9/mt discount to Zhoushan.

VLSFO availability in Singapore remains tight, with standard lead times around nine days. Expedited deliveries within five days are possible at higher costs. HSFO supply has improved, with lead times reduced from 9-15 days last week to 5-9 days currently. LSMGO lead times are in a wide range of 3-11 days.

In Zhoushan, lead times for VLSFO and HSFO have shortened to 4-6 days, down from last week’s 5-7 days. However, LSMGO lead times have increased to six days, compared to 3-5 days previously.

Bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages have been suspended since Tuesday due to rough weather. Several suppliers expect bunker operations in Zhoushan's OPL area to resume fully by tomorrow, according to a source.

Brent

The front-month ICE Brent contract has moved $1.73/bbl lower on the day, to trade at $76.11/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures have gained support from expectations of strong winter fuel demand. Oil demand in January is expected to rise by 1.4 million b/d year-on-year to 101.4 million b/d, driven mainly by increased heating fuel consumption in the northern hemisphere, according to Reuters, citing JPMorgan analysts. They noted that colder-than-normal winter conditions, and an earlier start to travel in China for the Lunar New Year holidays, are boosting heating fuel usage.

Anticipations of stricter sanctions on Russian and Iranian oil firms have also lent support to oil prices. New sanctions are expected to take effect after US president-elect Donald Trump’s inauguration later this month.

“Concerns over Iranian and Russian oil flows will also be providing some support,” two analysts from ING Bank have said.

Market watchers are also worried about global supply tightening amid rising demand, further adding to Brent’s upward momentum.

Downward pressure:

Despite a drop in commercial US crude oil stocks, build-ups in gasoline and distillate stocks have exerted some downward pressure on Brent futures.

The latest data from the US Energy Information Administration (EIA) revealed an increase in gasoline and distillate stockpiles last week in the US. Gasoline inventories rose by 6.33 million bbls to 237 million bbls, while middle distillate stocks increased by 6.07 million bbls to 128 million bbls.

Oil prices declined “on the back of a bearish weekly US oil stockpiles report,” said Vandana Hari, founder and analyst at VANDA Insights.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.