Biofuel Bunker Snapshot: Bio-blend prices rise on fossil fuel gains

VLSFO and LSMGO gains drive B30 and B24 prices higher

POME and UCOME price plunges prevent further gains

Dutch HBE rebates drop into the new year

Some market participants have been talking about a slow start to the year after the holiday wind-down across Europe. Others have gotten busy securing biofuel spot volumes to comply with a now-active FuelEU Maritime regulation, or on a more continuous voluntary basis to sell on green freight to environmentally conscious cargo owners.

Many owners of ships trading in the EU will for the first time dip their toes in a green bunker fuel market, opting for biofuel blends to work on their FuelEU compliance and take some of the sting out of their EU ETS bills.

Rotterdam

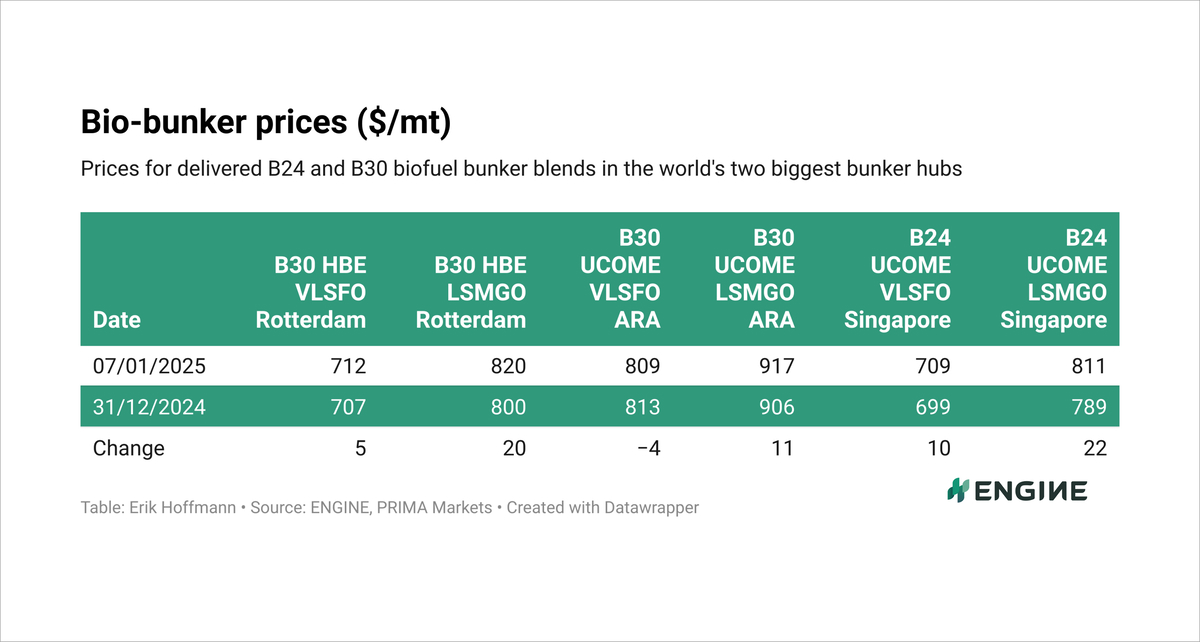

Rotterdam’s B30-VLSFO and B30-LSMGO HBE prices have come up in the past week. The gains have mainly been supported by $13/mt and $32/mt rises in ENGINE’s underlying VLSFO and LSMGO prices, respectively. These fossil fuels do, after all, make up 70% of the blends and a $17/mt weekly gain for front-month ICE Brent crude has had a knock-on effect on both the VLSFO, LSMGO and bio-blend prices.

An $8/mt drop in the Dutch HBE rebate for advanced biofuels has also lent support to the B30 blends, while a big $50/mt drop in PRIMA Market’s underlying POMEME CIF ARA price kept a lid on further price gains for the blends.

These prices are for HBE-qualifying biofuel blends produced from palm oil methyl ester (POME) as a feedstock. Without the HBE rebates, Rotterdam’s B30 bunker prices would have been $103/mt more expensive, and they would have failed to compete with Singapore’s price levels.

Price movements for Rotterdam’s B30 UCOME grades have been more mixed. B30-VLSFO UCOME is down a little amid a $50/mt drop in PRIMA’s underlying UCOME FOB ARA price. A $13/mt rise for ENGINE’s VLSFO price was not enough to keep the blended price out of the red.

B30-LSMGO has fared better, propped up by a $32/mt jump in the ENGINE LSMGO price.

Singapore

Singapore’s B24-VLSFO and B24-LSMGO prices are both markedly up on the week, drawing support from a $25/mt gain in PRIMA Market’s UCOME FOB China price. Freight for that UCOME from China to Singapore has gone up by $0.25/mt to $13.75/mt, which is not enough to materially impact delivered prices.

In Hong Kong, bunker supplier Chimbusco Pan Nation supplied a B24 blend to a cruise ship owned by Royal Caribbean. The cruise ship, Celebrity Solstice, took biofuel for the first time.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.