Americas Market Update 7 Jan 2025

Bunker benchmarks in key Americas ports have moved in mixed directions, and bunker deliveries can be delayed in New York due to bad weather conditions.

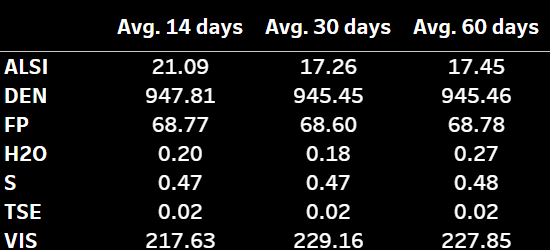

Changes on the day to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Los Angeles ($7/mt), unchanged in Zona Comun, and down in New York ($9/mt), Balboa ($3/mt) and Houston ($1/mt)

- LSMGO prices up in Los Angeles ($36/mt), Houston ($5/mt) and Balboa ($3/mt), and down in New York ($2/mt)

- HSFO prices down in Houston ($6/mt), New York ($5/mt), Balboa ($4/mt) and Los Angeles ($1/mt)

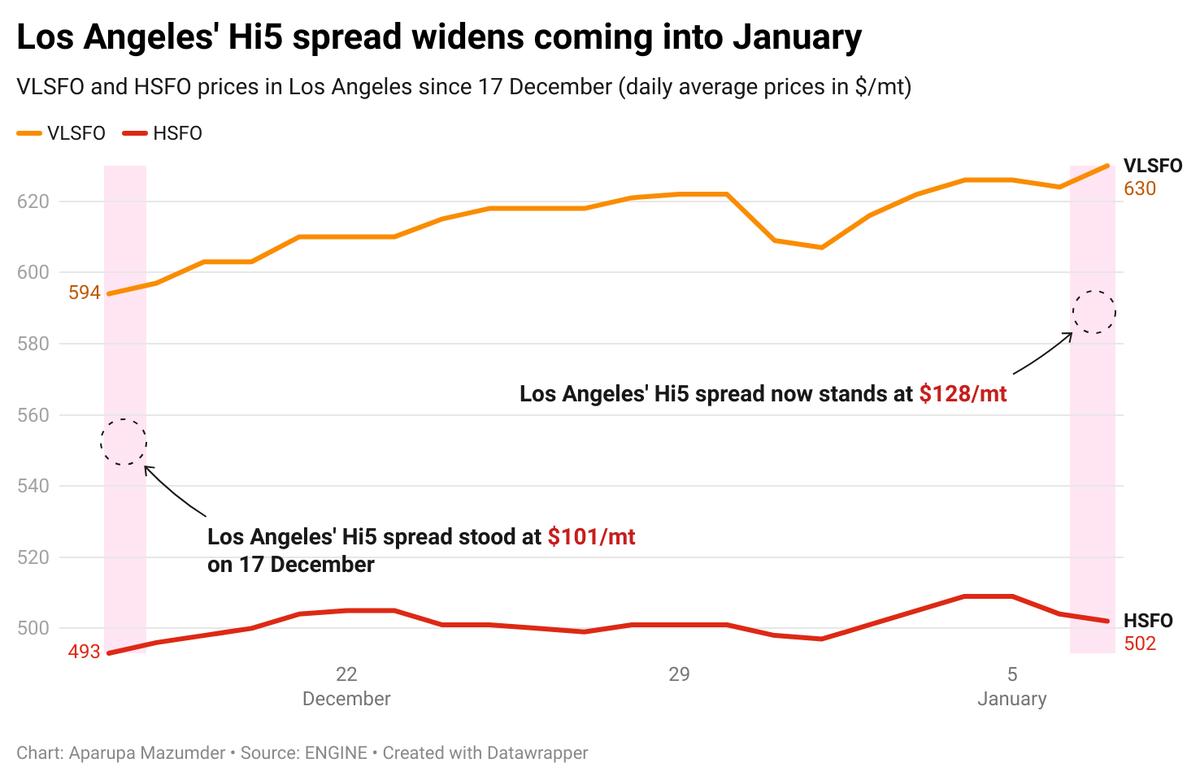

Los Angeles’ HSFO price has dropped marginally in the past day, tracking Brent’s downward movement, while the port’s VLSFO price has gained. The diverging price moves have widened the port’s Hi5 spread to $128/mt now.

VLSFO and LSMGO availability is good for prompt deliveries in the West Coast ports of Los Angeles and Long Beach, with lead times of less than seven days, according to a source.

Bunkering operations can face delays in New York through this week due to rough weather conditions and high wind gusts. Standby tugs may be required at certain times, a source says.

Deliveries remain suspended in the Galveston Offshore Lightering Area (GOLA) due to bad weather. The situation is expected to persist throughout the week.

Brent

The front-month ICE Brent contract has gained $0.42/bbl on the day, to trade at $76.65/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price has continued to trade above $75/bbl as oil demand growth optimism in the US got a boost from increased oil use for heating purposes during the winter storms.

Oil prices have been rallying, “on the back of severe cold weather in the US and Europe,” VANDA Insights’ founder and analyst Vandana Hari said.

Additionally, state-owned refiners in China are set to increase crude throughput in January amid expectations of strong demand for oil products around the Chinese New Year.

Chinese state-owned refiners plan to process a total of 40.50 million mt of crude in January, with the daily throughput at around 1.31 million mt (9.62 million b/d), up 3.12% from December 2024.

Downward pressure:

The surge in oil production outside OPEC+ has put some downward pressure on Brent’s price in recent days, according to market analysts, with more efficient ways to boost oil output in the US.

Global oil production is “rising at an average rate of more than 4% per year as the industry learns to squeeze more output from fewer rigs,” independent market analyst John Kemp remarked.

“Persistent production growth has frustrated efforts by Saudi Arabia and its OPEC⁺ allies to drain excess inventories and drive price higher by reducing their own output,” Kemp added.

Oil market investors are now waiting for new policy changes on oil production in the US as President-elect Donald Trump prepares to take office later this month.

By Aparupa Mazumder

Please get in touch with comments or additional info to news @engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.