Europe & Africa Market Update 6 Jan 2025

Regional bunker benchmarks have mostly gained over the weekend, and bad weather could disrupt bunkering in Gibraltar.

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($8/mt) and Gibraltar ($6/mt), and down in Durban ($16/mt)

- LSMGO prices up in Rotterdam ($14/mt) and Gibraltar ($3/mt)

- HSFO prices unchanged in Rotterdam, and down in Gibraltar ($3/mt)

- Rotterdam B30-VLSFO at a $192/mt premium over VLSFO

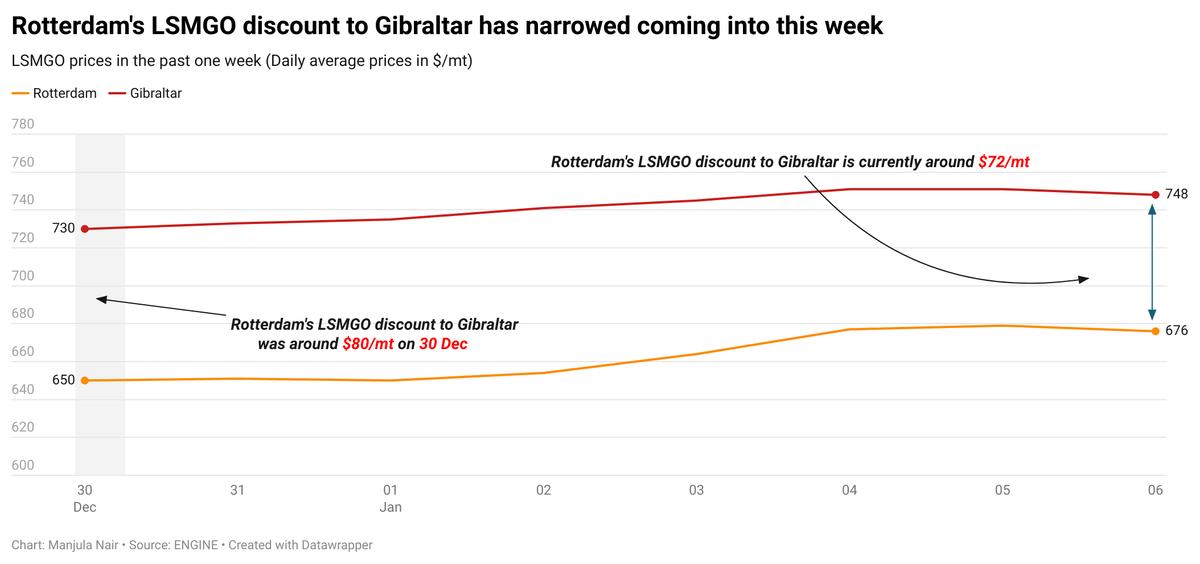

Rotterdam’s LSMGO price has seen a sharp rise over the weekend. A significantly higher-priced stem booked on Friday for non-prompt delivery has pushed the benchmark higher. Meanwhile, Gibraltar's LSMGO price has inched up. The price moves have narrowed Rotterdam’s LSMGO discount to Gibraltar by $11/mt to around $72/mt now. Availability of LSMGO and VLSFO is good in Rotterdam, with suppliers offering prompt deliveries for both the grades. However, HSFO is tight for very prompt delivery, requiring lead times of 5-7 days.

Gibraltar is facing rough weather conditions today with strong wind gusts of 23-29 knots, which could hamper bunkering. 12 vessels are currently waiting for bunkers in Gibraltar, up from 11 on Friday, according to a source.

Bunkering is proceeding smoothly in Ceuta, with five vessels due to arrive for bunkers today, down from six yesterday, according to shipping agent Jose Salama & Co. A supplier is currently experiencing some delays at one of the terminals in Ceuta.

HSFO availability is tight in the Greek port of Piraeus, a trader told ENGINE. VLSFO and LSMGO availability is normal in the port with suppliers able to offer prompt deliveries for both grades.

Brent

The front-month ICE Brent contract has gained $0.32/bbl on the day from Friday, to trade at $76.17/bbl at 09.00 GMT.

Upward pressure:

Brent futures found a strong start to the week, after manufacturing activity in the US and China showed signs of improvement in December.

China's Manufacturing Purchasing Managers' Index (PMI) reading recorded a 50.1% growth in December. In the US, manufacturing PMI increased to 49.3% in December.

A PMI reading above 50 typically indicates good economic health and an expansion in the manufacturing sector, as well as strong demand for commodities like oil.

“As 2025 begins, oil prices are climbing, fueled by robust demand optimism,” SPI Asset Management’s managing partner Stephen Innes noted.

Downward pressure:

Brent’s price felt some downward pressure from a relatively stronger US dollar ahead of other important economic data from the US Federal Reserve (Fed) later in the week.

Minutes from the US central bank’s last meeting will be out on Wednesday.

A stronger US dollar makes commodities like oil costlier for non-dollar holders, thereby denting demand in the market.

Concerns about potential oil sanctions on Iran under Donald Trump's presidency have bolstered market expectations of a supply increase from OPEC+. Analysts suggest that, in such a scenario, Brent's price could fall.

“There will also be concerns over how hawkish Trump will be towards Iran when he takes office later this month,” two analysts from ING Bank said. “It would also leave an opportunity for OPEC+ to increase supply,” they added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.