The Week in Alt Fuels: Why FuelEU’s first decade matters

The first 10 years of FuelEU will provide a window of opportunity to explore alternative fuels and technologies ahead of stricter regulations.

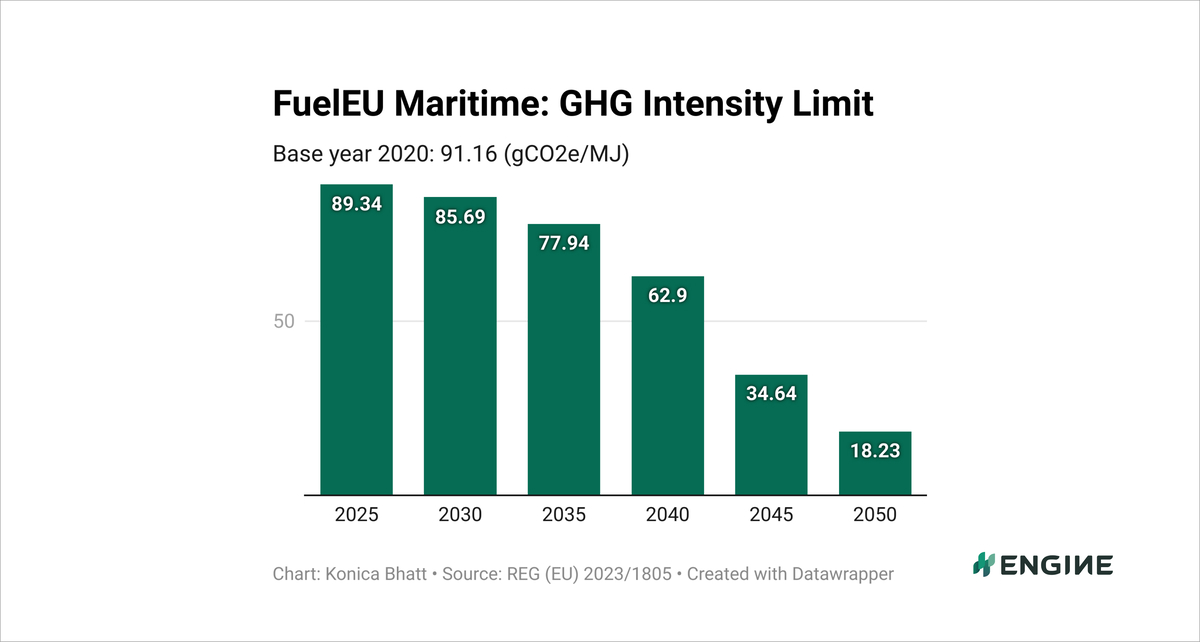

GRAPH: The well-to-wake (WtW) GHG intensity limits of energy consumed onboard ships sailing between EU ports. Official Journal of the European Union, ENGINE

GRAPH: The well-to-wake (WtW) GHG intensity limits of energy consumed onboard ships sailing between EU ports. Official Journal of the European Union, ENGINE

This year has ushered in a new regulatory era for shipping with the debut of the FuelEU Maritime regulation. This is the EU's first technical regulation aimed at reducing the greenhouse gas (GHG) intensity of maritime transport and promote adoption of low- and zero-emission bunker fuels.

Ships sailing between EU ports must cap the average well-to-wake (WtW) GHG intensity of onboard energy at 89.34 grams of carbon dioxide equivalent per megajoule (gCO2e/MJ) by 2030, and at 85.69 gCO2e/MJ by 2035. Those are 2% and 6% reductions from a 2020 baseline of 91.16 gCO2e/MJ.

These relatively modest targets provide shipowners with some breathing room to prepare for tightening requirements towards an 80% reduction by 2050.

To future-proof their fleets against more stringent targets, shipowners can invest in vessels that can consume fuels with low or zero GHG intensity. These include synthetic fuels such as e-methanol and e-ammonia - which the EU labels renewable fuels of non-biological origin (RFNBOs) - and they are incentivised through a regulatory multiplier available until 2034.

To qualify for the multiplier, a fuel's GHG intensity must be lower than 70% of a reference value of 94 gCO2eq/MJ on a well-to-wake basis.

When a ship uses an RFNBO as its primary fuel, the multiplier essentially halves the onboard GHG intensity of that fuel and leaves a greater "surplus intensity" compared to the GHG intensity target. This compliance surplus can then be used within a pool of vessels to improve the GHG intensity of vessels using conventional fossil fuels.

For example, a DNV study showed that one vessel running on 90% e-methanol (28.20 gCO2e/MJ) and 10% MGO (90.63 gCO2e/MJ) can be averaged out to make up to 55 MGO-fuelled ships/year compliant between 2025-2029. This number drops to 13 ships/year between 2030–2034.

Using 90% near-zero-emission e-methanol (2.47 gCO2e/MJ) with 10% MGO increases this ship's capacity to cover the compliance of 64 other ships/year between 2025-2029, and 16 ships/year between 2030-2034.

Now, from a cost-to-cost standpoint, using RFNBOs is not immediately economical. For instance, the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMMCZCS) has estimated e-methanol to cost $2,750/mt on a VLSFO-equivalent (mtVLSFOe) basis in 2025.

MMMCZCS estimates the potential value of the compliance surplus generated by an e-methanol-fuelled vessel in a pooling arrangement to $280/mtVLSFOe. This still leaves e-methanol far more expensive than VLSFO ($560/mt today), even after accounting for the FuelEU and EU ETS costs for consuming VLSFO.

MMMCZCS projects that RFNBOs will become more cost-competitive only after 2035, as fuel production costs decline and pooling values and VLSFO costs rise on rising regulatory penalties.

But as GHG intensity targets tighten and compliance surpluses decline, the ability to cover other vessels' compliance through pooling will diminish.

This highlights the importance of early planning. These initial years provide shipowners with the opportunity to retrofit existing vessels, invest in newbuilds capable of running on low GHG intensity fuels, and collaborate with fuel suppliers to secure long-term offtake agreements in preparation for stricter targets.

In other news, the Maritime and Port Authority of Singapore (MPA) has announced concessions for ocean-going vessels using alternative fuels or technologies during port stays of up to four days. Vessels using zero-carbon fuels, including ammonia (with pilot fuel capped at 25% and ammonia slip addressed), B100 biofuel, or green methanol, will also receive a full port dues concession. Those using blends between B50 and B99 are eligible for a 30% concession, while blends ranging from B24 to B49 can avail a 20% concession.

Carbon dioxide (CO2) storage and transport firm Northern Lights has announced that the second of four CO2 carriers under construction at Chinese shipyards is now ready for delivery. Its first operational customer will be the German building materials supplier Heidelberg Materials.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.