Europe & Africa Market Update 8 Nov 2023

Bunker benchmarks in European and African ports have moved in mixed directions, and bunker fuel availability is good off Malta.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($1/mt), unchanged in Gibraltar, and down in Durban ($6/mt)

- LSMGO prices up in Durban ($11/mt) and Gibraltar ($1/mt), and unchanged in Rotterdam

- HSFO prices up in Gibraltar ($3/mt), and down in Rotterdam ($1/mt)

- Rotterdam B30-VLSFO at a $187/mt premium over VLSFO

Rotterdam’s HSFO and VLSFO prices have broadly held steady in the past day. The port’s Hi5 spread has widened slightly by $2/mt, to $39/mt now. Availability across all grades is tight for prompt delivery in Rotterdam and in the wider ARA hub, a trader said. Lead times for HSFO are 7-10 days, while VLSFO and LSMGO require lead times of 5-7 days.

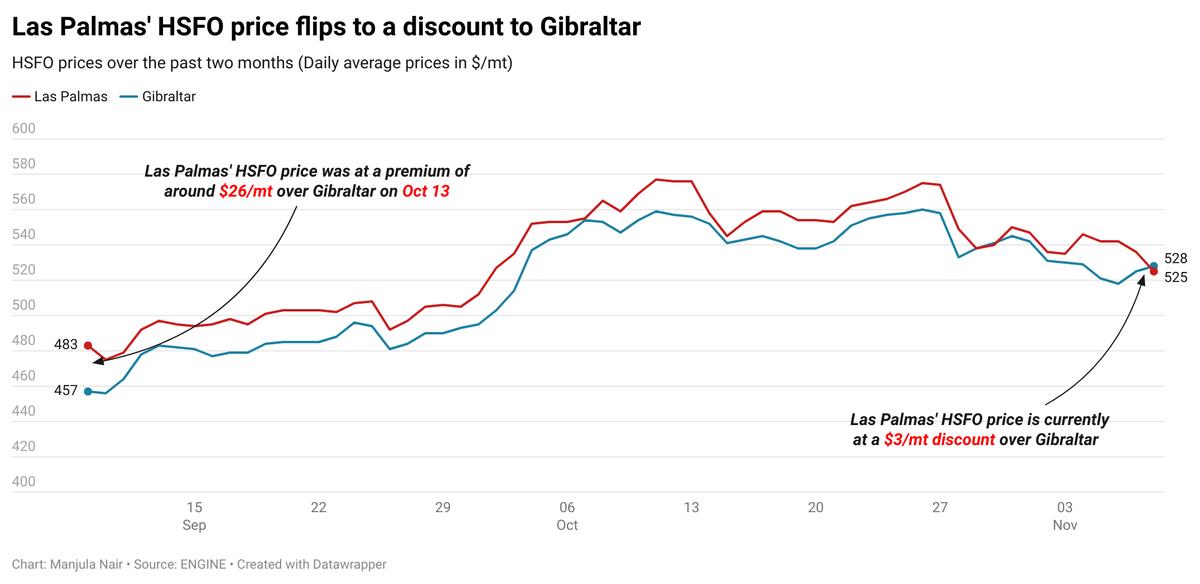

A significantly lower-priced prompt HSFO stem fixed in Las Palmas at $512/mt for 500-1500 mt has dragged the benchmark down by $18/mt in the past day. This has flipped Las Palmas’ HSFO premium over Gibraltar to a $3/mt discount now. HSFO is currently tight in Las Palmas, with traders advising lead times of up to 11 days for the grade. The last HSFO cargo arrived on 29 October in Las Palmas, according to Vortexa data.

Off Malta, bunker availability is normal for all three grades, a trader told ENGINE. Lead times of 3-4 days are advised for all bunker fuel grades. Bad weather is forecast till Saturday, which may impact bunkering.

Brent

The front-month ICE Brent contract has lost $0.36/bbl on the day, to trade at $74.51/bbl at 09.00 GMT.

Upward pressure:

Donald Trump’s victory in the 47th US Presidential Election has put some upward pressure on Brent’s price as market participants focus on oil supply risks.

Oil investors are trying to price in the implications of Trump’s government on policy changes and geopolitical relations, especially with Iran. The Republican candidate’s “tough stance” on Iran, which could impose severe sanctions on the country could damper oil supply, pushing Brent’s price up.

“The Iran sanctions tail risk—a clear sign the market is still weighing the impact. Trump’s policies could simultaneously fuel and temper oil prices, and much will depend on how his administration plays the sanctions,” SPI Asset Management’s managing partner Stephen Innes wrote.

Brent’s price found more support after the US Federal Reserve (Fed) cut its key interest rate for the second time in 2024.

In a largely anticipated move, the US Federal Open Market Committee (FOMC) cut its key interest rate by 25 basis points, bringing the central bank’s benchmark rate to a range between 4.50 - 4.75%.

Lower interest rates in the US may boost oil demand and support prices.

Downward pressure:

Brent’s price felt downward pressure as supply concerns related to Hurricane Rafael eased.

The US National Hurricane Center has said that Hurricane Rafael is expected to move slowly westward over the US Gulf of Mexico and away from US offshore oil fields. It is expected to weaken over the weekend.

Besides, weekly US crude stock data saw a rise and curtailed Brent’s price gains. Commercial crude oil inventories in the US rose by 2.15 million bbls to touch 428 million bbls for the week ending 1 November, according to the US Energy Information Administration (EIA).

“The weekly oil inventories for the week were less than inspiring,” Price Futures Group’s senior market analyst Phil Flynn said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.