Americas Market Update 9 Oct 2024

Regional bunker benchmarks have declined, and operations have been suspended in several ports in Florida ahead of Hurricane Milton.

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices down in Balboa ($26/mt), New York ($20/mt), Houston ($18/mt) and Zona Comun ($15/mt)

- LSMGO prices down in Zona Comun ($34/mt), Houston and New York ($19/mt), and Balboa ($17/mt)

- HSFO prices down in New York ($21/mt), Houston ($15/mt) and Balboa ($10/mt)

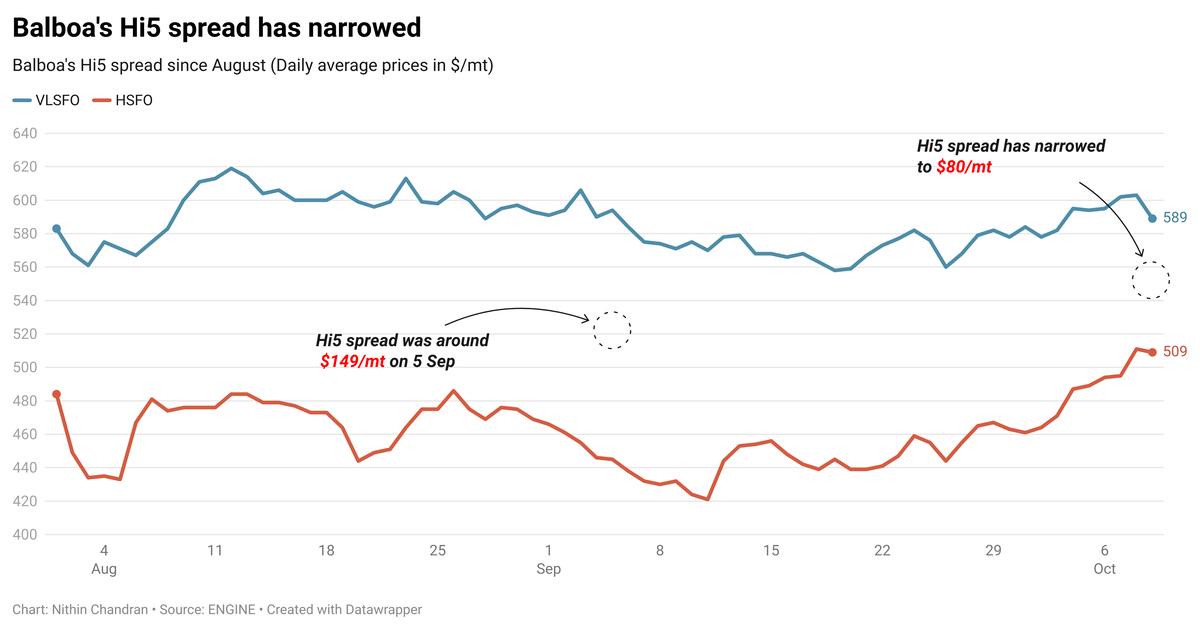

Balboa’s VLSFO price has declined by $26/mt in the past day, while its HSFO price has come down by a more modest $10/mt. Several lower-priced firm offers have put downward pressure on the port’s VLSFO benchmark.

As a result, Balboa’s Hi5 spread has narrowed from yesterday’s $94/mt to $80/mt now.

Availability of VLSFO and LSMGO is normal in the Panamanian port.

VLSFO and LSMGO availability is normal in the East Coast port of New York. Lead times of 2-4 days are recommended for both grades.

New York’s VLSFO is priced about $28/mt higher than Houston’s.

Prompt HSFO supply can be tight in the port, with lead times of seven days recommended for the grade, a trader said. There is strong HSFO demand from container lines in New York, the trader added.

Several ports in Florida have been shut as Hurricane Milton is expected to hit the state's west coast late tonight. The US Coast Guard has set port condition “Zulu” for the ports of Tampa, Manatee, St. Petersburg and Fort Myers, which fall in the direct path of the hurricane.

During port condition Zulu, all vessel movements and port operations are suspended.

Brent

The front-month ICE Brent contract has declined by $2.73/bbl on the day, to trade at $76.67/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

The war in the Middle East has continued to keep the global oil market on edge and put some upward pressure on Brent’s price.

One year into the conflict, the Iran-aligned Hezbollah militant group reportedly fired over 135 missiles at Israel yesterday, the Israel Defense Forces (IDF) claimed. Meanwhile, the IDF troops have continued their ground operation in Southern Lebanon.

“A Hezbollah underground tunnel that crossed approx. 10 meters from Lebanon into Israeli territory was located and dismantled,” the IDF said on social media platform X (formerly Twitter).

Oil market analysts fear disruption to oil infrastructure in the broader region if Israel-Iran conflict escalates. “Concern remains as to whether Israel will attack Iran’s oil industry following the recent missile strikes,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent’s recent rally has come to a halt as global demand concerns have once again taken centre stage.

Crude oil inventories in the US surged by a massive 10.9 million bbls in the week that ended 4 October, according to the American Petroleum Institute (API) estimates. Oil market analysts expected a much smaller inventory gain of 1.95 million bbls during the week.

An increase in US crude stocks indicates lacklustre oil demand growth, which can put downward pressure on Brent’s price.

Brent’s price trailed lower after China’s National Development and Reforms Commission (NDRC), in a recent press conference, did to announce any new supportive measures for the country’s economic growth.

“Without policy support, an economic slowdown could keep China’s oil demand subdued in the short to medium term,” two analysts from ING Bank said.

On the supply front, oil production in Libya reached 1.13 million b/d yesterday, its state-owned oil firm National Oil Corporation (NOC) said. The output growth comes days after oil producers resumed operations in the Sharara and El-feel oilfields, two of the largest Libyan oil production sites, NOC said.

The North African country has a production capacity of about 1.18 million b/d, according to OPEC.

By Nithin Chandran and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.