LNG Bunker Snapshot: Singapore's LNG premium over Rotterdam narrows

Rotterdam's LNG bunker price has increased due to lower natural gas supplies from Norway and Russia, while Singapore’s price has dropped as increased LNG supply and lower demand influenced the market.

PHOTO: CMA CGM's LNG-powered vessel bunkered at the Port of Rotterdam. CMA CGM

PHOTO: CMA CGM's LNG-powered vessel bunkered at the Port of Rotterdam. CMA CGM

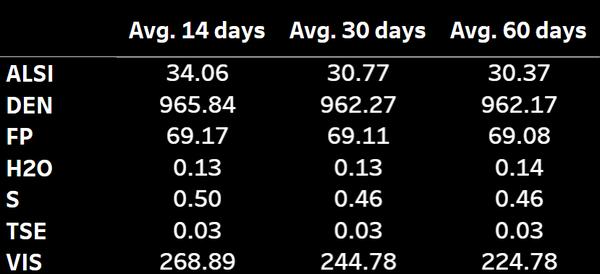

Changes in weekly LNG bunker prices:

- Rotterdam up by $9/mt to $748/mt

- Singapore down by $6/mt to $841/mt

Rotterdam

Rotterdam's LNG bunker price has climbed by $9/mt in the past week, reaching $748/mt.

The price increase reflects tighter natural gas supplies to Europe. Norway, a key supplier of gas to the continent, saw its pipeline flows into Europe drop by 2.3% from the previous week, reaching 184.6 million cubic meters per day (MMcmd) last week, according to Rystad Energy. This decline in supply is putting additional pressure on the market and contributing to the price rise.

While the Norwegian gas supply is still higher than last year’s 130.1 MMcmd, this recent reduction in flow was largely driven by a series of planned maintenance activities at major gas fields, including Asgard, Troll, and Sleipner, which are critical to Europe’s energy supply.

In addition to planned maintenance, an unexpected outage at the Davlin gas field has also curtailed supply.

Compounding the supply squeeze, gas flows from Russia, another significant supplier to Europe, were down 4.8% from the previous week, to 91.1 MMcmd, ING’s Warren Patterson said.

Singapore

Singapore’s LNG bunker price has shed $6/mt in the past week, driven by a lower NYMEX Japan/Korea Marker (JKM) price. Its LNG bunker price premium over Rotterdam's LNG has narrowed by $15/mt in the past week to $93/mt now.

One of the key factors contributing to Singapore's price dip is the resumption of operations at Australia's Queensland Curtis LNG Train 1 export terminal. Rystad Energy said the terminal, which had gone offline for four days, is back in action. The terminal's resumption has boosted sentiment in the market, signalling better supply prospects from the country.

Additionally, China’s new Chaozhuo LNG import terminal, co-operated by Sinopec and Huaying Group, began operations last week. New import capacity in a major market like China can ease the supply-demand balance, potentially lowering prices in nearby Singapore as well.

At the same time, Japan, one of the world's largest LNG importers, has seen some demand pressures ease due to operational issues at two of its gas-fired power plants.

Jera’s Joetsu plant (595 MW) went offline on 9 September due to electrical equipment issues, and its Shin-Nagoya plant (243 MW) remains offline, though it is expected to restart later this month.

By Debarati Bhattacharjee

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.