Europe & Africa Market Update 13 Sep 2024

Bunker benchmarks in European and African ports have gained with Brent, and prompt HSFO supply is tight off Malta.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($21/mt), Rotterdam ($6/mt) and Gibraltar ($4/mt)

- LSMGO prices up in Durban ($31/mt), Gibraltar ($10/mt) and Rotterdam ($7/mt)

- HSFO prices up in Gibraltar ($11/mt) and Rotterdam ($7/mt)

Gibraltar’s HSFO price gain has outpaced Rotterdam’s in the past day. This has widened Gibraltar’s HSFO price premium over Rotterdam by $4/mt to $82/mt now. HSFO availability is good in both ports, with traders recommending 3–5 days lead times.

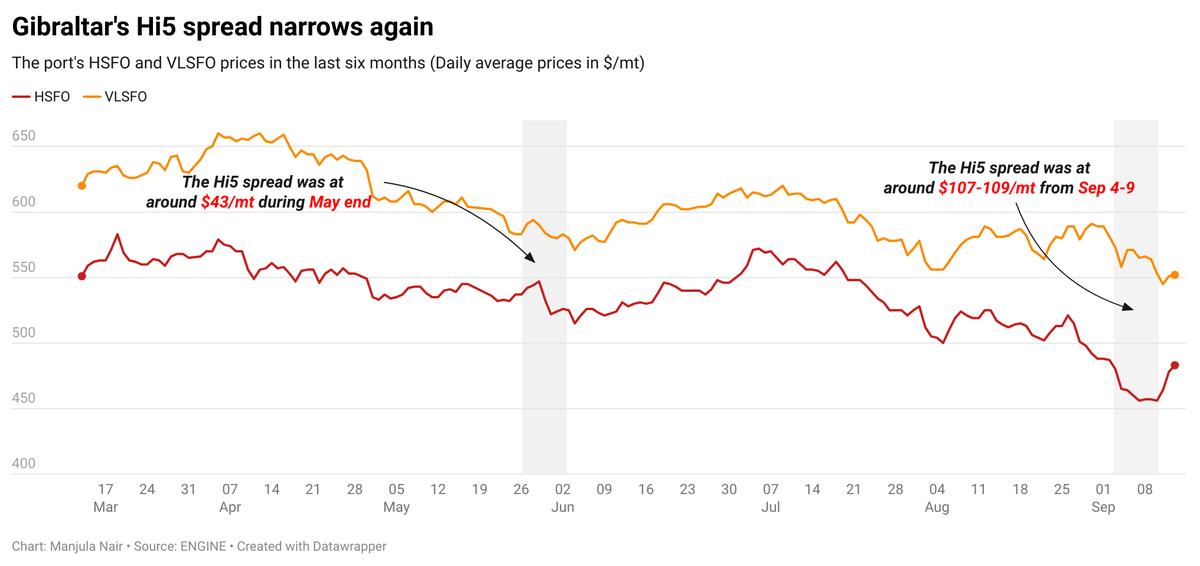

Gibraltar's VLSFO price has risen by a modest $4/mt in the past day. The port’s Hi5 spread has narrowed from $74/mt yesterday to $67/mt - the lowest it's been this month and down from the $107-109/mt highs recorded earlier this month.

Wind gusts ranging between 20-29 knots are forecast in Gibraltar from today onwards, which could delay bunker operations until Sunday. Winds at the higher end of that range can pose problems to bunker deliveries by barge. One vessel is waiting for bunkers in Gibraltar today, down from four yesterday, according to a source. Seven vessels are due to arrive for bunkers in Ceuta today, down from ten yesterday, says shipping agent Jose Salama & Co. Barge delays of around 5-7 hours are expected.

HSFO availability continues to remain tight off Malta, a trader said. Lead times of 4–6 days are advised for the grade. VLSFO and LSMGO availability is normal in the port, with lead times of 3–4 days recommended.

Brent

The front-month ICE Brent contract has moved $1.23/bbl higher on the day, to trade at $72.51/bbl at 09.00 GMT.

Upward pressure:

Brent crude futures moved higher on the back of supply disruption concerns emerging from the US and Libya.

Preventive shutdowns and evacuations of offshore oil production platforms in the US Gulf of Mexico due to concerns over Hurricane Francine’s impact has provided upward pressure to Brent’s price this week. Persistent disruption in Libya’s oil production provided additional support to Brent futures.

“[Brent] crude oil rallied for a second consecutive day as supply risks loomed over the market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Nearly 42% of the total oil production capacity in the US Gulf of Mexico has been shut as of yesterday, Reuters reports.

“Supply disruptions from Hurricane Francine continue to provide some support,” to oil prices, two analysts from ING Bank remarked.

Downward pressure:

The International Energy Agency’s (IEA) oil market report yesterday reinforced a “bearish picture” in the global oil market, analysts said. Brent’s price gains were partially capped after the Paris-based energy agency cut the global oil demand growth outlook.

It now expects global oil demand to grow by 900,000 b/d, with total consumption expected to reach 103 million b/d in 2024, noting a decline of 70,000 b/d from its previous month’s projection. This decline can be attributed to a slowdown in China’s economic growth.

“In contrast to OPEC’s relatively positive outlook earlier this week, IEA said demand growth is slowing as China’s economy cools,” Hynes remarked.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.