Americas Market Update 10 Sep 2024

Regional bunker benchmarks have moved in mixed directions, and several ports along the US Gulf Coast have been shut for incoming vessel traffic due to Tropical Storm Francine.

Changes on the day, to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Balboa ($22/mt), Houston ($17/mt) and Los Angeles ($7/mt), and down in New York ($9/mt) and Zona Comun ($8/mt)

- LSMGO prices up in Houston ($14/mt) and Balboa ($8/mt), and down in New York ($8/mt) and Los Angeles ($1/mt)

- HSFO prices up in New York ($6/mt) and Los Angeles ($1/mt), and down in Houston ($6/mt) and Balboa ($3/mt)

Houston’s VLSFO price has gained in the past day, while New York’s VLSFO price has dropped with downward pressure from several lower-priced firm offers. This has narrowed New York’s VLSFO price premium over Houston by $26/mt to $34/mt.

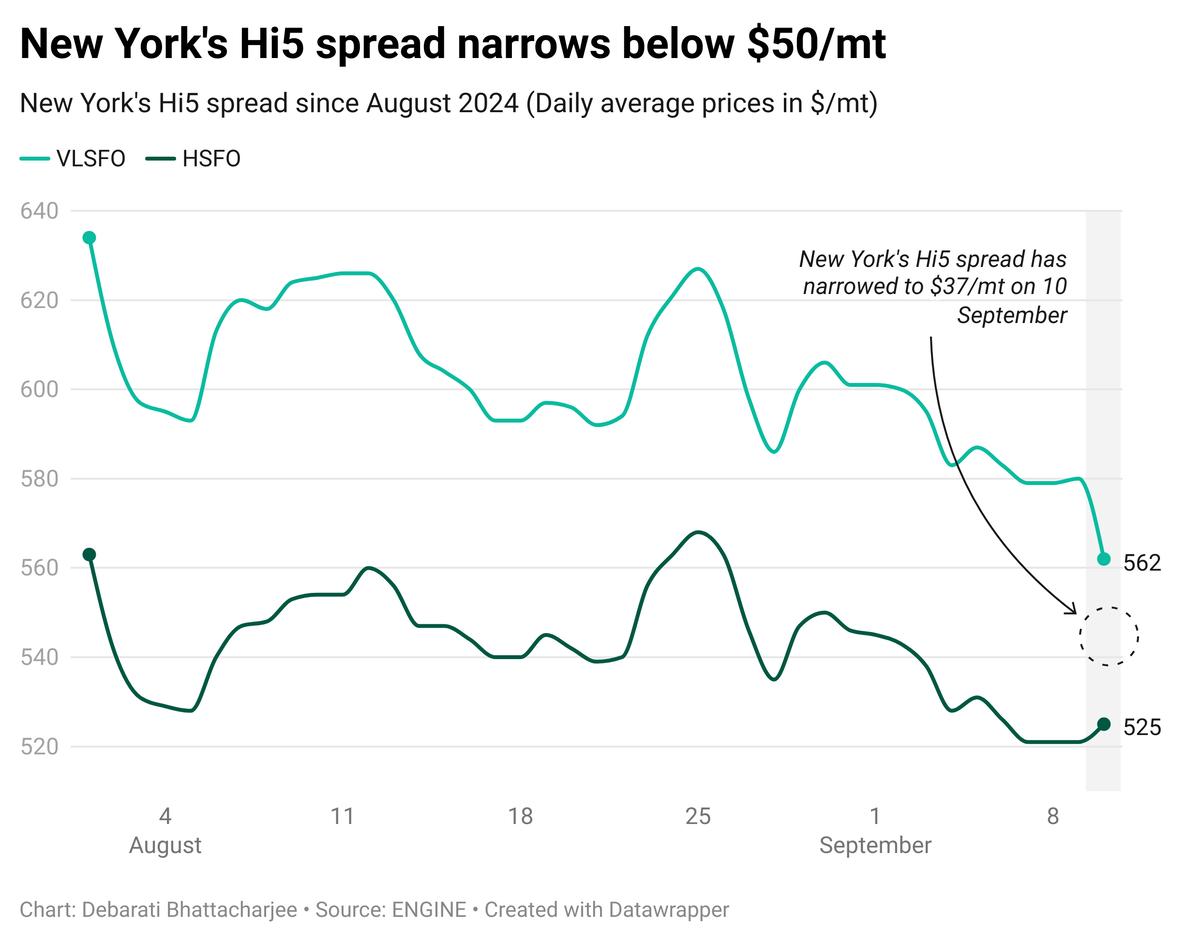

Unlike its VLSFO, New York's HSFO price has risen in the past day to narrow the port's Hi5 spread to $37/mt.

Tropical Storm Francine is expected to strengthen into a hurricane as it approaches the western Gulf of Mexico, with landfall likely in Louisiana tomorrow. The storm will bring storm surge, heavy rainfall and heavy winds, along with potential tornadoes to Louisiana and the Gulf Coast region.

Rainbands are already impacting parts of South Texas and the northern Gulf Coast, though most rain remains offshore.

The US Coast Guard has issued “Port Condition YANKEE” for the ports of Houston, Galveston, Corpus Christi, Freeport, and Texas City. This condition requires vessels to either depart or stay securely moored, with all inbound vessel traffic suspended.

Brent

The front-month ICE Brent contract has moved $0.14/bbl lower on the day, to trade at $71.31/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

US crude oil supply disruption fears after tropical storm Francine hit the Gulf of Mexico have put upward pressure on Brent’s price today.

The US Coast Guard has ordered the immediate closure of all port operations at Brownsville and other small ports in Texas before the tropical storm hit the coast yesterday, Reuters reported. The port of Corpus Christi has continued to operate partially, the report added.

Oil giants including Shell, ExxonMobil, and Chevron have already evacuated workers from some port terminals.

“Oil producers in the Gulf of Mexico began shuttering operations in preparation for Tropical Storm Francine,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

According to the US National Hurricane Center (NHC), the tropical storm is expected to become a hurricane today and further strengthen. As a result, more ports are expected to come under restrictions.

“At least 125kb/d [125,000 b/d] of oil capacity is at risk of being disrupted,” Hynes added citing data from the NHC.

Downward pressure:

Brent’s price has plunged further as demand growth concerns from the world’s top oil consumers, China and the US, have escalated in the past day.

China’s consumer inflation grew in August to its fastest pace in six months, Reuters reported. However, the country's producer price index declined by 1.8% last month and remained in deflation. This news has further fuelled demand growth concerns in the market as it signals that manufacturing and industrial activity may be slowing, which could indicate weaker demand for raw materials, including crude oil.

“China’s yuan (CNH) isn’t exactly on a joyride either, weighed down by domestic deflationary pressures,” SPI Asset Management’s managing partner Stephen Innes said.

“With consumer inflation barely inching up to 0.6%, the market is holding its breath, waiting for Chinese policymakers to offer more than just hollow promises,” he added.

A drop in the producer price index often indicates reduced costs for manufacturers, but it also signals a decline in production output due to lower demand for commodities like oil.

“Demand concerns are the main focus, particularly when it comes to China. Most are also looking at a well-supplied market in the months ahead,” two analysts from ING Bank said.

Economic activity in the US has continued to weaken, according to market analysts, further raising concerns about the nation's economic health. These worries have intensified after the US Bureau of Labor Statistics (BLS) released a report on Friday showing that employers added only 142,000 jobs in August, falling short of expectations.

“[Oil] prices suffered steep declines last week amid concerns over the US and especially Chinese [economic] growth,” analysts from Saxo Bank noted.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.