Europe & Africa Market Update 6 Sep 2024

Most bunker benchmarks have tracked Brent’s downward movement, and prompt HSFO is tight off Malta.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($7/mt) and Rotterdam ($1/mt), and down in Gibraltar ($1/mt)

- LSMGO prices up in Durban ($4/mt), and down in Gibraltar ($6/mt) and Rotterdam ($5/mt)

- HSFO prices down in Rotterdam ($5/mt) and Gibraltar ($4/mt)

A few suppliers in Rotterdam have been experiencing HSFO barge loading issues at terminals since yesterday, a trader told ENGINE. This is likely to cause delays in HSFO deliveries. HSFO availability remains tight for very prompt dates (0-2 days) in Rotterdam and across the wider ARA hub.

Rotterdam’s HSFO price has dipped by $5/mt in the past day, while its VLSFO price has remained steady. These price movements have widened Rotterdam’s Hi5 spread from $104/mt yesterday to $110/mt now.

One vessel is waiting to receive bunkers in Gibraltar today, down from three yesterday, according to a source. Nine vessels are due to arrive for bunkers in nearby Ceuta today, down from eight yesterday, said shipping agent Jose Salama & Co.

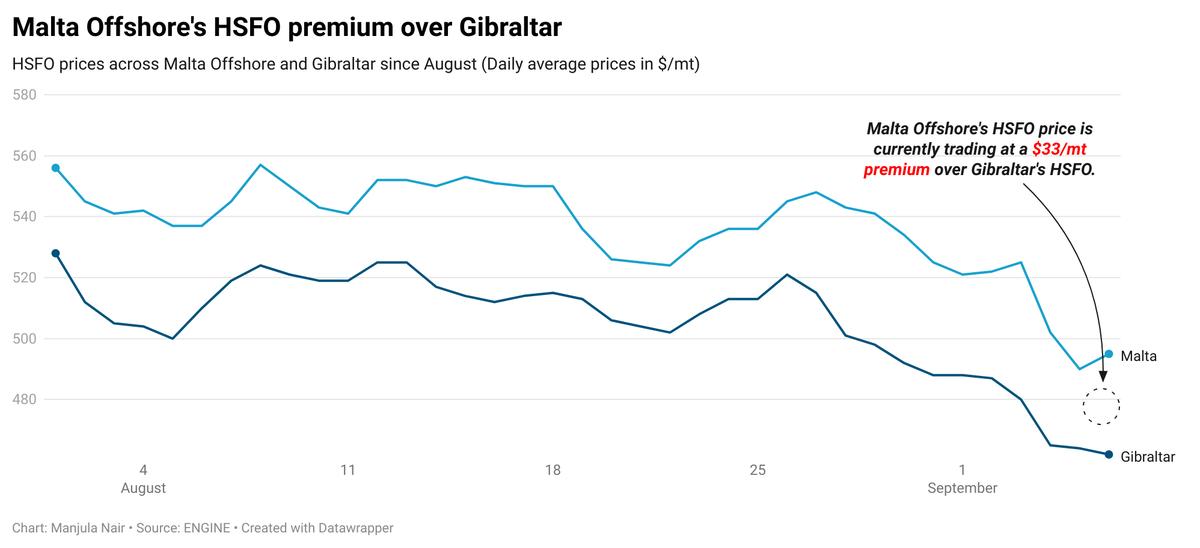

Malta Offshore has seen a slight uptick in demand this week, a trader said. Prompt HSFO availability is tight off Malta with lead times of 4–6 days recommended. Malta’s HSFO price is currently trading at a $33/mt premium over Gibraltar. VLSFO and LSMGO availability is good for prompt delivery off Malta, with lead times of 3–4 days advised.

Brent

The front-month ICE Brent contract has moved $0.58/bbl lower on the day, to trade at $72.74/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support after eight members of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) collectively decided to postpone the gradual easing of production cuts that was scheduled to begin in October.

OPEC+ members, including Saudi Arabia, Russia, Iraq, Kuwait, Kazakhstan, Algeria, Oman, and the UAE, have decided to extend the ongoing output cut of 2.2 million b/d for two more months. The group now plans to gradually unwind the production cuts beginning 1 December and continuing until November 2025.

“This [OPEC’s announcement] was not surprising, considering the pressure oil prices have been under in recent months,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

On the demand side, Brent found some support after the US Energy Information Administration (EIA) reported a sizeable decline in crude inventories. Commercial crude oil inventories in the US dropped by 6.87 million bbls to touch 418 million bbls on 30 August, according to the EIA.

A drop in crude stocks is considered a positive indication of oil demand growth in the world’s largest oil-consuming nation, according to market analysts. Yesterday’s EIA inventory report “was fairly constructive,” two analysts from ING Bank noted.

Downward pressure:

The global oil market’s sentiment is still negative as demand growth concerns from top oil consumers, China and the US, have outweighed any signs of supply tightness.

“Oil prices are giving into weak demand concerns out of China,” Price Futures Group’s senior market analyst Phil Flynn remarked.

Manufacturing Purchasing Managers' Index (PMI) readings in China and the US came in at 49.1% and 47.2% in August, respectively. A PMI reading below 50 indicates weak economic health and a contraction in the manufacturing sector. It also highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

Brent’s price has “taken a beating after breaking below key technical levels, with China demand concerns, weak global refinery margins,” analysts from Saxo Bank noted.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.