Singapore’s fuel oil inventories fell for second consecutive month

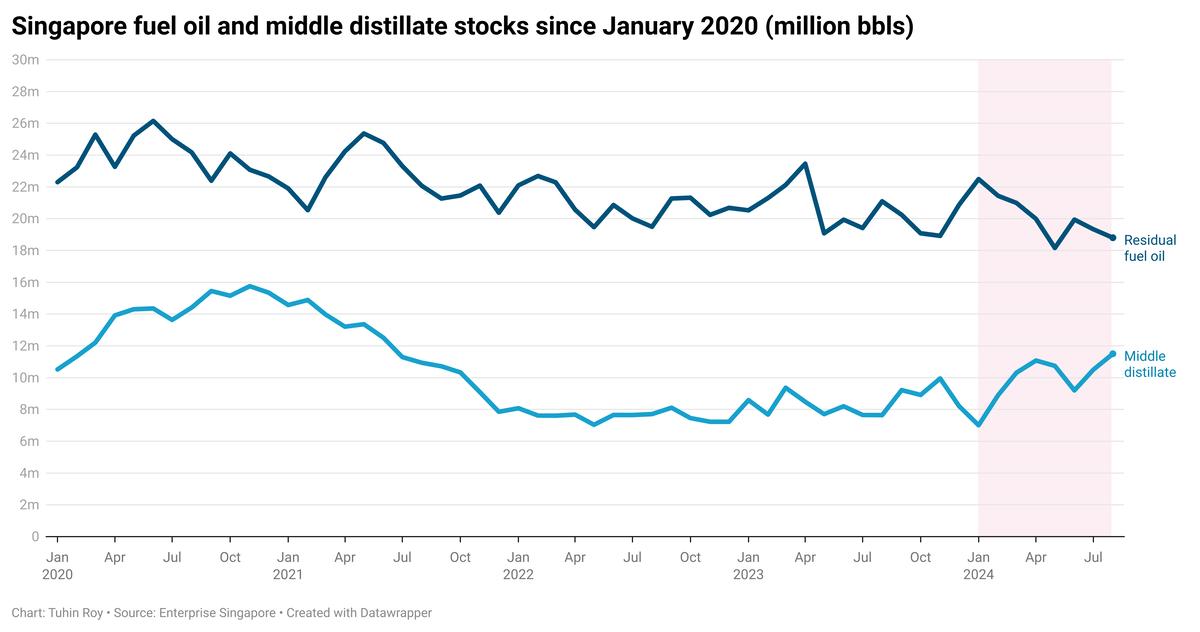

Residual fuel oil stocks in Singapore averaged 3% lower in August than in July, data from Enterprise Singapore shows.

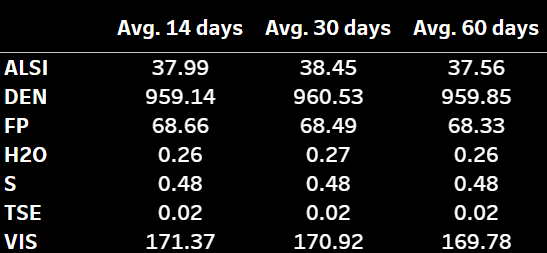

Changes in monthly average Singapore stocks from July to August:

- Residual fuel oil stocks down 540,000 bbls to 18.80 million bbls

- Middle distillate stocks up 1 million bbls to 11.50 million bbls

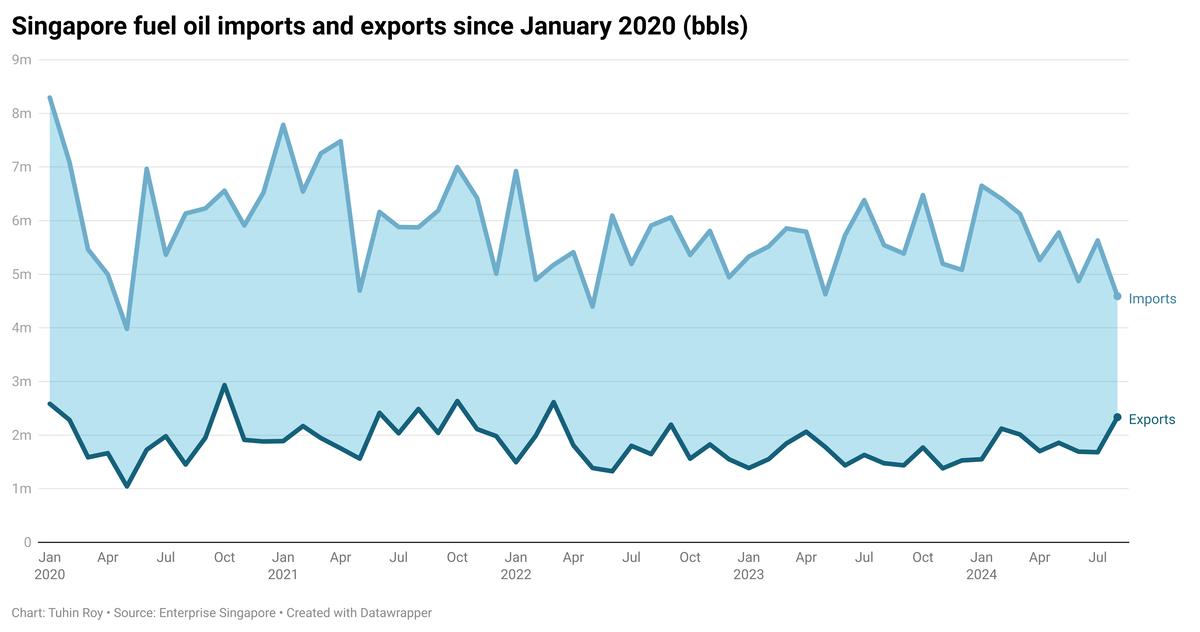

Singapore’s fuel oil stocks dropped below 19 million bbls amid a significant 43% decline in the port’s net fuel oil imports in August. Fuel oil imports declined by 1.04 million bbls, in contrast to the 654,000-bbl rise in exports. This contributed to pull the stocks level down in August.

Most fuel oil cargoes arrived in the Southeast Asian bunker hub from Russia (13%), the UAE (11%) and Indonesia (10%) in August. The bulk of fuel oil cargoes departed for China (54%), Malaysia (10%) and Bangladesh (7%).

On the other hand, the port’s middle distillate stocks surged and averaged 10% higher in August.

Changes in monthly average Singapore fuel oil trade from July to August:

- Fuel oil imports down 1.04 million bbls to 4.59 million bbls

- Fuel oil exports up 654,000 bbls to 2.33 million bbls

- Fuel oil net imports down 1.69 million bbls to 2.26 million bbls

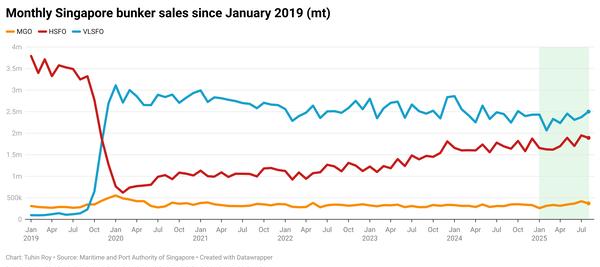

Despite average demand, VLSFO supply in Singapore remains tight due to low stock levels and bunker barge loading delays at terminals. This situation is expected to last through mid-September, a source says. Most suppliers now recommend lead times of 8-14 days. Some can supply with shorter lead times, but these stems are usually priced higher.

HSFO supply is also constrained, with lead times of 11-12 days advised. In contrast, LSMGO availability is better, with lead times of 3-5 days.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.