Americas Market Update 28 Nov 2024

Americas bunker benchmarks have taken mixed directions, and availability is tight in Houston.

Changes on the day to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in New York ($5/mt) and Houston ($2/mt), unchanged in Los Angeles, and down in Zona Comun ($7/mt) and Balboa ($2/mt)

- LSMGO prices up in New York and Balboa ($3/mt), and Los Angeles ($1/mt), and down in Houston ($4/mt)

- HSFO prices up in Los Angeles and Balboa ($1/mt), and unchanged in Houston and New York

Cristobal’s VLSFO price has gained by $17/mt in the past day. Meanwhile, Balboa’s VLSFO price has dropped marginally with downward pressure from a lower-priced stem. This has narrowed Balboa’s VLSFO price premium over Cristobal from $48/mt to $29/mt.

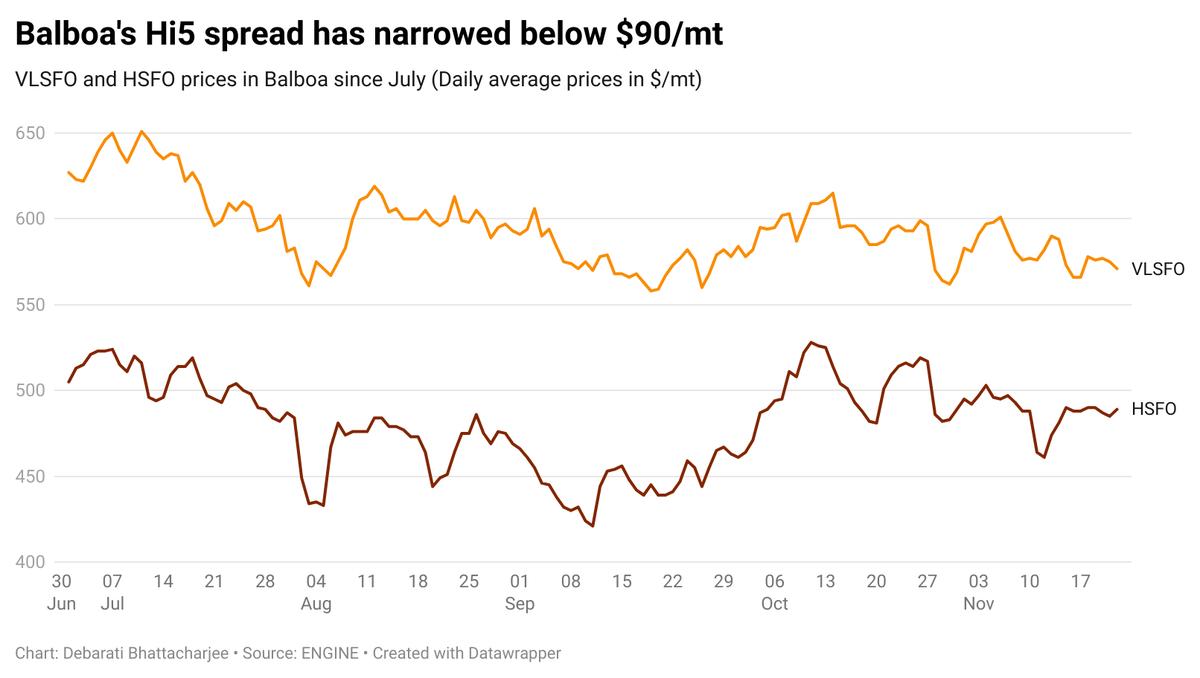

Balboa's Hi5 spread is currently around $82/mt, down from $102/mt at the beginning of this month.

Houston’s LSMGO price has dropped in the past day, while New York’s LSMGO price has gained marginally. This has again flipped Houston’s $3/mt LSMGO price premium over New York, to a $4/mt discount now.

Availability in Houston is tight for prompt dates. Most suppliers can offer VLSFO and LSMGO stems with a lead time of 7-8 days in Houston.

Brent

The front-month ICE Brent contract has inched $0.08/bbl higher on the day, to trade at $73.23/bbl at 07.00 CST (13.00 GMT) today.

Upward pressure:

OPEC has postponed its highly anticipated output policy meeting to 5 December to avoid overlapping with another key event. As anticipation around the meeting builds, oil prices have found marginal support.

Market analysts expect the Saudi Arabia-led consortium to keep output policy unchanged at the upcoming meeting, deferring from earlier plans to gradually start unwinding the 2.2 million b/d cut from January 2025.

“OPEC+ is expected to delay increasing production to address potential oversupply concerns next year,” analysts from Saxo Bank said.

Earlier on Wednesday, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman, the de-facto head of the group spoke with Russian Deputy Prime Minister Alexander Novak and Kazakhstan’s Energy Minister Almasadam Satkaliyev to discuss OPEC’s plans, Reuters reported. Meanwhile, Iraq, Saudi Arabia, and Russia held talks in Baghdad on Tuesday.

“[OPEC] Delegates are said to be concerned they can go ahead with the 180kb/d [180,000 b/d] increase amid signs of a global oversupply in the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent crude oil price has continued to move lower on the back of easing supply disruption concerns in the Middle East and Eastern Europe.

Analysts noted that the geopolitical risk premiums on oil supply have diminished slightly, as no significant developments occurred in the Russia-Ukraine conflict over the past week.

Besides, the ceasefire deal achieved in Lebanon has also pulled Brent’s price lower.

Earlier this week, US President Joe Biden announced a ceasefire deal between Israel and the Iran-aligned Hezbollah armed group in Lebanon. Israel’s war cabinet approved the ceasefire agreement, which took effect on Wednesday across the Lebanon-Israel border.

“[Oil] prices are somewhat subdued due to eased tensions in the Middle East,” SPI Asset Management’s managing partner Stephen Innes said.

China's oil demand growth continues to trend lower, adding to the downward pressure on Brent. October saw a 5.4% month-on-month drop in Chinese oil consumption, with refiners processing 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

“Oil prices have been hovering within a confined range, caught in the perpetual tug-of-war between geopolitical shifts and classic supply-and-demand dynamics,” Innes said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.