East of Suez Market Update 28 Nov 2024

VLSFO and LSMGO prices in East of Suez ports have moved down, and bunker demand remains low across South Korean ports.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($22/mt), Singapore ($7/mt) and Fujairah ($4/mt)

- LSMGO prices down in Singapore ($8/mt), Zhoushan ($4/mt) and Fujairah ($3/mt)

- HSFO prices up in Singapore ($5/mt), unchanged in Zhoushan, and down in Fujairah ($6/mt)

Zhoushan's VLSFO price has dropped by $22/mt in the past day, marking the steepest decline among the three major Asian bunker ports. This decrease was partly driven by a lower-priced VLSFO stem fixed in Zhoushan, which helped pull the benchmark price down. Despite this sharp price drop, Zhoushan’s VLSFO premiums remain elevated, at $26/mt over Fujairah and $22/mt over Singapore.

Bunker fuel availability in Zhoushan remains stable, with lead times for VLSFO at 5-7 days, and 4-6 days for LSMGO and HSFO, consistent with the previous week.

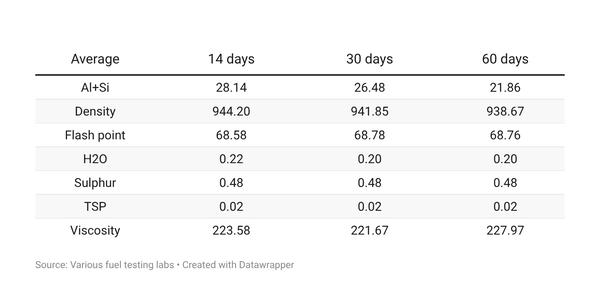

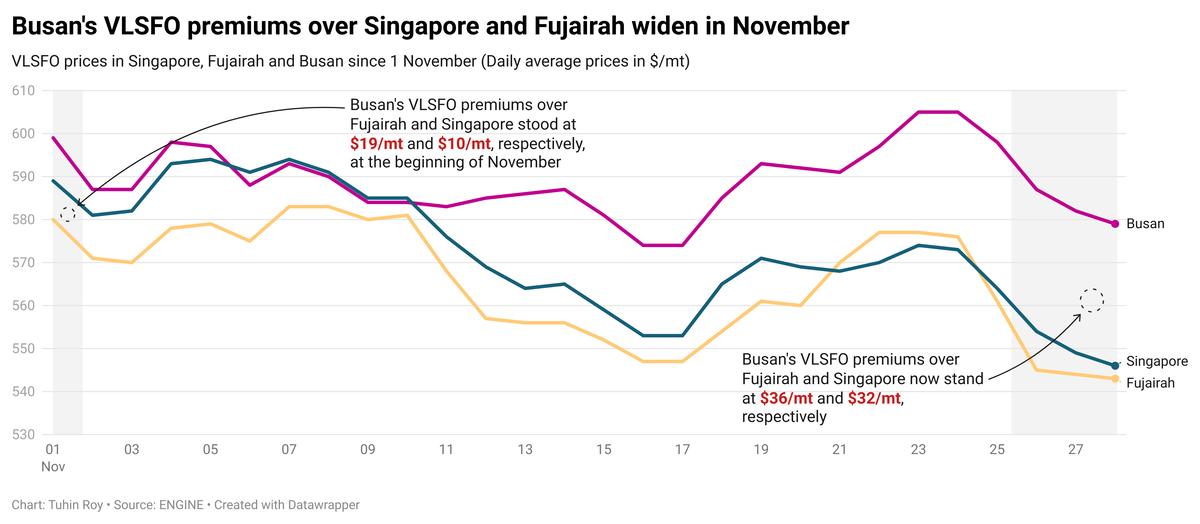

In South Korea, bunker demand remains subdued due to higher bunker prices. Busan’s VLSFO is currently at premiums of $36/mt and $32/mt over Fujairah and Singapore, respectively.

Availability across South Korean ports is steady, with most suppliers recommending lead times of 6-8 day for all grades.

Brent

The front-month ICE Brent contract has moved $0.51/bbl lower on the day, to trade at $72.53/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

OPEC has postponed its highly anticipated output policy meeting to 5 December to avoid overlapping with another key event. As anticipation around the meeting builds, oil prices have found marginal support.

Market analysts expect the Saudi Arabia-led consortium to keep output policy unchanged at the upcoming meeting, deferring from earlier plans to gradually start unwinding the 2.2 million b/d cut from January 2025.

“OPEC+ is expected to delay increasing production to address potential oversupply concerns next year,” analysts from Saxo Bank said.

Earlier on Wednesday, Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman, the de-facto head of the group spoke with Russian Deputy Prime Minister Alexander Novak and Kazakhstan’s Energy Minister Almasadam Satkaliyev to discuss OPEC’s plans, Reuters reported. Meanwhile, Iraq, Saudi Arabia, and Russia held talks in Baghdad on Tuesday.

“[OPEC] Delegates are said to be concerned they can go ahead with the 180kb/d [180,000 b/d] increase amid signs of a global oversupply in the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent crude oil price has continued to move lower on the back of easing supply disruption concerns in the Middle East and Eastern Europe.

Analysts noted that the geopolitical risk premiums on oil supply have diminished slightly, as no significant developments occurred in the Russia-Ukraine conflict over the past week.

Besides, the ceasefire deal achieved in Lebanon has also pulled Brent’s price lower.

Earlier this week, US President Joe Biden announced a ceasefire deal between Israel and the Iran-aligned Hezbollah armed group in Lebanon. Israel’s war cabinet approved the ceasefire agreement, which took effect on Wednesday across the Lebanon-Israel border.

“[Oil] prices are somewhat subdued due to eased tensions in the Middle East,” SPI Asset Management’s managing partner Stephen Innes said.

China's oil demand growth continues to trend lower, adding to the downward pressure on Brent. October saw a 5.4% month-on-month drop in Chinese oil consumption, with refiners processing 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

“Oil prices have been hovering within a confined range, caught in the perpetual tug-of-war between geopolitical shifts and classic supply-and-demand dynamics,” Innes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.