Europe & Africa Market Update 27 Nov 2024

Regional bunker benchmarks have fallen with Brent, and HSFO availability is still tight in the ARA hub.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Rotterdam ($4/mt), and Gibraltar and Durban ($1/mt)

- LSMGO prices down in Rotterdam ($6/mt) and Gibraltar ($2/mt)

- HSFO prices down in Rotterdam ($5/mt) and Gibraltar ($3/mt)

- Rotterdam B30-VLSFO at a $157/mt premium over VLSFO

Prompt HSFO and VLSFO availability remains tight in Rotterdam and across the wider ARA hub, a trader told ENGINE. Lead times of 7-10 days are advised for HSFO and 5-7 days for VLSFO.

LSMGO is available in the ARA hub with a shorter lead time of 3-5 days.

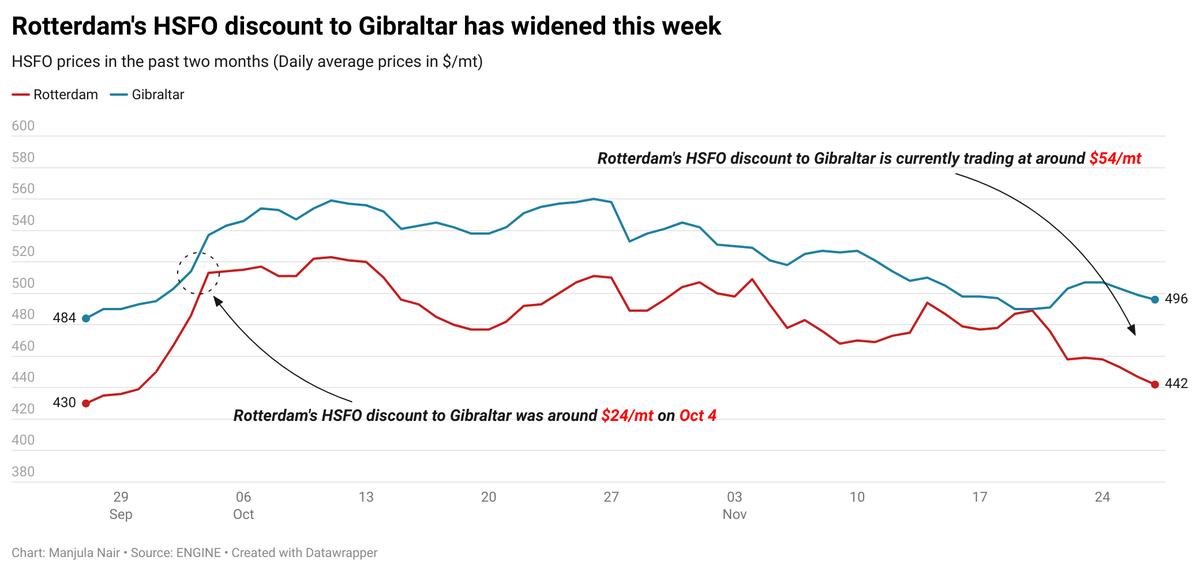

Two lower-priced LSMGO stems fixed in Rotterdam for prompt delivery have dragged the benchmark lower. Rotterdam’s LSMGO discount to Gibraltar has widened by $4/mt to $78/mt, while its HSFO discount to Gibraltar has also widened to $54/mt now.

In Gibraltar, HSFO and LSMGO availability is a bit tight for very prompt delivery dates, with lead times of 5-7 days recommended for both grades. VLSFO availability is relatively better with most suppliers able to supply within 3-5 days, a trader said.

Prompt availability has tightened off Malta, a trader told ENGINE. Lead times of 5-7 are recommended for all three grades off Malta. Bunker availability typically tightens towards the end of the year in Malta Offshore, the trader added.

One supplier offered B24-VLSFO at about $770/mt in Istanbul yesterday, about $170/mt higher than the pure VLSFO price in the port.

Biofuel bunker demand has been negligible in Turkey, a source said.

Brent

The front-month ICE Brent contract has inched $0.49/bbl lower on the day, to trade at $73.04/bbl at 09.00 GMT.

Upward pressure:

Brent’s price felt some upward pressure after the American Petroleum Institute (API) reported a big drop in US crude stocks.

Crude oil inventories in the US dropped by 5.9 million bbls in the week that ended 22 November, according to the API. A drop in US crude stocks indicates growing oil demand, which can push Brent's price higher.

The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due later today. “Focus is on the EIA’s weekly report after the API indicated that crude stocks shrank by 5.9 million barrels,” analysts from Saxo Bank said.

Meanwhile, OPEC+ is preparing for a critical meeting on 1 December. Oil analysts expect that the Saudi Arabia-led consortium will delay the planned production increase for January and maintain current supply cuts due to rising concerns of oversupply.

“Delegates are said to be concerned about going ahead with the 180kb/d [180,000 b/d] increase, given signs of a global oversupply in the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent’s price inched lower after US President Joe Biden announced a ceasefire deal between Israel and Iran-aligned Hezbollah armed group in Lebanon.

Israel’s war cabinet approved the ceasefire agreement, which took effect early Wednesday morning across the Lebanon-Israel border, Prime Minister Benjamin Netanyahu said. The news has eased some supply concerns in the Middle East.

“As expected, Israel and Hezbollah announced a 60-day ceasefire agreement and plans to discuss a longer-lasting peace agreement,” two analysts from ING Bank said. “The oil market is assessing the new dynamics and how it impacts the other ongoing conflicts in the region,” they added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.