East of Suez Market Update 27 Nov 2024

Prices in East of Suez ports have moved in mixed directions, and HSFO supply remains tight in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($2/mt), and down in Singapore ($4/mt) and Fujairah ($3/mt)

- LSMGO prices up in Fujairah ($9/mt) and Zhoushan ($6/mt), and down in Singapore ($4/mt)

- HSFO prices up in Fujairah ($8/mt) and Singapore ($4/mt), and unchanged in Zhoushan

VLSFO prices in East of Suez ports have remained mostly steady over the past day. The grade's price in Zhoushan remains elevated, with premiums of $44/mt over Fujairah and $37/mt over Singapore.

Most suppliers in Zhoushan are recommending lead times of 5-7 days for VLSFO, while lead times in Singapore range widely from 2-10 days. VLSFO deliveries in Fujairah require around 5-7 days.

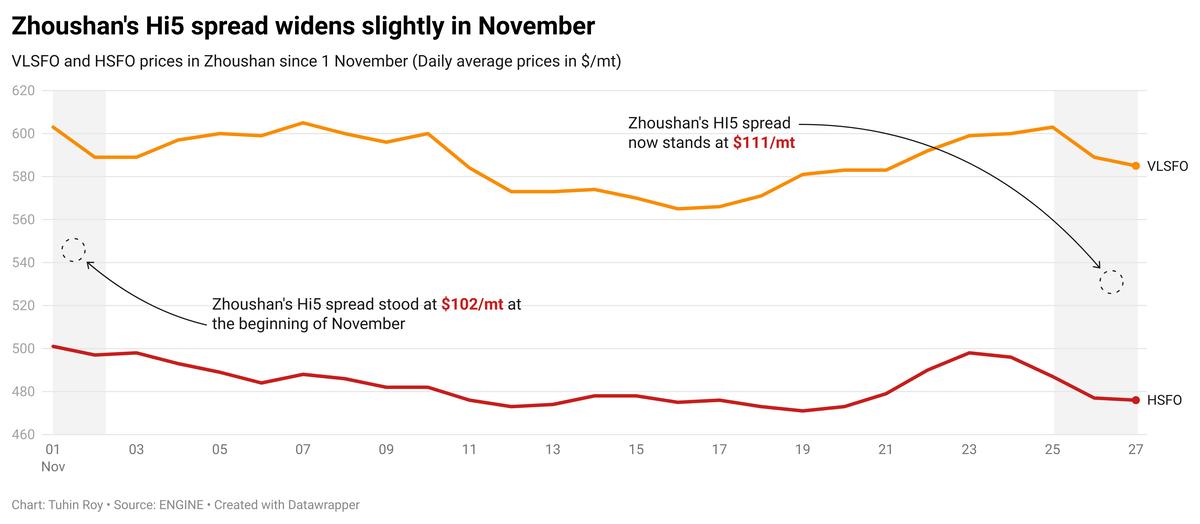

In Fujairah, the price of HSFO has increased, while the VLSFO price has decreased, narrowing the Hi5 spread from $97/mt to $86/mt. This spread is narrower than those in Zhoushan at $111/mt and Singapore at $94/mt.

For HSFO in Fujairah, lead times of 5-7 days are recommended, and in Zhoushan, 4-6 days. Meanwhile, HSFO supply remains tight in Singapore, with most suppliers recommending lead times of 8-13 days, unchanged from last week.

Brent

The front-month ICE Brent contract has inched $0.49/bbl lower on the day, to trade at $73.04/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price felt some upward pressure after the American Petroleum Institute (API) reported a big drop in US crude stocks.

Crude oil inventories in the US dropped by 5.9 million bbls in the week that ended 22 November, according to the API. A drop in US crude stocks indicates growing oil demand, which can push Brent's price higher.

The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due later today. “Focus is on the EIA’s weekly report after the API indicated that crude stocks shrank by 5.9 million barrels,” analysts from Saxo Bank said.

Meanwhile, OPEC+ is preparing for a critical meeting on 1 December. Oil analysts expect that the Saudi Arabia-led consortium will delay the planned production increase for January and maintain current supply cuts due to rising concerns of oversupply.

“Delegates are said to be concerned about going ahead with the 180kb/d [180,000 b/d] increase, given signs of a global oversupply in the oil market,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent’s price inched lower after US President Joe Biden announced a ceasefire deal between Israel and Iran-aligned Hezbollah armed group in Lebanon.

Israel’s war cabinet approved the ceasefire agreement, which took effect early Wednesday morning across the Lebanon-Israel border, Prime Minister Benjamin Netanyahu said. The news has eased some supply concerns in the Middle East.

“As expected, Israel and Hezbollah announced a 60-day ceasefire agreement and plans to discuss a longer-lasting peace agreement,” two analysts from ING Bank said. “The oil market is assessing the new dynamics and how it impacts the other ongoing conflicts in the region,” they added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.