Europe & Africa Market Update 11 Sep 2024

Most bunker benchmarks in European and African ports have declined with Brent, and HSFO supply has improved in Rotterdam.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($5/mt), and down in Gibraltar ($14/mt) and Rotterdam ($13/mt)

- LSMGO prices up in Durban ($3/mt), and down in Gibraltar ($13/mt) and Rotterdam ($4/mt)

- HSFO prices up in Gibraltar ($8/mt), and down in Rotterdam ($5/mt)

Rotterdam’s HSFO price has declined for the third consecutive day. A lower-priced non-prompt HSFO stem fixed at $386/mt for 150-500 mt in the past day has dragged the benchmark down.

HSFO availability has returned to normal in Rotterdam, a trader told ENGINE. HSFO supply was tight for very prompt delivery dates (0–2 days) last week, but supply has improved now. Some suppliers in the port experienced HSFO loading delays at oil terminals last week, which have now subsided, the trader added.

Gibraltar’s HSFO price has increased in the past day to reverse some of its losses from the previous session. The price increase has widened Gibraltar’s HSFO premium over Rotterdam by $13/mt to $70/mt now.

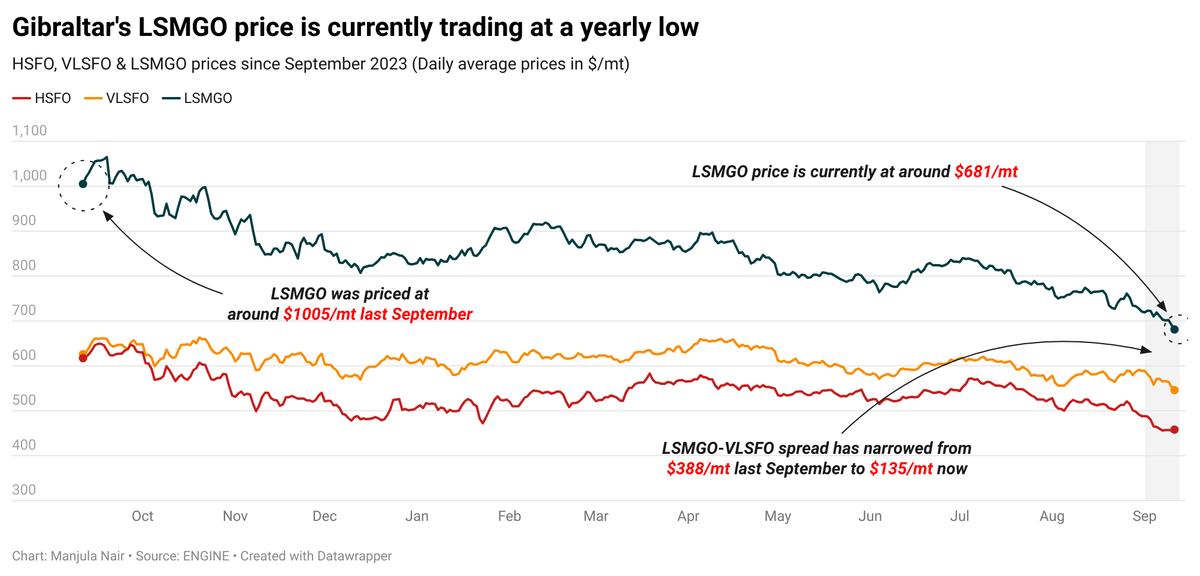

Gibraltar’s LSMGO price is currently trading at a 12-month low. The port's LSMGO price drop has been greater than Rotterdam's in the past day to narrow its LSMGO premium over Rotterdam by $9/mt to $77/mt now. Minimal congestion has been reported in Gibraltar today, with only one vessel waiting to receive bunkers, according to a source.

In South Africa’s Durban and Richards Bay, VLSFO continues to be tight for prompt delivery with lead times of 7–10 days recommended. In Durban, LSMGO is tight with suppliers offering lead times of up to two weeks for the grade, a trader said.

Brent

The front-month ICE Brent contract has declined by $0.68/bbl on the day, to trade at $70.45/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price found slight support after the American Petroleum Institute (API) reported another drop in US crude stocks, easing some demand growth worries.

Crude oil inventories in the US dropped by about 2.8 million bbls in the week that ended 6 September, according to API estimates. A drop in US crude stocks can support oil demand growth and put upward pressure on Brent’s price.

On the supply front, the US Energy Information Administration (EIA) forecasts a continued decline in global oil inventories this year, citing production outages in Libya and OPEC’s decision to extend output cuts for an additional two months.

Global oil inventories are projected to fall by 900,000 b/d in the third quarter of 2024, with a further decline exceeding 1 million b/d expected through the first quarter of 2025, as the market adjusts to the extension of OPEC+ supply cuts, the EIA said in its September short-term energy outlook (STEO) report.

This news has added some upward pressure on Brent’s price. “More oil will be taken out of inventories in the fourth quarter of 2024 that [than] we previously expected because OPEC+ announced that they will delay production increases until December,” the EIA said.

The US energy agency expects Brent’s price to push back above $80/bbl by the end of this year.

Downward pressure:

Brent’s price is lingering close to $70/bbl as a slowdown in demand growth in top oil consumers continued to outweigh supply tightness fears.

China imported 11.56 million b/d of crude oil last month, down from 12.43 million b/d imported in August 2023, market intelligence provider JLC reported citing data from the General Administration of Customs (GACC).

The sharp drop in China's crude imports signals a slowdown in the country’s oil demand growth, according to oil market analysts. “The real story here is China’s persistently weak demand—a red flag for the rest of the global economy,” SPI Asset Management’s managing partner Stephen Innes remarked.

Brent fell further after global oil producers’ group OPEC slashed its demand growth forecast to 2.03 million b/d in September from 2.11 million b/d reported in its previous monthly oil market report (MOMR).

Brent’s price has slumped due to “intensifying demand worries, firmly pushing aside any supply worries,” VANDA Insights’ founder and analyst Vandana Hari said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 65+ traders in 13 offices around the world, our team is available 24/7 to support you in your energy procurement needs.