East of Suez Market Update

Most bunker prices have inched up in major Asian hubs, and bunkering remains suspended by bad weather in Zhoushan’s OPL area since Wednesday.

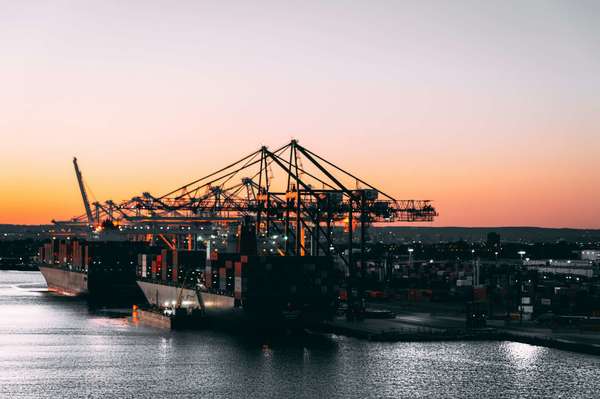

PHOTO: Bunker barge at berth in Fujairah, UAE. Port of Fujairah

PHOTO: Bunker barge at berth in Fujairah, UAE. Port of Fujairah

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore and Fujairah ($3/mt), and Zhoushan ($2/mt)

- LSMGO prices up in Singapore ($4/mt), Zhoushan ($3/mt) and Fujairah ($2/mt)

- HSFO prices up in Zhoushan ($10/mt) and Singapore ($3/mt), and down in Fujairah ($2/mt)

Most benchmarks in East of Suez ports have tracked Brent and gained for a second consecutive day. But Fujairah’s HSFO price has moved counter to the general market direction and dropped by $2/mt. A lower-priced HSFO indication in the past day has contributed to weigh the benchmark down. Fujairah’s HSFO price dip has widened its discounts to Zhoushan and Singapore to $68/mt and $33/mt, respectively.

Meanwhile, despite a rise in Fujairah's VLSFO price, its discounts to Singapore and Zhoushan remains almost steady at $17/mt and $16/mt, respectively.

Most suppliers in Fujairah can offer all grades with lead times of 5-7 days – almost unchanged from last week. But some suppliers can offer all bunker fuel grades at prompt dates depending on stem size, a source says.

The other UAE port of Khor Fakkan has good availability of all grades, with recommended lead times of 5-7 days.

Securing large VLSFO stems can be difficult in Zhoushan, but some suppliers can offer smaller stems of the grade with lead times of 3-5 days. LSMGO and HSFO deliveries are more readily available.

However, bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen anchorages have been suspended since Wednesday due to rough weather conditions, a source says. Bunkering is likely to fully resume from tomorrow, when calmer weather is forecast.

Brent

The front-month ICE Brent contract has increased by $0.89/bbl on the day, to $75.19/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures gained after the US reported a big drawdown in crude stocks, outweighing concerns about weak global oil demand.

According to the US Energy Information Administration (EIA), crude oil inventories in the US dropped by 9.6 million bbls in the week ended 23 June.

The EIA report along with the OPEC+ nations’ pledge to continue output reduction into 2024 has led the oil market to worry about the increasing supply crunch.

“The belief that OPEC+ will take further action if there is significant further weakness provides a floor to the market,” said ING’s market analyst Warren Patterson.

Downward pressure:

Brent felt some downward pressure as weak economic recovery from the pandemic in China, the world's second-largest oil consumer, has not improved as much as the market had expected.

The market is “concerned that signs of slowing in the broader economy will begin to impact demand in China from Q3 onwards,” said SPI Asset Management’s managing partner Stephen Innes.

The talk of “peak oil” demand is exaggerated, commented the Price Futures Group’s senior analyst Phil Flynn. “The problem is the lack of investment in fossil fuels and if we indeed reach that level, the question will be is the world going to produce enough oil to meet that demand,” he said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.