Sulphur Compliance & Enforcement

It was widely anticipated that IMO 2020 would bring significant challenges as to fuel quality and compliance with the new sulphur limit for VLSFO 0.50% Wt. not least due to the initial changes required for the infrastructure and because of the changing face of blends needed to achieve these lower limits.

It therefore wasn’t too much of a surprise when a spike of claims occurred initially, these perhaps due to cross-over or cross contamination of High Sulphur and Very Low Sulphur Fuels.

However, since then we have settled into a new normal whereby Sulphur Claims are worryingly still responsible for around 1 in 3 of every off- specification notice alleged for VLSFO.

Current Statistics

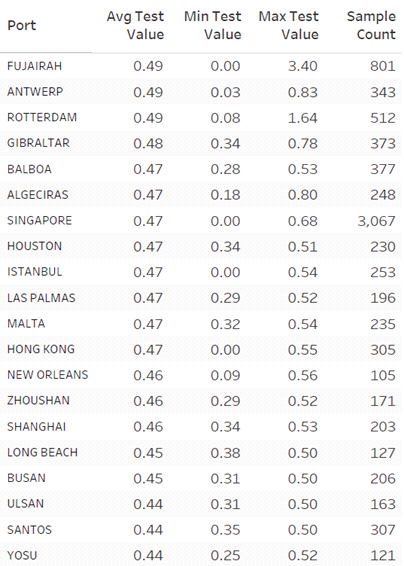

Data available for the last 90 days suggests that the global average for VLSFO Sulphur Content is 0.46%Wt which on the face of it appears good news.

Globally, when comparing thousands of lines of data, 97.5% of all VLSFOs tested at or below 0.50%Wt Sulphur during this time, 1.7% tested between 0.51 and 0.53%Wt Sulphur and 0.7% tested at or above 0.54%Wt Sulphur

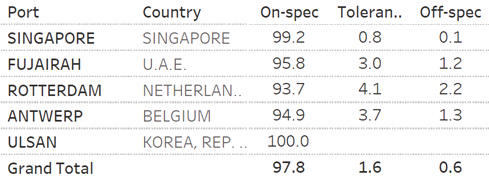

However, when we drill into this further and consider key bunker hubs it is very noticeable how some blending hubs perform much worse than others. For example 4.3% of Rotterdam fuels test between 0.51% and 0.53% and 1.9% of VLSFO’s at 0.54% or above.

Singapore on the other hand, is seen to perform far better with less than 1% of all fuels testing above the 0.50% Sulphur limit which somewhat bucks the general trend that blend hubs are by far the highest risk areas for Sulphur Compliance.

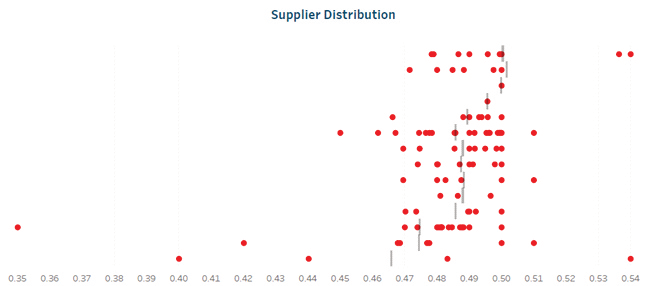

Table 3 – Distribution of Sulphur Content by Supplier in Rotterdam LSMGO however is seen to perform far better over the same period with 99.4% of all samples testing at or below 0.10%Wt, 0.3%testing at 0.11%Wt Sulphur and 0.3% of samples testing 0.12% or above.

We can therefore conclude that we are likely to receive four times as many notifications for Sulphur non- compliance for VLSFOs than MGOs and as a result it is essential that data driven purchasing is considered especially for VLSFOs.

Compliance

To refresh our memories let us first clarify what constitutes a non-compliance within Marpol Annex VI when it comes to Sulphur in bunker fuels.

For VLSFO, the Marpol Sample provided by the Supplier (& listed on the BDN) cannot exceed 0.50% Wt. Sulphur and they do not benefit from the tolerance (written around 95% confidence limits) that the vessel enjoys whereby the ‘In Use’ or ‘Onboard samples’ are only non-compliant at the 0.54%Wt Sulphur level or above.

Similarly for MGO, the supplier cannot exceed 0.10%Wt Sulphur but the ‘in use’ or ‘onboard’ samples are only non-compliant at 0.12%Wt Sulphur or above.

Moreover, it is important to draw a clear line in the sand between the commercial samples as governed by the bunker contract and the Marpol sample placed onboard the vessel for regulatory purposes with regard their value in defining compliance (or otherwise).

Simply put, commercial samples are not defined in the Sulphur verification procedure within Appendix VI of Marpol Annex VI. Marpol Annex VI does not even mandate the testing of an owner’s sample, only that a compliant BDN is placed onboard the vessel along with a Marpol Sample, this borne out by anecdotal evidence of owners requesting Sulphur is not reported on their quality reports due to the difficulties that may arise as a result.

Enforcement

Sadly, the only consistent part of enforcement by Port State Control (PSC) is their inconsistent approach to non-compliance.

Examples of concern include Authorities treating a fuel as non-compliant based on a single in use sample testing within the tolerance levels at 0.51 or 0.52% or even debunkering being demanded basis an owner test marginally above 0.50%Sulphur.

This lack of clarity has been causing concern for some time but despite lobbying by IBIA within IMO we are still no closer to a consistent global approach as to the basis that PSCs determine that a fuel is non-Compliant as per Marpol Annex VI.

IBIA pushed to ensure a consistent approach to verification by implementing the amended Sulphur verification procedure (as adopted by MEPC 75) however this was rejected.

This is disappointing as these procedures cover the analysis of the Marpol sample to verify the fuel delivered to the vessel and the use of ‘in use or onboard’ samples to verify the fuel in use, this again incorporating 95% confidence

Therefore it remains possible that a black and white outcome still could be enforced onto a vessel despite the shades of grey basis the inherent errors of the test method itself and these concerns can only lend themselves to adjusting your buying strategies accordingly and trying to prevent these issues at source.

It is important therefore to use online platforms such as Engine where quality benchmarking gives us the best chance to navigate through this minefield and allows our customers to sail on with fair winds and calm seas. So to conclude, whilst these inconsistencies remain it is imperative in to ensure that purchasing strategies incorporate port and supplier risk and benchmarking of suppliers and ports can save you a lot more than money, it can stop a claim spoiling your day?

Chris Turner, Manager – Bunker Quality & Claims

E: Chris.T@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.