How are bunker prices doing compared with the rest of the oil market and in what direction are they going?

Recent Price Movements: A divergence between crude & bunkers

In mid-April we looked at the ‘bigger picture’ developments in the oil market and highlighted the key drivers that are likely to influence the absolute price of oil (and how bunker prices fitted into this). In this report we dig a bit deeper, looking at what is happening to the price of bunkers in relation to crude and other main oil products; are there differences and are we back to ‘normal’ yet?

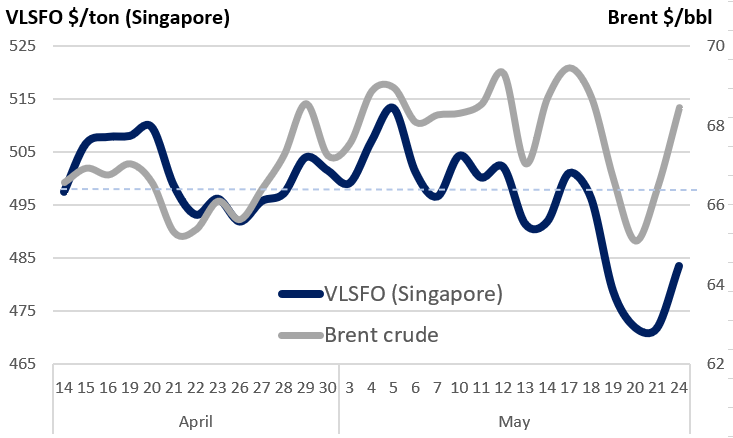

Current crude oil prices are $2/bbl higher than in mid-April (equivalent to $15/ton), but conversely VLSFO prices in Singapore and Fujairah are more than $10/ton lower. Singapore VLSFO prices tended to track crude price movements through the second half of April and early May, but over the past 3 weeks there has been a big divergence. Brent crude is currently towards the high of the recent $66-69/bbl range, but VLSFO prices East of Suez are now in a much lower trading range than in mid-April, at around $485/ton.

Reiterating what is happening to demand by product

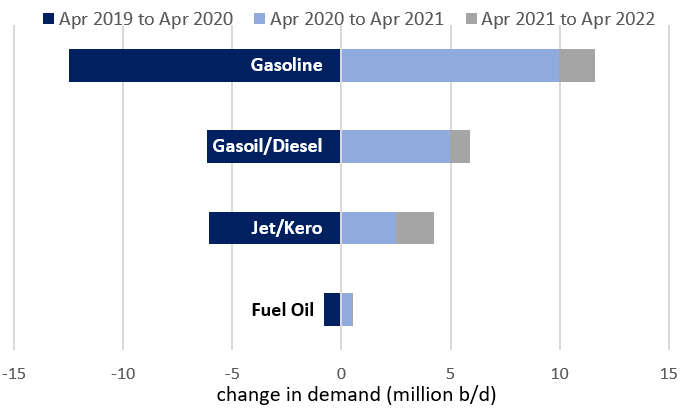

In the report last month, we highlighted how the COVID impact on bunker demand has been far less than almost all other products; especially against the jet market as a proportion of its overall size (which has been hardest hit of all), and for gasoline in volume terms.

The graph below illustrates how hard demand volumes have been hit in each main sector, and clearly shows the extreme demand impacts on gasoline, gasoil/diesel and jet and how well ‘protected’ the fuel oil market was; there was only a minimal drop in fuel oil demand between April 2019 and April 2020 levels.

However, after demand for these other products collapsed in early 2020, the pattern has been reversed and demand has rebounded over the past 12 months, albeit on a stuttering and regional basis. Because bunker demand was least affected, so there is no major, overall rebound in our market.

The underlying global position now is that there is growing support for other products, and expectations are that this will continue. This then helps support crude prices and higher refinery throughputs.

Based on the demand rebound over the past 12 months, it would seem that a lot of the re-balancing has already taken place, but there are still some more demand gains to be seen in other products over the coming 12 months. This would suggest pricing relationships between bunkers and other products have already made a major move back to pre-pandemic ‘normality’, but we could see some further movements over the next year.

Singapore VLSFO prices relative to jet have fallen to their lowest levels

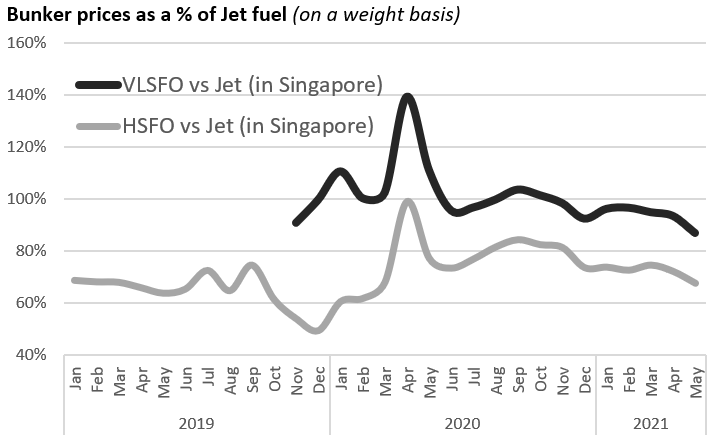

For bunkers, future relationships are not necessarily going back to their pre-pandemic ‘norms’. VLSFO had only just started to be mass-marketed a few months before the pandemic hit.

Also, going forward, high sulphur fuel oil may be weaker against most other products than the historical ‘norms’, because of the large-scale switch out of this product with IMO 2020.

However, looking at the relative price of bunkers versus the jet market, the premise that we have already seen a major revision is borne out. In Singapore, VLSFO peaked at 40% above jet prices at the outset of the pandemic (on a weight basis). During the second half of last year VLSFO and jet were priced more-or-less the same, but over the past month this relationship has eased and VLSFO is now at its weakest relative position to jet, at around 87% of the price. This ties in with the demand picture outlined above, and as jet demand increases over the next 12 months, this price relationship may well weaken further.

The trend has been similar for HSFO against jet prices. In ‘normal’ times before the pandemic, HSFO was priced at around 65% of jet. The unprecedented pandemic condition meant that HSFO and jet prices were briefly the same! Again, the situation has eased and fallen more sharply over the past month. Current relative prices put HSFO back to the 2019 levels versus jet, at around 65%. However, the specification and demand changes in the bunker market may mean HSFO continues to weaken on an underlying basis against jet.

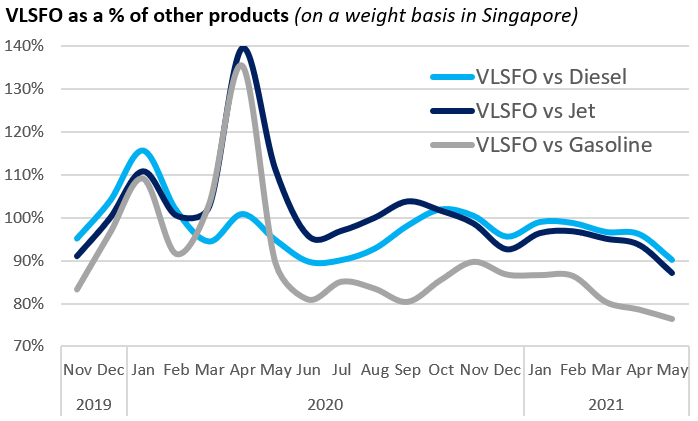

Singapore VLSFO is also at relative lows versus other products

These relative bunker price movements have not been isolated just to the jet market. The graph on the next page illustrates Singapore VLSFO prices against other local cargo product prices and shows the relative price of VLSFO falling across the barrel.

Current VLSFO prices relative to other product prices in Singapore are now at their lowest since the large-scale introduction at end 2019

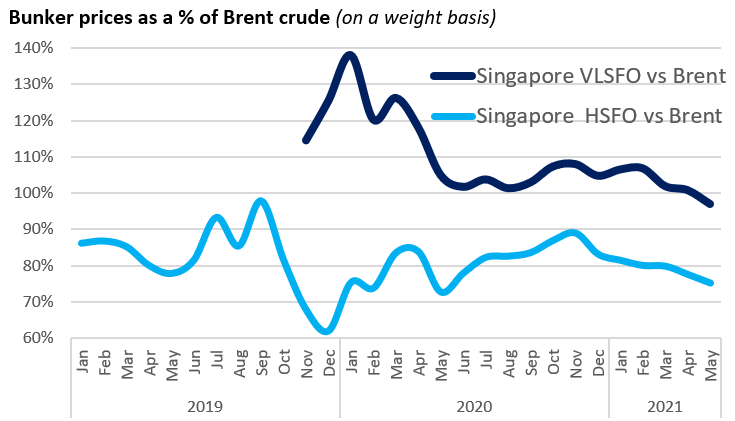

Bunker prices relative to crude incorporate most of the key factors

All of these individual product issues are wrapped up in the crude price, and it is no surprise that bunker prices relative to crude have followed a very similar pattern to those outlined above. VLSFO and HSFO prices in Singapore have fallen further relative to Brent over the past month. Whereas VLSFO hit a peak of 20-40% above crude in Q1 2020, and then traded at a 0-10% premium to crude over the past year, it is only this month that the VLSFO price has fallen to a slight discount to Brent. In the same way, relative HSFO prices have also dipped more recently.

If oil demand does continue to rise, as most analysts are forecasting, then underlying bunker prices relative to the rest of the barrel, and ultimately to crude, could ease further.

Big-picture factors will determine absolute oil prices, but there are nuances and relative bunker prices could weaken further

Ultimately, the crude oil price will reflect the various market dynamics across the barrel, along with refinery issues and

developments, political and covid uncertainties, plus an input of market psychology. The ‘bigger picture’ market issues outlined in the mid-April report still hold true, plus a few others to consider:

- The demand rebound across all products, including air passenger flights;

- Oil supply developments and the OPEC+ strategy;

- COVID developments, and in particular what is happening in India;

- Progress or not in the Iran/US talks on a nuclear deal and the lifting of sanctions;

- Refinery margins and output;

- Outcomes from the recent Chinese tax hike.

So, a lot of the relative price readjustment for bunkers may have already been accomplished in the past month, but given the demand dynamics already outlined in this report, bunker prices could still continue to weaken relative to jet, other products and crude over the next 12 months.

Steve Christy

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.