US crude exports to remain stable, but seaborne imports likely to rise

New trends in US crude trade may arise, as oil demand recovers but impacts from the Covid-19 pandemic on US oil supply linger.

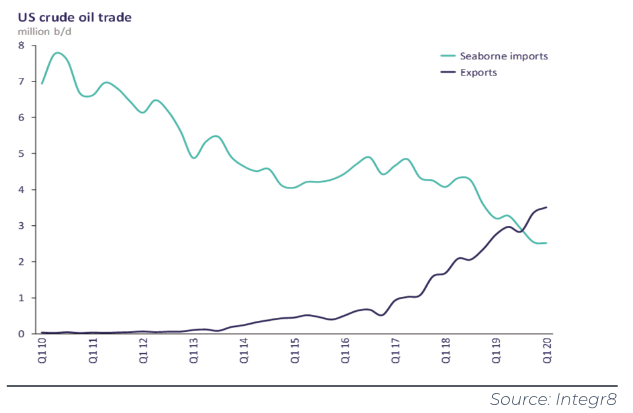

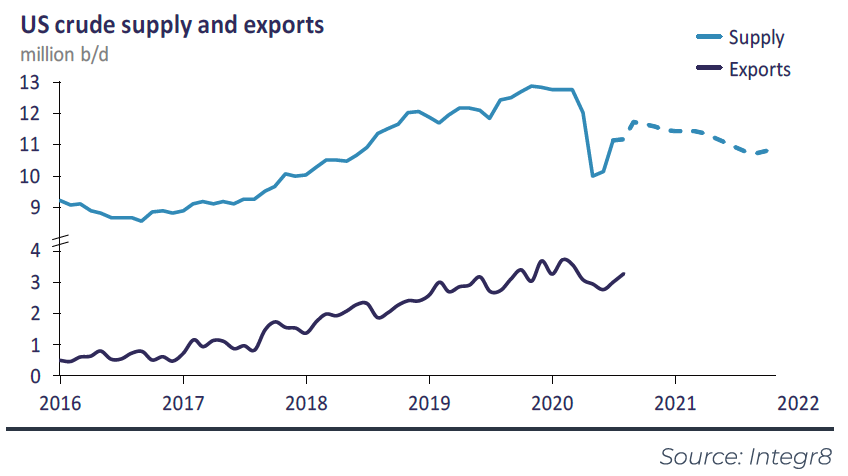

US crude exports have expanded sharply in recent years following the lifting of US oil export restrictions in December 2015, driven in large part by rising US tight oil production, which increased by 6.1 million b/d between 2012 and Q1 2020 to reach 8.3 million b/d. Shipments reached a record high of 3.5 million b/d in Q1 2020, supported by expanded pipeline infrastructure that boosted crude flows to export terminals.

On the other hand, US crude imports by sea have declined since 2010, falling 5.0 million b/d between 2010 and Q1 2020 to sit at 2.5 million b/d. Declining seaborne imports came against a backdrop of rising domestic oil supply and higher landborne imports from Canada, which doubled between 2010 and Q1 2020 to reach 4.0 million b/d.

As Q1 2020 drew to a close, fundamentals in the oil market shifted significantly. The Covid-19 pandemic caused unprecedented destruction to global oil demand, as countries imposed ‘lockdown’ restrictions and economic activity declined. Global oil demand collapsed by 15.6 million b/d y-o-y in Q2, whilst global crude throughput fell 11.4 m b/d y-o-y.

Meanwhile in April, a flood of oil entered the market as OPEC+ supply cuts ended, following the collapse of discussions in early March. Amid a massive oversupply, crude oil prices crashed, which resulted in price-sensitive US shale operators shutting-in supply. US production fell sharply, with tight oil supply dropping 2.3 million b/d in two months to 6.0 million b/d in May.

US crude exports dropped back only 0.3 million b/d q-o-q in Q2, supported by lower domestic oil consumption and inventory building in Asia. Shipments have rebounded somewhat in Q3 as global demand continued its recovery and curtailed US supply has been restored quickly.

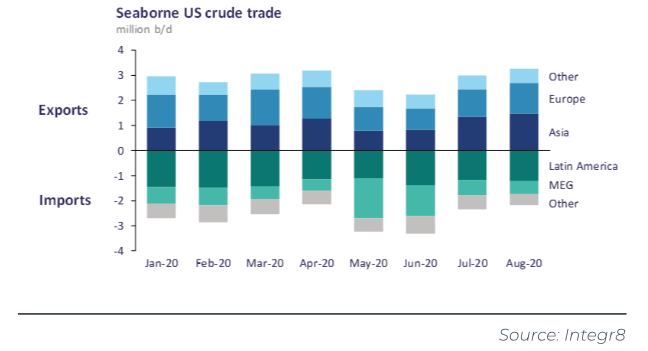

US seaborne crude imports were initially boosted by the disruption in OPEC+ supply. Discharges of cheap Saudi crude, loaded amid Saudi Arabia’s price war with Russia, increased in May and June. However, higher imports partly offset falling US supply to maintain high crude flows into US storage, with elevated stockpiles subsequently suppressing imports into Q3.

Despite US exports not dropping as much as expected during the initial stages of the pandemic, growth in US crude exports is expected to remain limited and volumes may hold around the 3 million b/d mark into 2021.

Undermining the outlook for US crude export growth is the projection of US crude supply declines beyond September 2020, owing to reduced drilling activity, with US tight oil production declining 0.3 million b/d y-o-y in 2021. Export growth also faces headwinds outside the US from high global oil inventories, whilst persistent ‘first-wave’ and emerging ‘second-waves’ in Covid-19 affected countries could prolong economic contraction into 2021. Supply factors may also play a role, such as tapering OPEC+ cuts supporting higher OPEC+ exports, or potential shifts in Libyan, Venezuelan or Iranian crude flows.

However, there remain positive factors that could support a more optimistic outlook, including from continued gradual improvements in global oil demand. There is inherent upside risk, including from the impact of a Covid-19 vaccine ahead of end-Q1 2021, which could spur the pace of demand recovery. Meanwhile, high oil inventories in the US, likely to suppress domestic US refinery output somewhat, could push more crude to export markets.

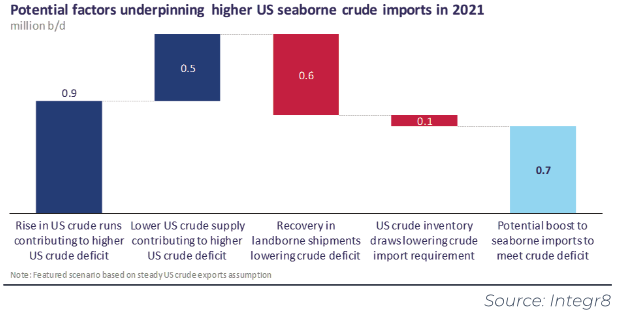

Elevated US crude stockpiles are likely to keep US seaborne imports under pressure in the near-term. However, with US crude inventories falling steeply in August to return close to the 5 year range, the outlook for rising seaborne crude shipments to the US is positive, with shipments having the potential to increase by 0.7 million b/d y-o-y in 2021.

Seaborne imports appear well positioned to benefit from a projected rise in the US crude deficit next year, as US oil demand continues to improve and domestic US oil supply eases back. However, landborne shipments are expected to largely recover, although remain limited by pipeline infrastructure and muted growth in Canadian production, whilst further draws on US crude stockpiles may also present a headwind to import growth.

VLCCs are likely to be supported next year by higher US imports of Middle Eastern crude as OPEC+ supply cuts ease, whilst Aframax demand is expected to benefit from higher US crude imports from Latin America. Meanwhile, Suezmaxes are likely to benefit from firmer US imports of both Middle Eastern and Latin American crude.

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.