VLSFO pricing conditions for less distillate blending and higher viscosity

The recent drop in VLSFO viscosity has been a talked about topic. It is the result of more distillate making its way into the VLSFO blending pool. Having analysed over 15,000 VLSFO test results, viscosity was found to have dropped by over 35% between November 2019 and March 2020, from 160cst to 100cst.

Lower VLSFO viscosity has been linked with a number of potential issues, from purification difficulties to stability and ignition problems. This is particularly applicable to the <30cst viscosity product, whose has been growing.

The reason for more distillate going into the VLSFO blending pool is pricing, where at times VLSFO was sold at a premium to MGO — a phenomenon few could envisage prior to the IMO 2020 switch.

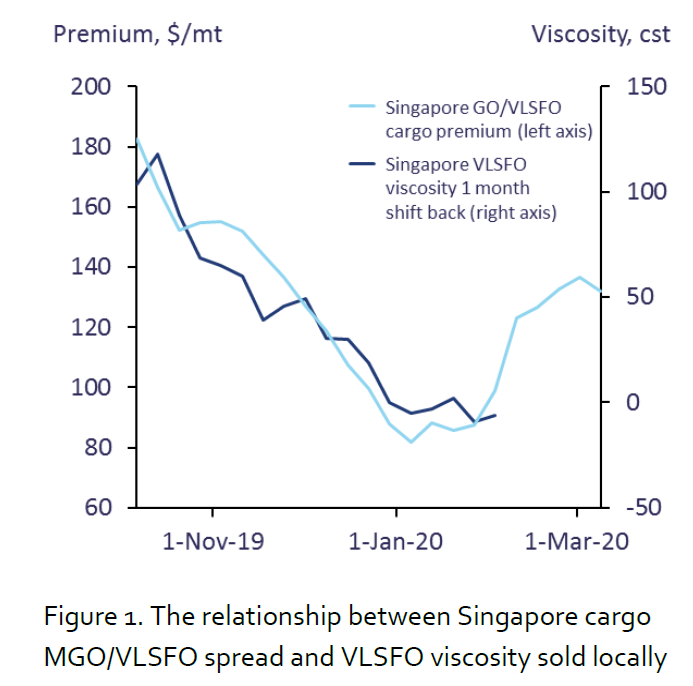

Using Singapore as an example, Figure 1 shows how the cargo pricing spread between VLSFO and MGO affected the viscosity levels of VLSFO sold locally.

The line for viscosity has been shifted one month back as in reality there is always a similar lag between the pricing reaction and the fuels being produced, making it to the bunker market and getting tested before put to use.

It is clearly seen that both viscosity and the pricing spread movements are very similar. In recent weeks the MGO premium to VLSFO cargo in Singapore flipped from negative back to the more expected positive and this is likely to put a cap on the amount of distillate going into VLSFO blending.

The expectation is that more non-distillate blending components will start being blended to produce VLSFO pushing viscosity higher and potentially resulting in a different mix of VLSFO quality issues.

Anton Shamray

Senior Research Analyst

P: +207 4675 856

E: Anton.s@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.