Cheaper Bunkers Ahead? Supply Surge Signals More Downside

Falling prices in August

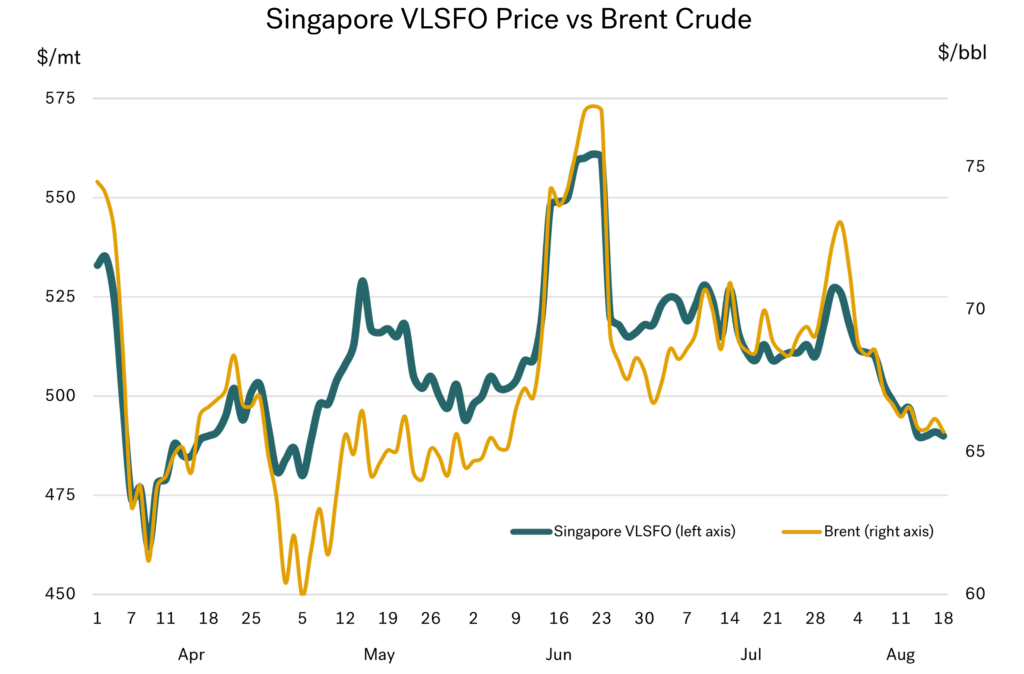

Singapore VLSFO prices have continued to track Brent crude, and the good news for bunker buyers is that Brent prices have fallen. VLSFO prices in the main bunker centres are now at their lowest levels for around three months.

Source: Integr8 Fuels

The challenge is always to gauge where prices are going from here. Of course, politics, war and sentiment are going to have a huge bearing, and who knows where the ongoing discussions between President Trump and President Putin will take us. Stating the obvious, an end to the war in Ukraine (and the removal of sanctions on Russia) would see oil prices fall; an escalation in the war, or heightened tensions, or further direct and indirect sanctions on Russian oil exports could see prices rise. But even political experts will struggle to tell us which way it is going to go!

All we can do here is to take onboard the dynamics in international relations, and then separate and focus on the main drivers within the oil market.

OPEC+ unwinding production cuts is pushing prices lower

On the supply side, in April, OPEC+ members started to unwind the 2.2 million b/d of voluntary production cutbacks (these cutbacks were agreed in November 2023 and started in the first quarter of 2024). At the same time as the OPEC+ increase, UAE’s production quota is being raised by 0.3 million b/d.

The increase in OPEC+ production since April has not been linear. There are also other complications, in that some countries are unlikely to be able to raise production back to their quota levels. However, in early August, OPEC+ agreed to increase September production by 0.55 million b/d, which will fully unwind the cuts. This means Saudi Arabian output is likely to be close to 10 million b/d (versus 9 million b/d earlier in the year) and UAE production is forecast to rise as its agreed higher quota is introduced. As a result, by September/October, OPEC+ output is likely to be around 2 million b/d higher than it was in March.

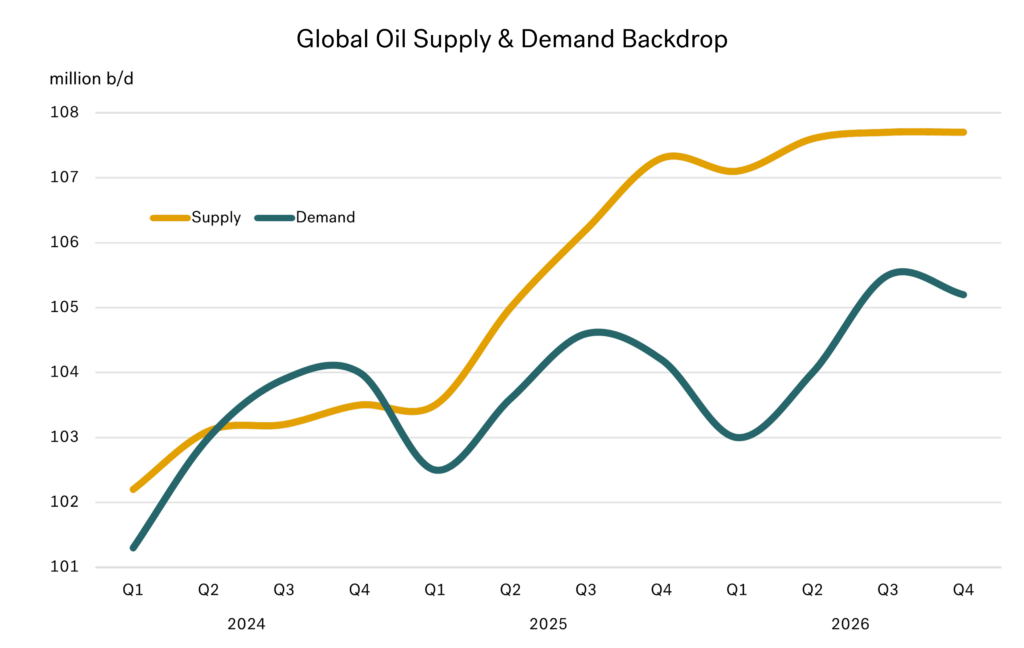

On top of this, non-OPEC+ production is forecast to rise by around 1 million b/d over the same period. Hence supply is forecast to rise very steeply this year, with the graph below illustrating the hike from 104 million b/d in Q1 to 107 million b/d in Q4.

Source: Integr8 Fuels

However, the same cannot be said for oil demand. Relatively weak underlying economies, huge economic uncertainty surrounding proposed hikes in US tariffs and the continual shift towards more electric vehicles (EVs) has undermined growth in global oil demand. There have been continual downwards revisions to forecast demand for this year and next, with the IEA currently indicating growth of 0.7 million b/d for 2025 and another 0.7 million b/d in 2026 (equivalent to 0.7%).

Global oil stocks set to rise sharply?

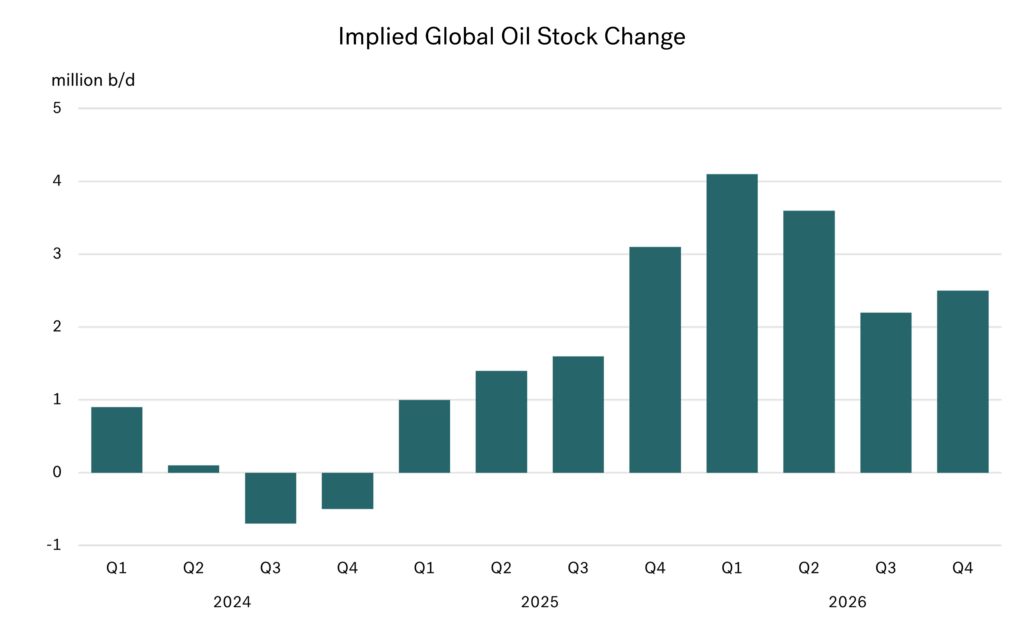

With OPEC+ restricting output in 2024, oil supply and demand were more-or-less in balance. But this balance is literally unwinding as OPEC+ remove their voluntary production cutbacks over the second and third quarters of this year.

We have already seen slight global stock-builds so far this year. Now we are expecting OPEC+ production to ramp up at the same time as world oil demand goes into a seasonal decline from the third to the fourth quarter. Nowadays peak oil demand is in the northern hemisphere summer months, with a seasonal fall of around 1.5 million b/d from Q3 to Q1 the next year.

The pointers are very clear on this basis; we are looking at potentially very big oil stock-builds over the remainder of this year and going into next year. This bearish view is compounded when looking at the demand fundamentals for next year. Even if OPEC+ keep to their plans and maintain their other 3.65 million b/d of cuts in place through 2026, there is still too much oil in the market!

In the case outlined here, stock builds would start to balloon to around 3 million b/d in the fourth quarter this year and then continue at 3-4 million b/d through the first half of next year.

Source: Integr8 Fuels

The issue for OPEC+ is these bearish fundamentals don’t go away, with potential stock-builds going through the second half of next year as well.

War and politics will cloud the outlook and drive oil prices at certain key periods. But we can’t get away from the fact that OPEC+ unwinding their voluntary production cutbacks at this time has placed a massive bearish fundamental position on the oil market. War, Trump, Putin, and sanctions aside, it would look like bunker prices should go much lower over the rest of this year and into 2026.

Given this, what can change?

Any escalation in wars, or the threat of wider involvement will push oil prices high. As will any tightening of sanctions on Russia (or Iran). These developments would ‘cover’ the increases in OPEC+ output and likely support oil prices at higher levels.

Alternatively, any end to the war in Ukraine and ‘reinstatement’ of Russia back into the international arena will only add to the bearish fundamentals outlined here, and push prices even lower. This second option looks good for ‘world order’ and for bunker buyers!

If prices go ‘too low’ then expect an OPEC+ response

However, if prices fall to very low levels because of very weak fundamentals, or a solution to the Russia/Ukraine war, or a combination of both, then OPEC+ is likely to respond. The big players in these OPEC+ decisions are still hugely reliant on oil incomes for their economies and development programs. They are also very good, and ultimately successful, at responding to extreme price falls, with production cuts to re-balance the market. A 10% cut in oil production by these players would result in a much bigger than 10% rise in oil prices, i.e. a cut would raise their revenues.

So, perhaps we want lower prices, but not too low to provoke an OPEC+ response!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.