Have We Reached the Bottom for Bunker Prices?

Prices have dropped sharply again…

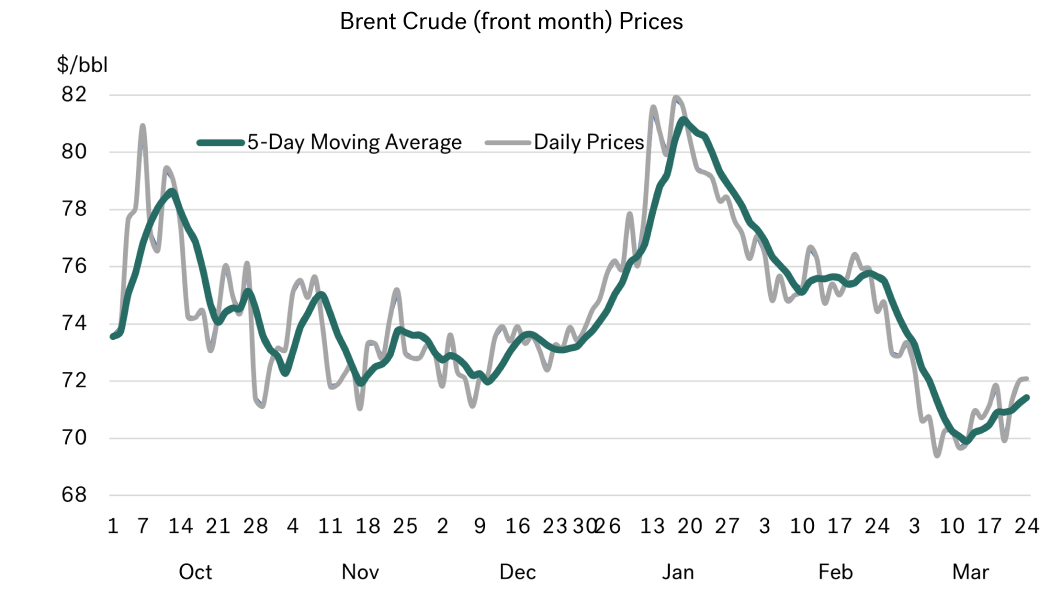

In the past four months we have talked consistently about the bearish nature in oil markets, both on the fundamental and political fronts. The mantra of ‘too much oil’, and a Trump led end to the wars in Ukraine and Gaza have, until now, led oil prices down sharply. Front month Brent has hit the low $70s, and is some $10/bbl below peak levels seen two months ago.

Source: Integr8 Fuels

Source: Integr8 Fuels

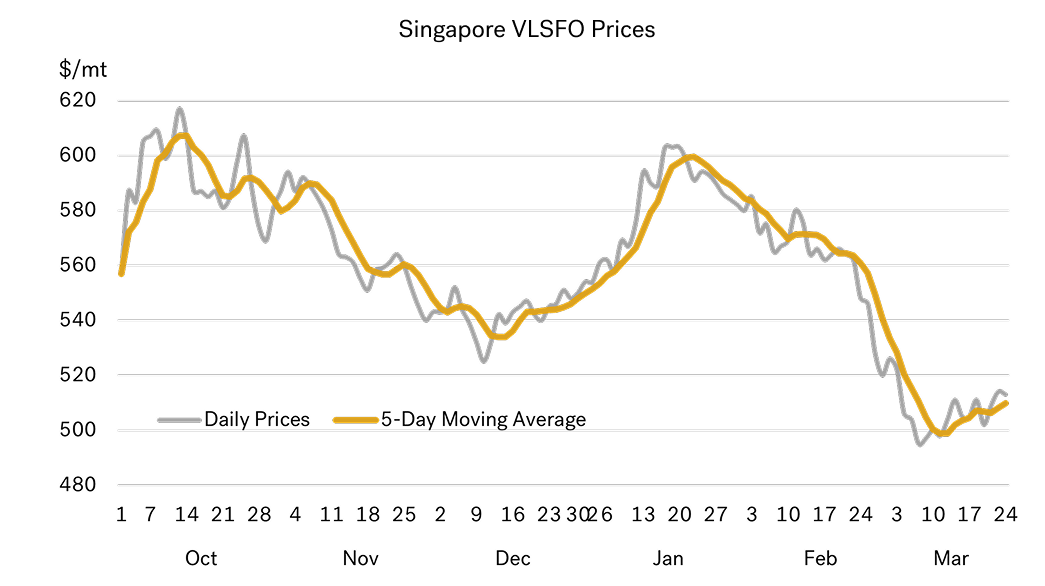

For us in bunkers, Singapore and Fujairah VLSFO prices have fallen by almost $100/mt in the past two months, to around $500/mt. The absolute drop in Rotterdam VLSFO prices has been less, at around $70/mt. But the main point is VLSFO bunker costs are now 13-15% lower than in mid-January.

Source: Integr8 Fuels

Source: Integr8 Fuels

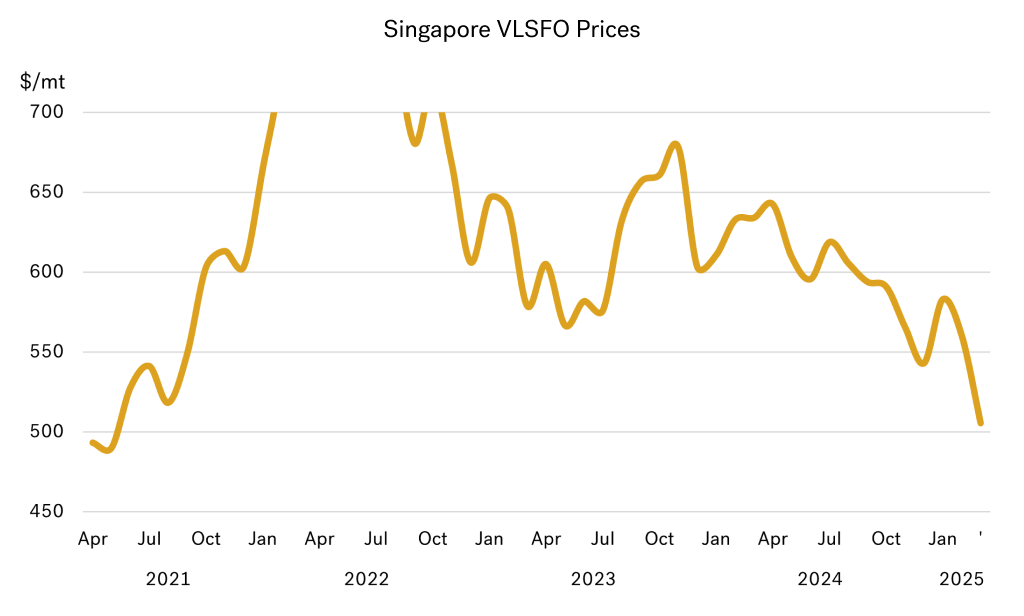

Singapore VLSFO at a 4-year low

Putting this in a more historical context, Singapore VLSFO prices are at their lowest for four years; back to levels we last saw in the first half of 2021.

Source: Integr8 Fuels

Source: Integr8 Fuels

Given this, are we now at a position where the downside risk to prices is far more limited?

Watching peace negotiations & OPEC+

There are always bullish and bearish factors to consider in our market; it’s just that over the past four months the bearish factors have been huge. Given where we are today, are we in a more ‘balanced position’ in terms of price direction?

We still have the potentially bearish issue of OPEC+ unwinding their voluntary production cutbacks starting in April. In early March, the group re-iterated the plan, but it looks like the increases will now be staggered and that any gain in April is likely to be minimal. These moves by OPEC+ are already factored into current prices, and so the group is likely to ‘take a backseat’ in determining oil price direction in the very near-term.

Another bearish fundamental is the expectation that there will be too much oil over the next 12-18 months, even before any increase in OPEC+ output. But again, this is largely baked into current prices.

The upside to prices is if there is any faltering in peace negotiations in the Ukraine/Russian war.

No one wants ‘failure’, but at the moment these negotiations are taking small steps and look highly precarious.

But everyone wants to know how far President Trump will go

In the short term it seems a lot of the sentiment in price direction will come from the US peace talks with Russia and Ukraine.

However, President Trump’s strategy and rhetoric on US tariffs means there is now another bearish factor to consider, which goes well beyond our market. Potential trade wars and any accompanying recession has already contributed to the bearish sentiment and the recent fall in oil prices. If the situation escalates and major tariffs are fully implemented, it is a double-edged sword for us; yes, we could see lower bunker prices, but this world be at the expense of recession and a reduction in world trade.

So, having said we have hit a four-year low in bunker prices and we could be at a more balanced view on the price outlook, there still seems to be more bearish stories around, rather than bullish!

And now for something completely different… Refining

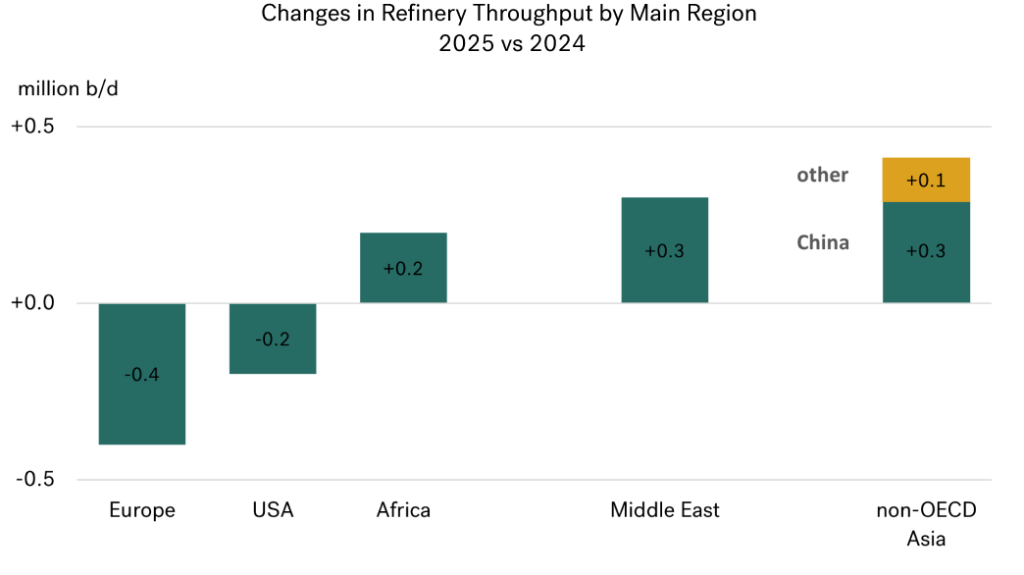

Taking a ‘side-step’ from looking at peace negotiations, tariffs, and economic prospects, here we look at some broad directions in the refining sector. Clearly supplies and blending in the oil bunker markets are dependent on refining and international trade. There is a clear direction here that refinery capacity and throughputs in Europe and the US are declining, whilst the reverse is happening in the Middle East and non-OECD Asia, with rising refinery investments and increased throughputs.

The graph below shows the clear shift in refinery operations this year from west to east, and, as highlighted in the following paragraphs, all the indications are that this trend will continue.

Source: Integr8 Fuels

Source: Integr8 Fuels

BP has plans to cut around 30% of its European refining interests. There are also at least three refineries in Germany up for sale, with more assets in France likely to go. There are further complications in the region, with the Russian companies Lukoil and Rosneft trying to disentangle themselves from their European refining interests by selling them. Although independent refiners and traders could takeover some of these refineries, the end result is still that European crude runs in the future will be less than this year.

In the bigger picture, oil demand is falling in the west, so the overall strategy of selling/closing refineries may appear ‘sensible’. But this could be a key issue for the bunker market. Although the moves towards EVs, renewables and electrification mean total oil demand in the west is falling, for us in bunkers, along with aviation, we are the two sectors where oil demand in the region is rising. There are a lot of ‘moving parts’ in the outlook, but the possibility is that more bunker products/blending components will have to be moved into Europe and less HSFO moved out.

Summing up

It is always worth looking at some of the longer-term issues in the bunker market, such as refining. BUT it is very hard to move away from some of the bearish sentiment still in the market, and what is happening now politically around President Trump, and what impact this will have on bunker prices going forward.

Taking all of this into account, many analysts are still lowering their crude price forecasts for next year, with a number projecting Brent in the mid/high $60s. So, overall, this is not the time to stop talking about falling bunker prices!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.