Oil Prices Surge as Sanctions Shake the Market

Biden and Trump mean we are paying more for bunkers

Through most of last year, and especially in the fourth quarter, we highlighted the weak fundamentals in the oil market and the downward pressures on oil (and bunker) prices. Markets were at ‘obvious’ low prices through to the end of last year, and then politics kicked in, and prices surged!

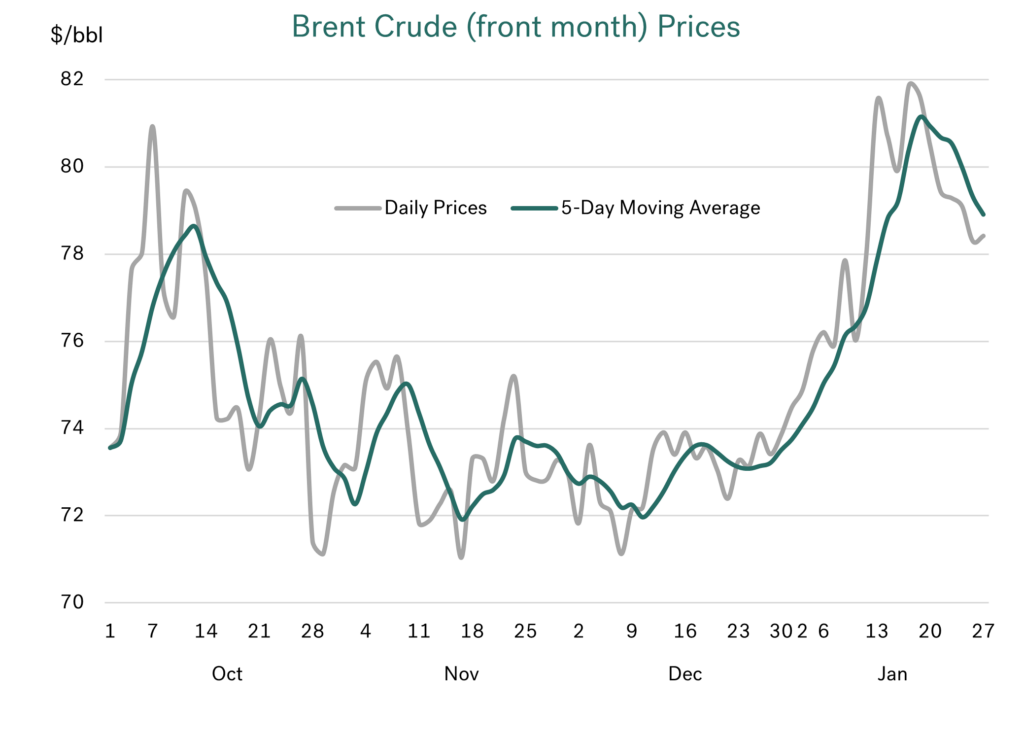

Brent crude back to $80/bbl

Politics have triggered a significant hike in crude oil prices to their highest level in 5 months, with front month Brent up from the low $70s to a high close to $82/bbl. Prices have eased back after their initial hike, but they are still 7% higher than in December. Clearly politics trump any bearish fundamentals in the market; no one at the moment is talking about oil supply exceeding demand this year!

Source: Integr8 Fuels

Source: Integr8 Fuels

Biden started the ball rolling

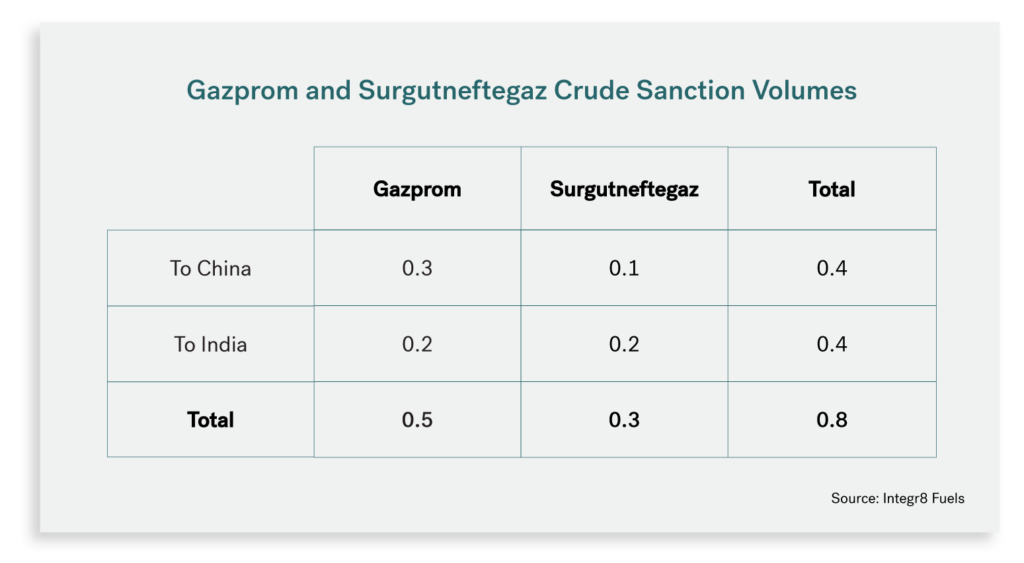

The first surprise was that right at the end of his term, on 10th January, President Biden imposed new sanctions on Russia, targeting around 160 tankers (the ‘dark/shadow fleet’), marine insurance companies and two Russian production companies, Gazprom and Surgutneftegaz. These two companies had been exporting around 0.8 million b/d of crude, mainly to China and India. Now buyers from these companies only have a grace period until February 27th to offload their cargoes before facing sanctions themselves.

The implications and uncertainty surrounding these new US sanctions has meant the Russian crude export market has now ground to a halt. The response has been for Chinese and Indian buyers to act quickly and enter the market looking for alternative supplies, including from the Middle East, West Africa, and Brazil. The net result is that China and India are now competing with each other, alongside previous buyers of these crude grades. Such an increase in competition and uncertainty about the future could only lead to one thing, a surge in oil prices.

VLSFO prices up by around 8%

Consequently, we have been hit with much higher bunker prices. Singapore VLSFO has been back up at around $590-600/mt, with Rotterdam prices around $540-550/mt, 9% and 7% higher than their December averages.

Source: Integr8 Fuels

Source: Integr8 Fuels

Oil sanctions on Russia are making us pay the price

Direct sanctions on the two Russian oil companies amount to around 0.8 million b/d of crude exports, split 50:50 between India and China.

Source: Integr8 Fuels

Source: Integr8 Fuels

This alone may seem relatively small, given Russia had been exporting a total of some 4.6 million b/d of crude and 2.7 million b/d of products. However, there are further issues that restrict export volumes, with non-compliant tankers also sanctioned, and these moved an estimated 1.6 million b/d of Russian exports last year. Also, with sanctions on marine insurance companies and issues fulfilling US dollar financial transactions, it is no surprise there has been a halt in Russian exports and a rush to secure alternative crude volumes.

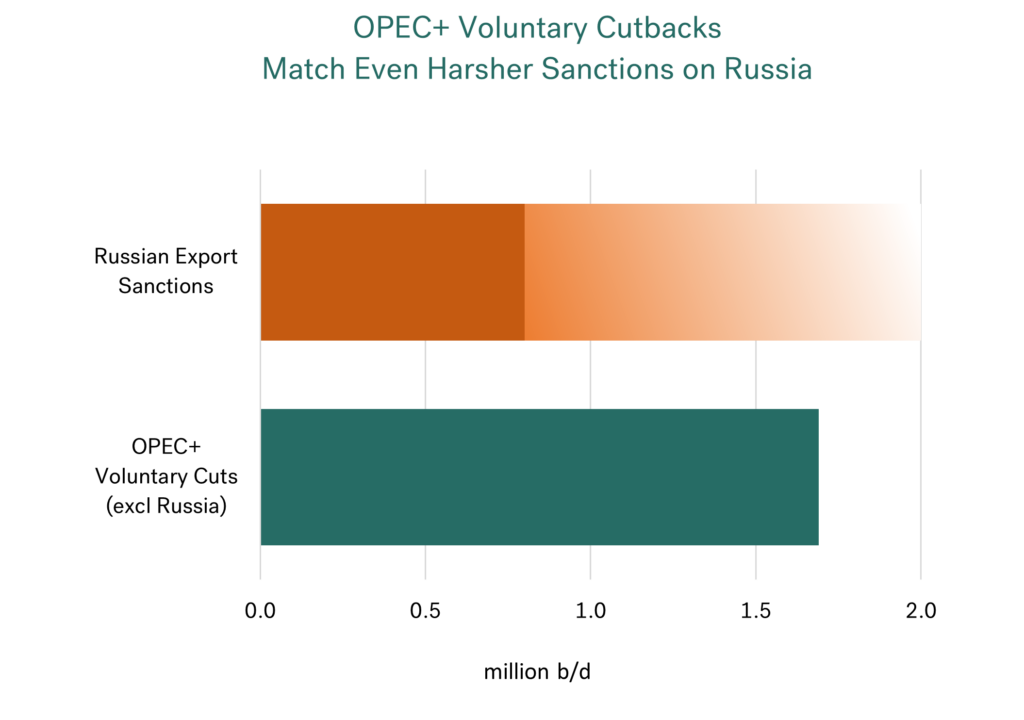

Russian sanctions will open the door for OPEC+

When one door closes, another often opens. In this case the closure of Russian ‘doors’ now makes it far easier for the opening of OPEC+ ‘doors’. If we exclude Russia, OPEC+ currently has 1.7 million b/d of voluntary production cutbacks that they have been looking to unwind since last year. The re-introduction of these volumes has been pushed back to April this year because previous ‘market conditions’ were not right (i.e. oil prices were too low).

President Trump has already asked Saudi Arabia and OPEC+ to reduce oil prices, and the only mechanism they have for this is to raise production. Although lower oil prices would appear to contradict incentives for companies to “Drill Baby Drill” in the US, an increase in OPEC+ production would ultimately take the sting out of prices following sanctions on Russia. In fact, the full unwinding of OPEC+ cutbacks could offer Trump an ability to put even tighter sanctions on Russian oil exports, if he chooses.

Source: Integr8 Fuels

Source: Integr8 Fuels

An eye on a bigger prize?

There are many dichotomies in what President Trump has said so far, such as talk of putting 25% tariffs on Canada and Mexico (and China?) and wanting lower oil prices, and wanting the US to “Drill Baby Drill”. But, if it takes such a tight sanction squeeze on Russia (or even the threat of one) to start negotiating an end to the 3-year war with Ukraine, then President Trump could be a peacemaker. Then Iran next?

This unpredictable, or ‘non-traditional’ approach to politics looks like we will continue to get extremes in oil prices. Timings never match; a tightening of sanctions on one country will never coincide with an agreement to raise production in another country. However, Saudi Arabia has an estimated 3 million b/d of spare capacity, the UAE another 1 million b/d, with Kuwait and Iraq another 1 million b/d between them. If Trump works with these countries, there is potentially up to 5 million b/d of ‘replacement oil’ to work with if he imposes even tighter oil sanctions on Russia, or decides to escalate the position with Iran.

Higher bunker prices today, but where do we go from here?

There are nuances in bunker prices in different regions, and in their relationship with crude, but we are essentially ‘price-takers’ in the oil market. Biden and Trump have made their moves, and we are currently paying around 7-9% more for bunkers than in December.

At the moment we are in the ‘initial shock’ period, which has meant a reversal in all the bearish oil price dynamics we were looking at for most of 2024. However, prices have eased back a bit, and there will be ways that alleviate the initial response to these sanctions. Buyers of Russian crude will have to use unsanctioned tankers and also prove the purchase price of Russian crude is less than the $60/bbl imposed cap; but it can be done (at the moment).

In the bigger picture, President Trump says he wants to end the war between Russia and Ukraine, following the Israel-Hamas ceasefire agreed on January 15th. We are not political commentators, nor forecasters of where the Nobel peace prize may go, but Biden has disrupted Russian oil exports and President Trump will continue disrupting global politics and markets throughout his term.

In the short-term, politics have pushed bunker prices higher, and obviously even tighter ‘Trump sanctions’ on Russia could see another leap in prices. But if there is a negotiated peace in the Russia/Ukraine war, or one looks highly likely, then we could see oil prices tumbling and the Nobel peace prize making its way to the US.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.