A Wild Ride for Oil Prices—Biden, Trump, and What Comes Next

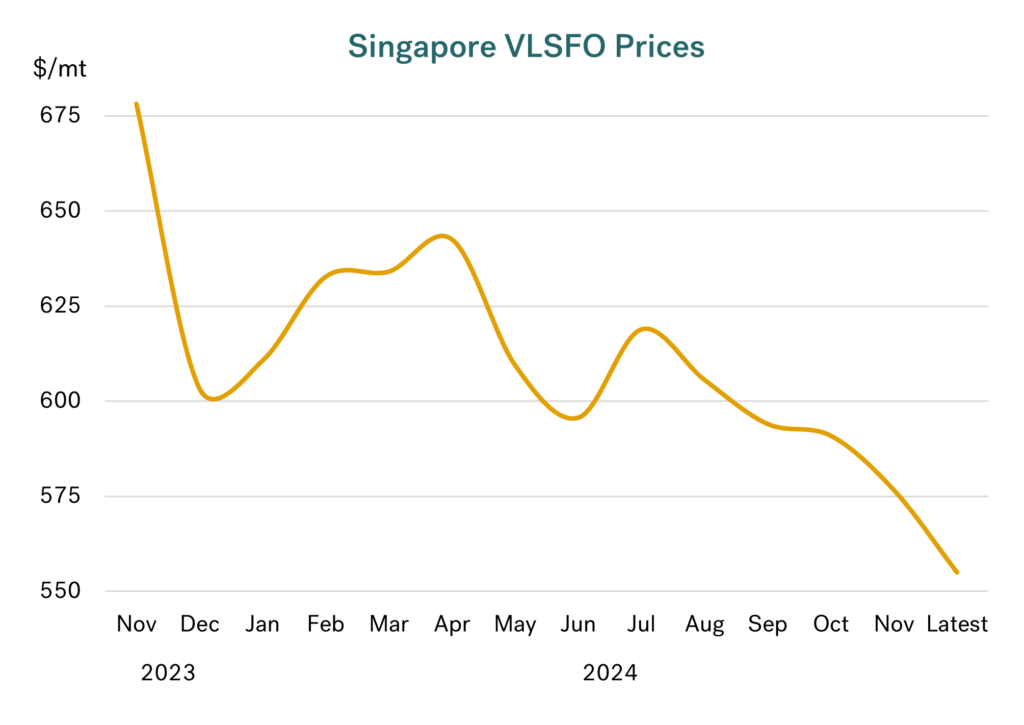

Singapore VLSFO 20% lower than 12 months ago

Singapore VLSFO prices have fallen even further over the past month, to their lowest levels since last June.

The driving force behind this continual slide in prices is the bearish fundamentals in the oil market. There have been short-term ‘interruptions’ in this decline, largely from war-related developments in Ukraine/Russia and Gaza. Though the market has continually come back to focus on the bearish oil fundamentals outlined for this year and next year, especially by the IEA.

Source: Integr8 Fuels

Source: Integr8 Fuels

Developments in the Russia/Ukraine war have not (so far) been enough to reverse the fall in prices. Hence Singapore VLSFO is $50/mt lower than 3months ago, and has fallen by around $125/mt (close to 20%) over the past 12 months.

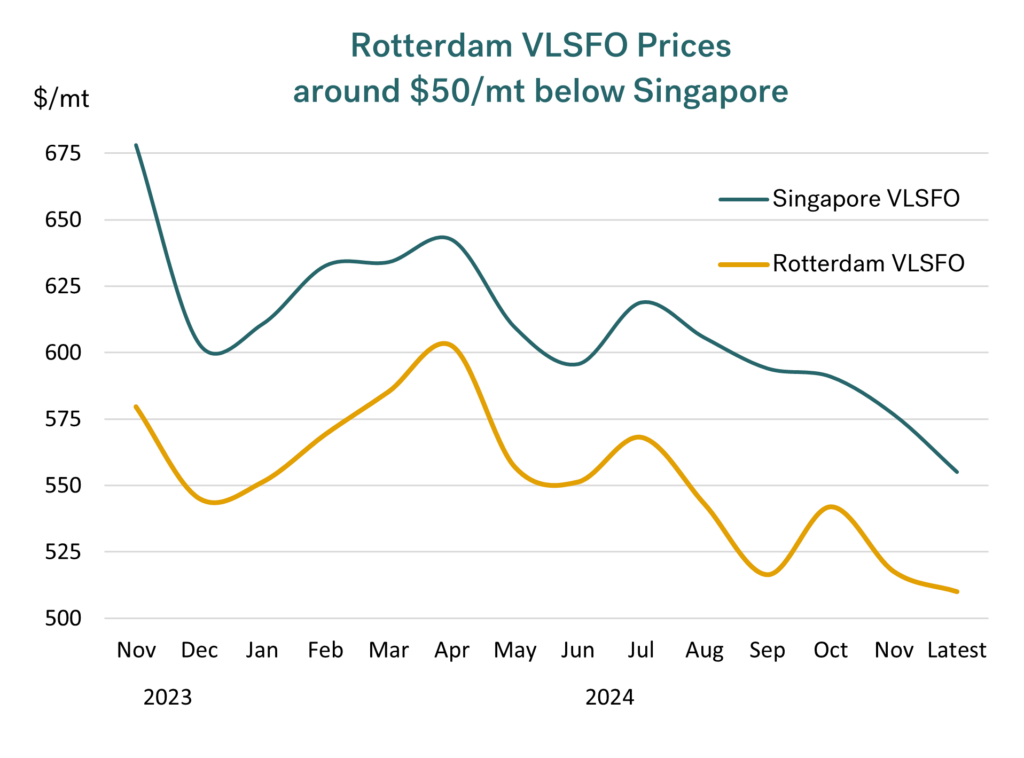

Rotterdam prices also lower

The same price movements have been seen across the bunker world, and in other product markets as well. The graph below illustrates VLSFO prices in Rotterdam, which generally follow the same trend as in Singapore (apart from in September, when there was tightness in the Singapore market). Consequently, Rotterdam VLSFO prices are now just above $500/mt, and back to around $50/mt below those in Singapore.

Source: Integr8 Fuels

Source: Integr8 Fuels

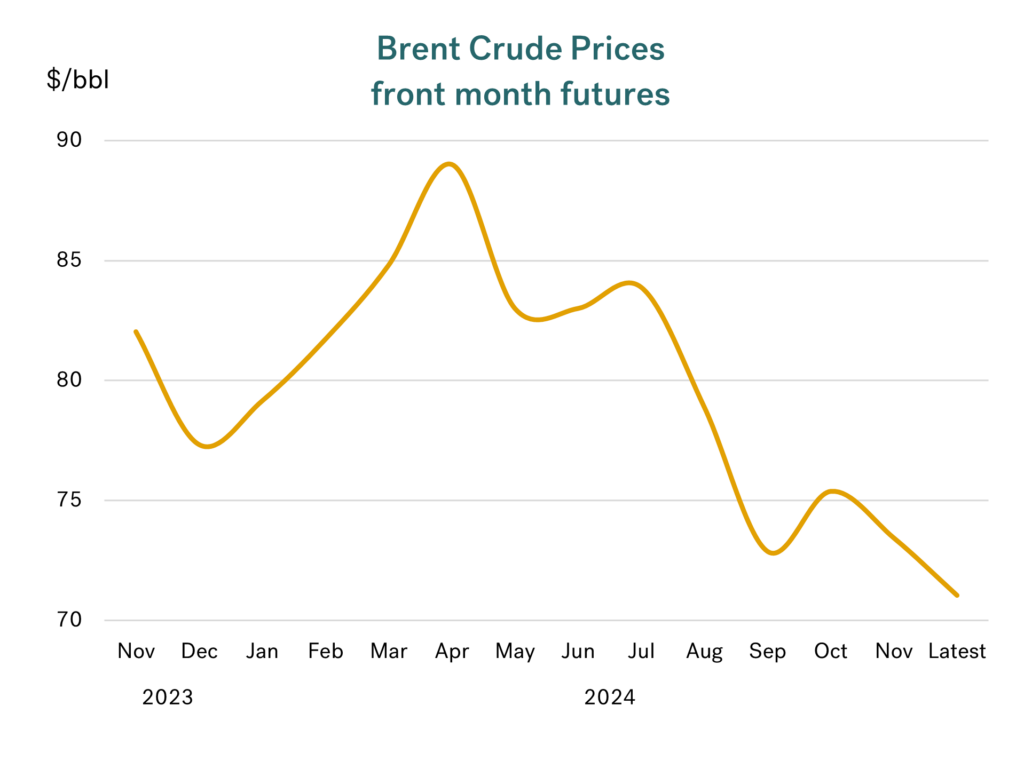

It all comes back to crude

Everything ultimately comes back to the crude oil price, and the benchmark references we all use are Brent and WTI futures prices; the whole industry feeds off these prices. So, the starting point for us is Brent, and the graph below is more-or-less the same illustration we have highlighted for VLSFO above; there are of course important nuances in bunker prices, but here we are just focusing on the bigger picture.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are always three things to assess!

Two big things to look at now are the Russia/Ukraine war, and anything that OPEC+ does. But we must also include any significant changes that newly elected President Trump implements, including bringing the Russia/Ukraine war to an end and possible higher trade tariffs against China.

However, before Trump is inaugurated, it seems President Biden is potentially making one last big move for Ukraine, with the provision of long-range missiles able to strike well into the Russian interior. This may also be a trigger for European allies to offer ‘more-powerful’ weapons to Ukraine. These comments have already pushed oil prices a little higher.

What will it take to push bunker prices even lower?

So, if long-range missiles are available to Ukraine, it is likely to mean oil prices go higher; but a Trump ‘solution’ to the war will mean prices go lower. At this stage no one knows where this will go, but it won’t be difficult to follow, it will be all over the front pages!

We can only sit and wait to see what happens in Russia/Ukraine, but we can look more closely at the situation for OPEC+, and what that might mean for oil prices and us in the bunker market.

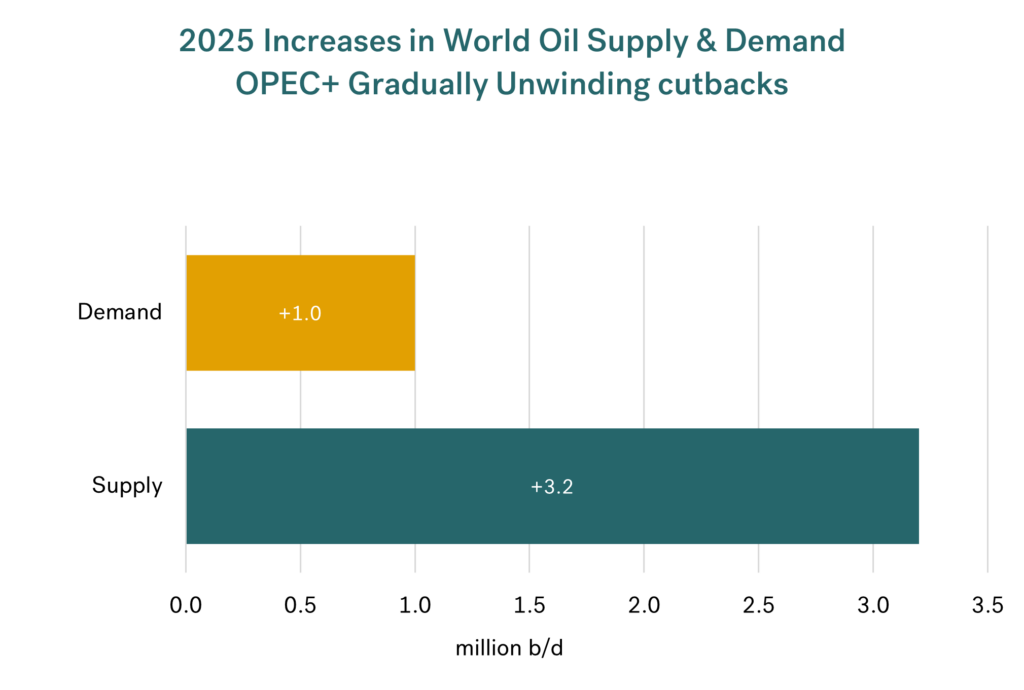

OPEC+ is in a difficult position in that it has planned to gradually unwind at least 2 million b/d of additional voluntary cutbacks, but has said this is dependent on market conditions. With oil prices falling, the market conditions for OPEC+ ‘have not been met’, so they have continually deferred any decision to increase production, despite some individual members pushing to raise output. The latest decision is to potentially start ramping up production in January, adding around 180,000 b/d each month.

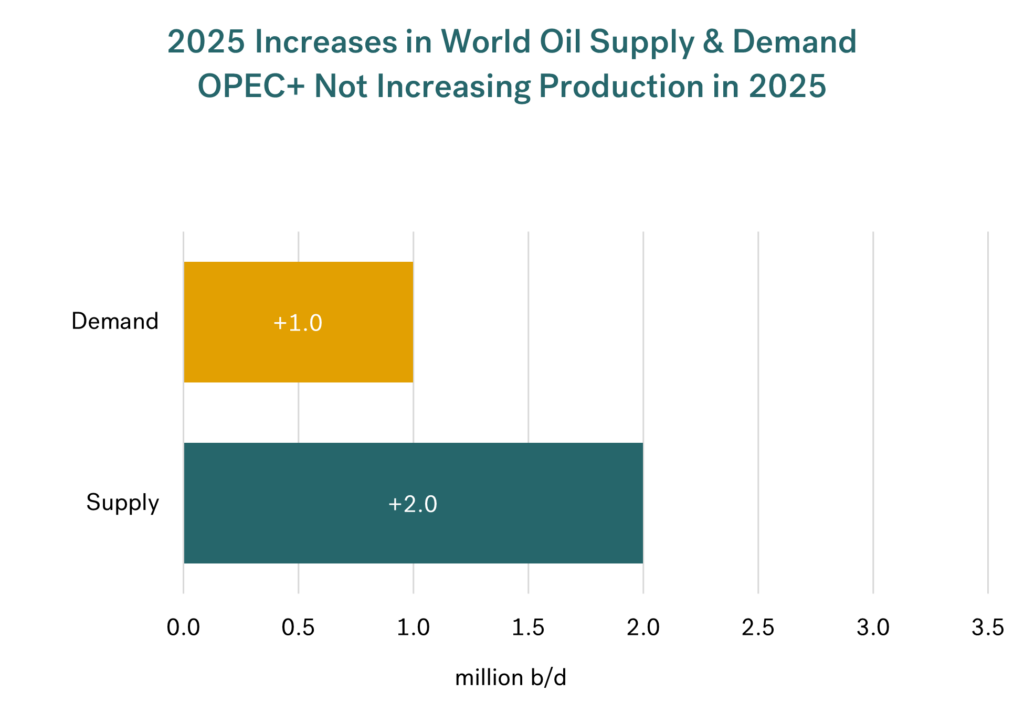

There is already strong growth in non-OPEC+ production projected for next year. Therefore, if OPEC+ does go ahead and unwind their production cuts, world oil supply could increase by more than 3 million b/d in 2025. This is against a projected increase in oil demand of only 1.0 million (by the IEA). The graph below illustrates the massive difference between the supply and demand increases next year, with the implication of a much weaker oil market and even lower oil and bunker prices.

Source: Integr8 Fuels

Source: Integr8 Fuels

The IEA is at the lower end of demand forecasts for next year, but even looking at the US EIA and OPEC themselves, they only indicate a demand growth of 1.2 million b/d and 1.5 million b/d respectively. So even here, it still shows a large imbalance and infers weaker bunker prices.

Even if OPEC+ does continue to defer any decision to unwind the cutbacks for the whole of next year, it still suggests that world oil supply will increase by 2 million b/d. Again, taking any of the main forecasters’ views on demand for 2025, it still implies ‘too much oil’, and a potential further fall in bunker prices.

Source: Integr8 Fuels

Source: Integr8 Fuels

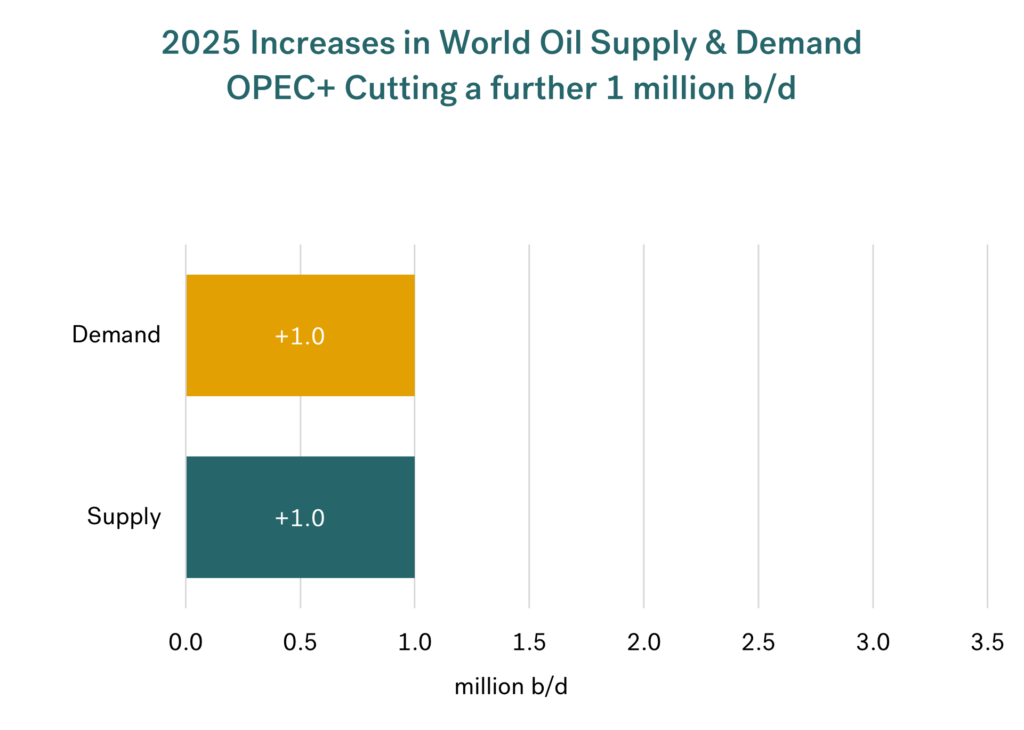

Looking at the fundamentals, the only ‘balanced’ outlook for next year is if OPEC+ make a further production cutback of around 1 million b/d!

Source: Integr8 Fuels

Source: Integr8 Fuels

Given that OPEC+ is talking about increasing production, at this stage it seems highly unlikely they will make a quick decision to impose further cuts.

The fundamentals & Trump could mean even lower bunker prices in 2025

So, from a purely fundamental view, everything points to sustained ‘low’ prices next year, and if OPEC+ is not prepared to make further cuts then there is every indication that oil and bunker prices could be even lower in 2025.

BUT we are not in a purely fundamental market, and in geopolitical terms it is Russia/Ukraine that is at the forefront. If Biden’s latest move on long-range missiles is carried out, then prices are likely to rise, even if its in anticipation of an escalation in the war. However, from the early part of next year we may see far more unpredictable outcomes under President Trump. If the war does come to an end, and OPEC+ increase, or even maintain output, then VLSFO prices in the $500s may look high!

Let’s watch Biden, Trump, and OPEC+ to see what happens.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.