Prices still look like falling, even after OPEC+ announce a 2.2 million b/d cut.

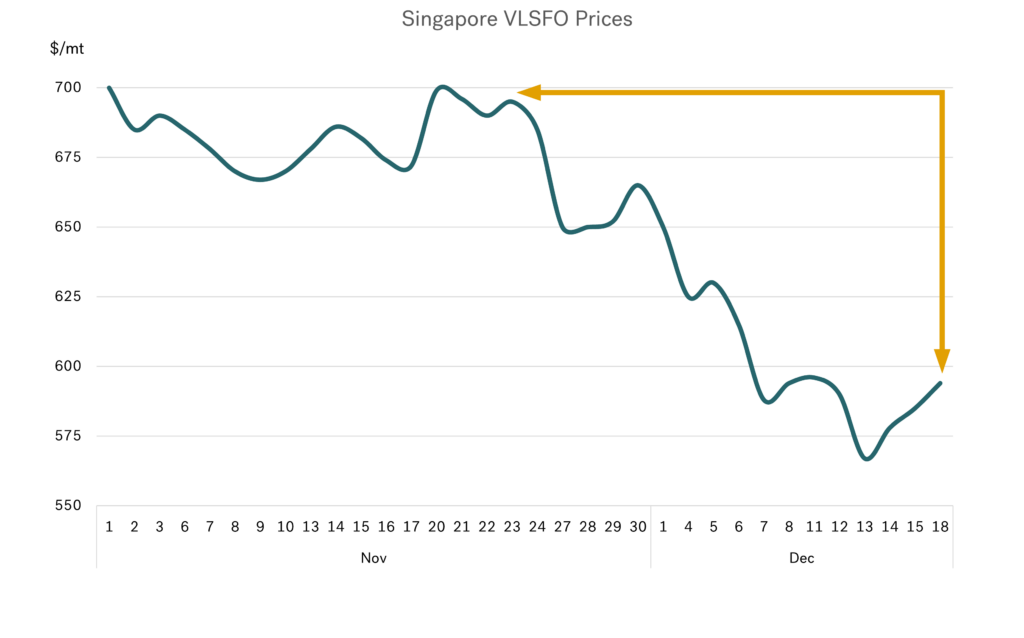

Oil prices are down, but Singapore VLSFO is DOWN.

A month ago, we wrote about the oil fundamentals looking more bearish and that OPEC+ may cut production at their end November meeting to counter these views and support oil prices. Well, OPEC+ did come up with an agreement to cut output by 2.2 million b/d, but oil prices still fell!

From the lead-up to the OPEC+ meeting to now, Brent crude is down by around $6/bbl, and Rotterdam VLSFO is down by around $50/mt. However, with tightness in the Singapore VLSFO market unwinding at the same time, bunker prices here have fallen by a massive $100/mt over the past four weeks (15%). All this is certainly welcome news for bunker buyers, but also shows the bearish nature of the market at the moment.

Source: Integr8 Fuels

Source: Integr8 Fuels

There are always three reasons for market moves!

The three key features why we are seeing much lower oil prices and the big drop in bunker prices are:

- There are more bearish signals for growth in world oil demand, predominantly because of weak global economic prospects and the knock-on effects.

- Increases in non-OPEC oil production are much bigger than most people expected, especially in the US, but also with output ramping up in Brazil and Guyana.

- Actual production cutbacks from OPEC+ will be much lower than the headline 2.2 million b/d figure that came out of the end November meeting, and could be even less than 0.5 million b/d.

Again, it is these fundamental features that are currently driving the market, and the fundamentals look weak.

US production has hit record highs – and it means lower oil prices

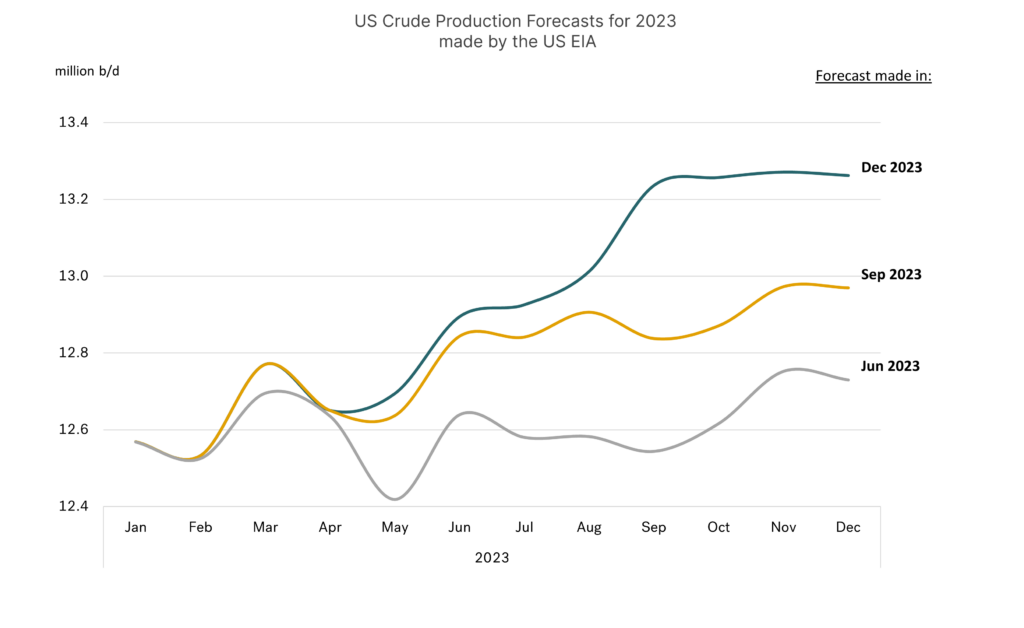

Until recently the main talk in the US shale sector was of limited new investments, constraints on equipment and labour, and a general slowdown in developments. Just six months ago the view was very much that US crude production was going to remain flat. Now the market is booming!

This turnaround in US shale output has come with gains in operating efficiencies and higher productivity at the wells. These moves have been far greater than people envisaged and have driven US oil output to a record high level. In the latest estimates by the US Energy Information Administration (EIA), December crude output is at close to 13.3 million b/d; three months ago, their December estimate was 13.0 million b/d and only 6 months ago it was at 12.7 million b/d.

Source: EIA

Source: EIA

So, over the past 6 months, the OPEC+ group has cut production by around 0.8 million b/d, but the US has seen an ‘unexpected’ increase of 0.6 million b/d. This has been a ‘surprise’ to the market, an additional challenge to OPEC+ and a blessing to those looking for lower bunker prices.

The challenge for OPEC+ to ‘manage the market’ is huge

Given the weaker prospects for growth in oil demand next year, and production gains in certain non-OPEC countries, the challenges facing the OPEC+ group going into their recent meeting were immense. The headline number of a 2.2 million b/d production cut by the group was, on the face of it, very impressive. However, it wasn’t enough to maintain prices you don’t have to dig very deep to see there are some optics in this figure.

Within these figures, Saudi Arabia has agreed again to extend its voluntary cutback of an additional 1 million b/d into the first quarter of next year. Before the OPEC+ meeting, the plan was for Saudi to end this voluntary arrangement at the end of this year. So, this is one of those cases where the ‘reduction’ is from ‘what would have otherwise happened’, not from current production levels.

In a similar development, Russia has announced that it will also rollover its 0.3 million b/d cut in crude/product exports into Q1 2024 and add a further 0.2 million b/d cut to this from January i.e. a theoretical cutback of 0.5 million b/d.

So, 1.3 million b/d of the announced 2.2 million b/d OPEC+ cutback comes from extending the Saudi and Russian voluntary cuts into Q1; it is not a cut from current production levels! There is a planned additional 0.2 million b/d cut from Russia, but there are questions about this.

Therefore, this only leaves an implied 0.7 million b/d actual cut in OPEC+ output from the start of next year. However, there is another twist, as some time ago it was agreed that the quota for the UAE will be increased by 0.2 million b/d from the start of 2024. This means the actual agreed OPEC+ cut from current levels is only 0.5 million b/d, and full adherence to this is questionable.

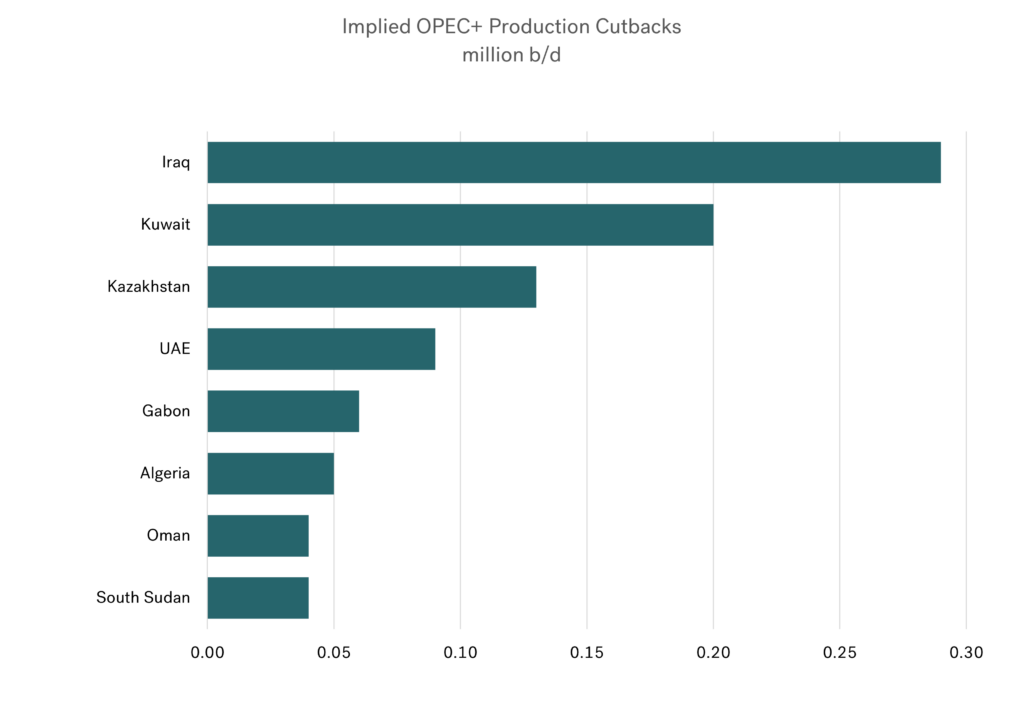

Based on the new quotas and that some OPEC+ members are producing more than their existing allocation, the chart below illustrates the countries that need to cut production and by how much to ‘fall in line’ with the new agreement starting in January.

Source: Integr8 Fuels

Focus is likely to be on the four biggest countries here, and a general view is that not all of these will be fully compliant. Also, the existing agreement excludes Iran and Venezuela, where there are potential increases in production. This means OPEC+ will be doing very well if they can reduce current production by even as much as 0.5 million b/d, despite the headline news of a 2.2 million b/d cutback.

The market still looks bearish

In summarising these reports, geopolitics are always the great unknown. But, based on the prospects for oil demand, increases in non-OPEC production and as we have outlined here, the reality/challenges to OPEC+, the market still looks bearish. The fundamentals are still pointing towards lower bunker prices.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.