Integr8 sees spot LNG bunker demand pick up in evolving market

Integr8 Fuels’ LNG desk has recently traded several LNG stems as a volatile market encourages buyers to seek spot deals to manage their price risk.

LNG bunkering is typically more complex than bunkering of conventional fuels. It requires a very good understanding of the operational, commercial and contractual aspects of LNG deliveries, and Integr8 has been helping several clients through the purchasing process.

Volatility spurs spot trading

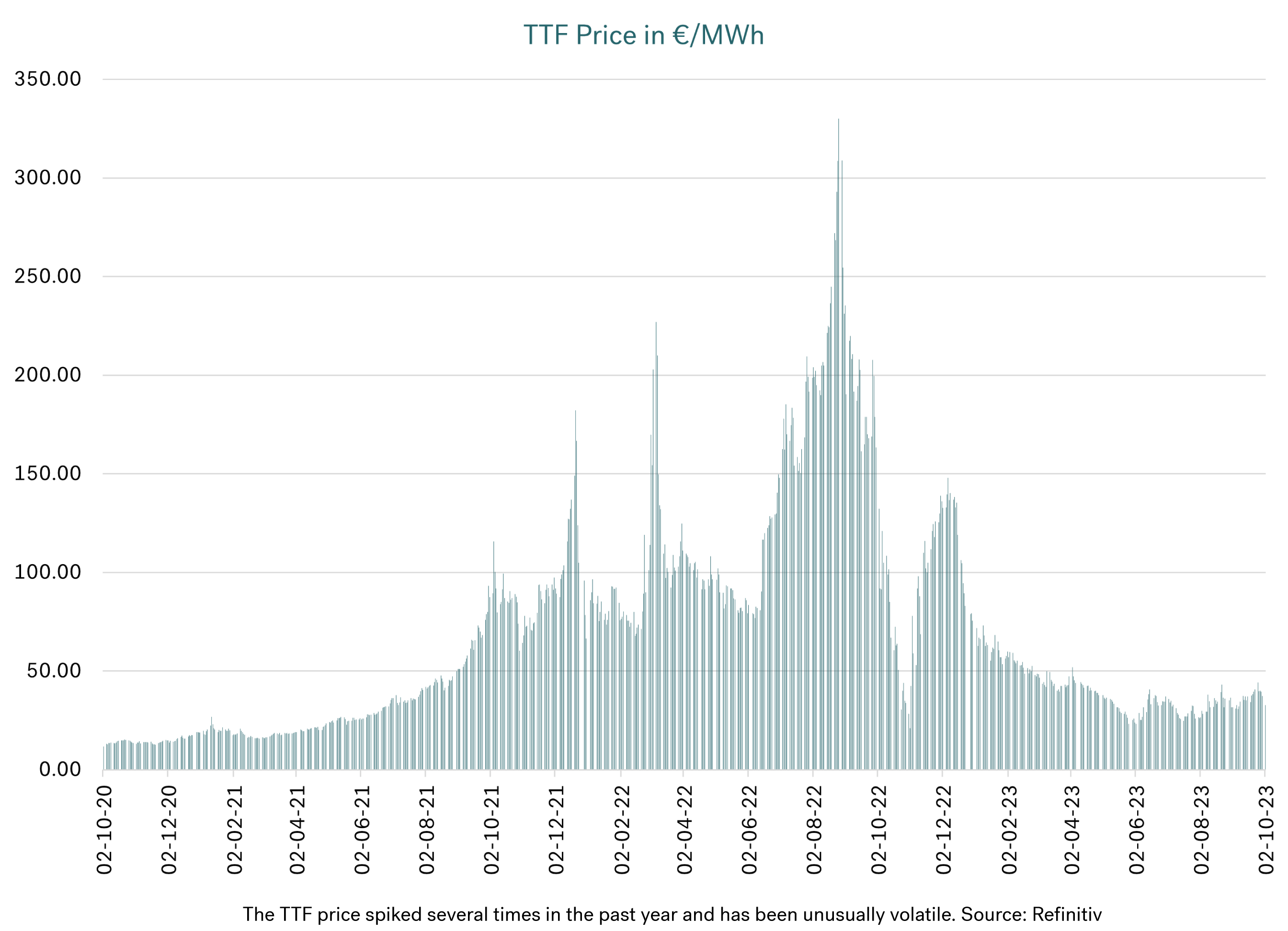

When strike action was announced by workers at two Chevron LNG plants in Australia, it sent shockwaves through the LNG market in September. While these plants primarily produce LNG for exports to Asian markets, the impact on prices was global and Europe’s benchmark TTF price surged on the news. The market feared global supply disruptions in an interconnected LNG supply chain. And this shows just how sensitive the global supply-demand balance has been to supply disruptions after Russia invaded Ukraine.

Volatile LNG prices are here to stay for the time being, but are expected to come down and stabilise at a lower level after 2025, argues Integr8 Fuels business manager Jonathan Gaylor. “We forget that before Russia’s war with Ukraine, LNG prices were competitive against conventional marine fuels and rather stable,” he says.

LNG was priced below €500/mt in Rotterdam’s bunker market until December 2021, when it had risen gradually for about a year. When Russia invaded Ukraine in late February, it started gathering pace and rose rapidly to new highs. A year later, the price had quintupled and peaked at over €2,500/mt. It had gone from a discount to VLSFO to a three-fold premium, and this discouraged owners of dual-fuel vessels from bunkering LNG. Their fuel flexibility came on display and the market saw widespread gas-to-oil switching.

Rotterdam’s LNG price has since come off sharply. It has dipped below LSMGO and traded at parity with VLSFO. Buyers have subsequently readjusted to take advantage of the renewed pricing opportunities, and oil-to-gas switching has become more prevalent again.

LNG and conventional low-sulphur marine fuels alternate between being at a discount to one another. This discourages terming up supply in contracts and has increasingly turned buyers towards the spot market to manage their price risks and costs on a more predictable near-term basis.

A highly volatile and competitive market presents new opportunities for traders to get involved, particularly as the global LNG-capable fleet is set to more than double from just over 400 vessels now to more than 800 by 2028, according to data from classification society DNV.

Container vessels used to make up the vast majority of vessels bunkering LNG. We have recently seen more dual-fuel tramp vessels bunkering. These typically require greater flexibility in timing and location, especially for tankers. Oil and chemical tankers now make up the biggest LNG-capable vessel type, with 116 vessels in operation and another 85 on order, according to DNV data.

Price references vary between suppliers and geographies. It is quite common to link LNG stem pricing to established wholesale oil and gas benchmarks like TTF, JKM, Henry Hub and Brent to cover some exposure to price swings.

There are longer-term Brent or fuel oil price linkage options for LNG, but they will typically come at a premium for buyers. By locking in the delta on a linked price of a certain percentage, LNG prices will have a partial ceiling based on conventional fuels and buyers can pay down the premiums they paid for investments in dual-fuel engines. The rate of payback on dual-fuel vessels is expected to pick up after 2026 as global LNG supply is set to be boosted by huge new volumes from Qatar and the US, according to multiple industry forecasts.

Challenges remain

LNG stems still require longer time to fix and deliver than conventional ones and this is also probably how things will play out in the foreseeable future. In many cases, compatibility studies between delivering and receiving vessels need to be performed to ensure safe and smooth deliveries.

Integr8 has the knowledge and network to identify competitive suppliers and advice buyers on how best to streamline the bunkering process. Having an overview of and ready access to supply intelligence can certainly help to make the bunker planning and delivery process more efficient for buyers.

Outlook

- Gas prices could easily rise on increased heating demand this winter, but will then likely come down again post winter. Especially if this winter proves that there is sufficient supply in Europe and industrial demand remains subdued.

- The global LNG-fuelled fleet is projected to grow faster than the LNG bunker fleet is expanding. This could lead to undersupply of bunker vessels in 2025-2026, when bunker demand is on track to rise above supply capacity and LNG prices become competitive. It could pose challenges to tramp trading vessels looking for timely LNG spot bunker deliveries.

- Looking further ahead, global gas supply is set to rise with production gains in Qatar and the US. Qatar is in the process of a major expansion of its North Field and two new LNG export terminals. A surge in exports is expected to boost US gas investments and production capacity to new highs over the next decade, with Europe as a key outlet.

Contact the Integr8 Fuels LNG bunker desk:

Email: LNG@integr8fuels.com

Tel: +44 20 7943 5408

Address: Zig Zag Building, 70 Victoria St, London SW1E 6SQ, UK

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.