The IEA has just published its 5-year outlook; What does it mean for the bunker market?

Overview

The IEA has just published its annual medium-term outlook for the oil industry. This looks five years ahead and covers the fundamental aspects of the industry, from demand and supply to refining and trade, plus a view on the outlook for Brent crude oil prices.

In this report, we analyse the key features of the oil market (which will set the underlying price for oil) and specific issues for the bunker sector, including pricing pressures in our sector and the potential overall size of our market; will it continue to grow?

What are the prospects for oil demand in the next 5 years?

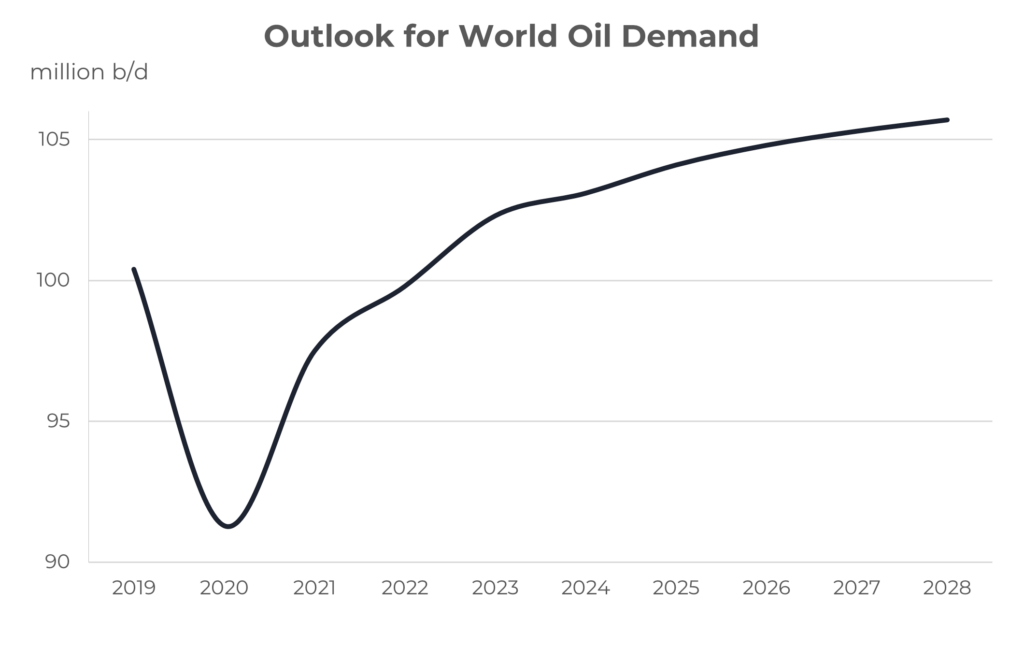

The first thing to say is that the IEA sees oil demand continuing to grow throughout the period, but the rate of growth is forecast to slow considerably.

Source: Integr8 Fuels

We are clearly still in the post-pandemic ‘return to normal’, but we are almost there; it is probably only international air travel from China that has to be ‘normalised’, and that will come soon. In this context, world oil demand is forecast to rise by 2.4 million b/d this year. Next year demand is forecast to rise by 0.8 million b/d, and is then projected to slow to only 0.4 million b/d growth by 2028. This slowdown in demand growth is principally down to energy transition to electric vehicles (EVs), with one in seven new car sales last year being EVs. This is only increasing and also being driven by China. However, greater efficiencies in the combustion engine are also a significant contributing factor.

Driving, air travel and shipping activity are all forecast to continue rising, but EVs and more efficient engines mean any increase in oil demand is much lower than otherwise expected. Efficiency is a key word across most sectors, with government backed strategies targeting net zero emissions by 2050. We are clearly involved ourselves through the IMO’s drive to reduce greenhouse gas emissions through the Energy Efficiency Design Index (EEDI) on new ships.

So, by 2028 there is still growth in oil demand, but only just and the writing is on the wall for peak oil demand to be reached sometime soon after this, and then go in to decline.

Asia is the focus for demand growth

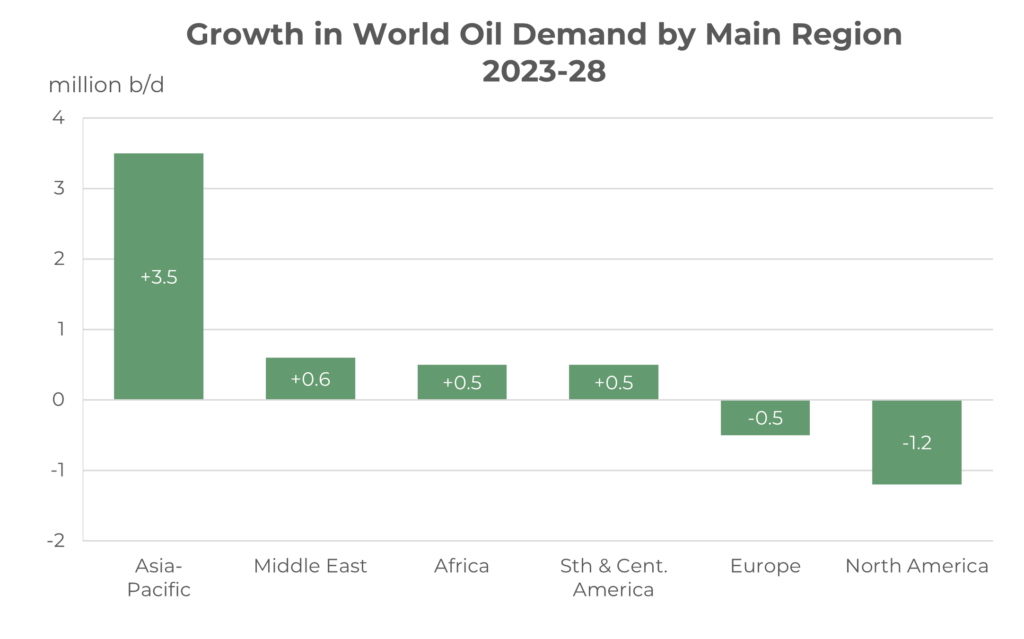

Simply put, growth in oil demand over the next five years is centered on Asia. China alone accounts for 1.5 million b/d of the growth, followed by India, at 0.8 million b/d; each of these countries is greater than any other entire region.

Source: Integr8 Fuels

It is shifts in the advanced economies of the US and Europe where demand for oil is falling.

Will oil supply be able to match oil demand?

The IEA does include a detailed analysis of future oil supply, with the bottom line that there is enough new oil to meet the expected gains in demand. The key players in additional oil production are the US, Brazil and Guyana in the non-OPEC+ countries, and Saudi Arabia, UAE and Iraq in the OPEC+ countries.

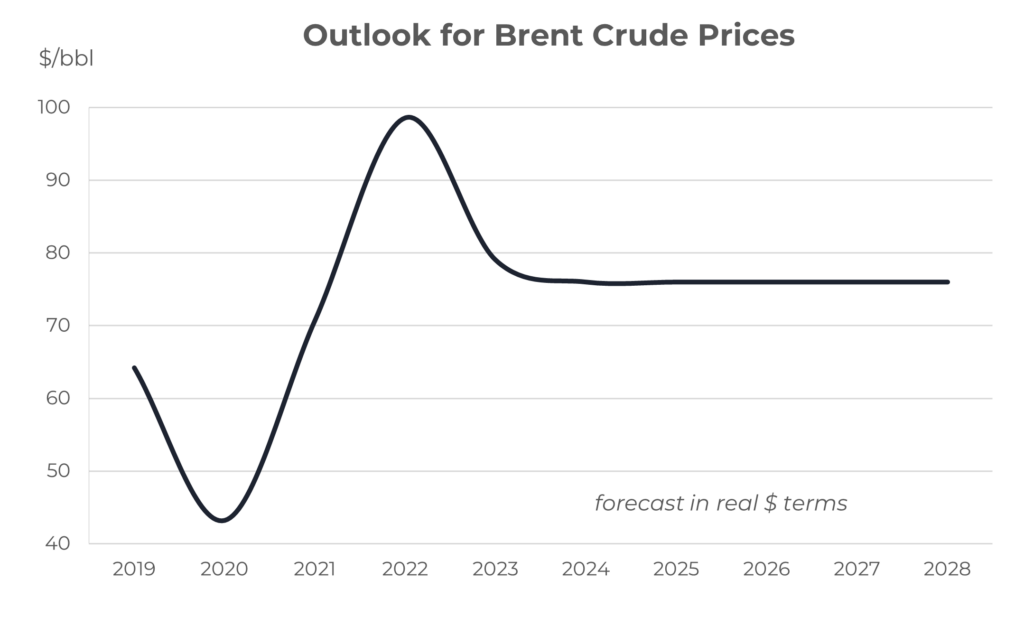

As a base forecast, the IEA envisages spare oil production capacity at close to 4 million b/d throughout the period. This implies no major price hikes in their 5-year outlook, and an underlying Brent price around $76/bbl (in real $ terms) and close to current levels.

Source: Integr8 Fuels

A straight-line forecast may be concerning, but their starting point is that there will be adequate supplies to meet demand. However, there are always major caveats, with the economy a huge variable, OPEC+ strategy a key player and political events potentially damning everything; but you have to start somewhere, and these ‘events’ are largely unforecastable.

What are the products in demand?

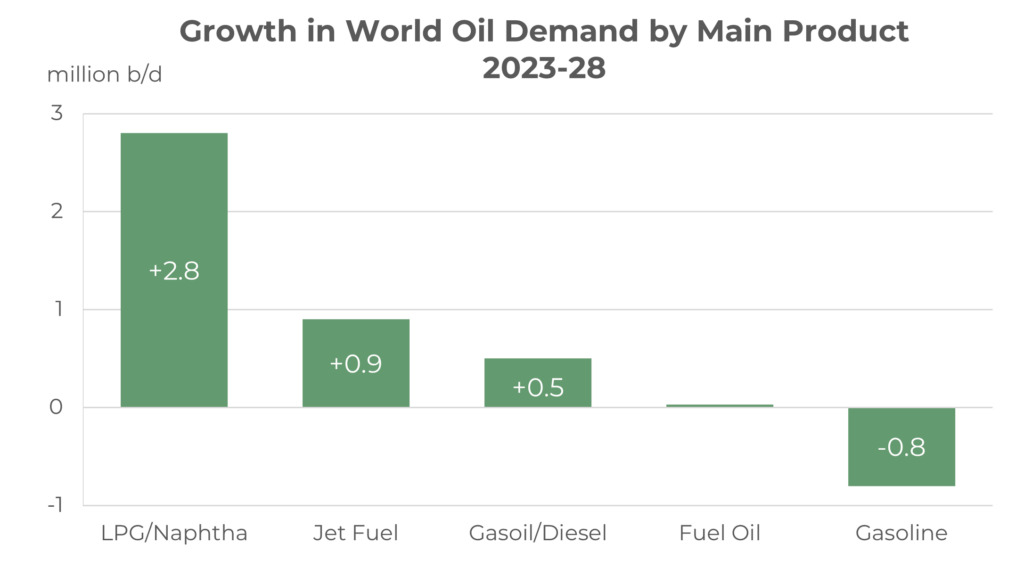

There is always a lot going on in the oil sector, but the backdrop to the IEA’s 5-year forecast is strong growth in demand for petrochemicals (LPG and naphtha) and jet fuel, but declines in the demand for gasoline from now on and declining demand for road transport in general towards the end of the period. Interestingly, the IEA sees demand for bunkers continuing to rise (see below). The magnitude of these changes is clearly seen in the graph below.

Source: Integr8 Fuels

The growth in jet fuel demand (and the smaller gains in gasoil) are crucial features for us in bunkers, as these will have a direct impact on refining balances, leading to pressures on VLSFO supply and pricing.

The nuance for us may not be the absolute price of crude but potential constraints in the refining industry leading to a squeeze on middle distillate supplies and prices. This would push the relative price of VLSFO higher versus crude.

What about the size of the bunker market?

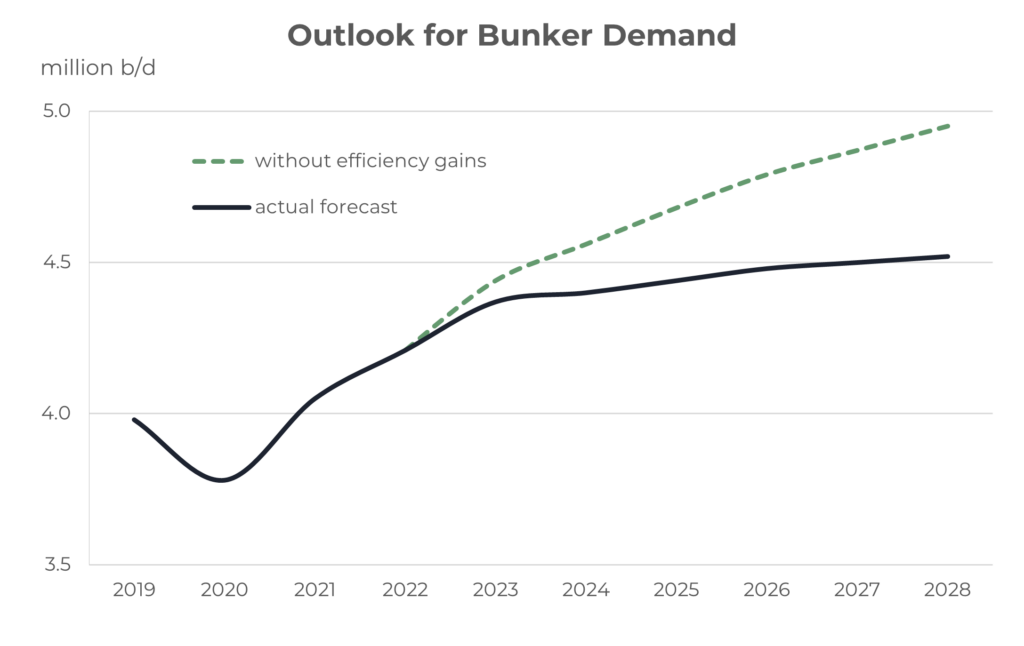

The IEA forecast seaborn trade to increase by 2-3% p.a. over the next 5 years. Ordinarily this would give a strong push on the overall size of our market, up from around 4.4 million b/d this year to around 4.9 million b/d by 2028.

However, like everywhere else, we know there is a huge drive towards greater efficiencies in our industry as part of the commitment towards ‘net zero’. With phases 1 and 2 of the EEDI kicking in during 2015 and 2020, and phase 3 starting in 2025, the shipping fleet is increasingly more efficient. The net result is bunker demand is forecast to rise not by 0.5 million b/d, but by around 0.1 million b/d by 2028. Nonetheless, the size of our market is likely to be relatively stable over the next 5 years (unlike the gasoline market and road diesel markets, which are in decline).

Source: Integr8 Fuels

Source: Integr8 Fuels

What is the outcome for us?

So, for us in the bunker market looking at it day-to-day, or week to week, it is positive, and we may actually see a very slight increase in the amount of activity taking place over the next 5 years. For those planners in our business, we are potentially looking at a ‘decent’ market size in the next 5 years.

Beyond 5 years it is more difficult, with the fleet becoming more efficient over time and talk of alternative fuels. Add to this the likelihood of more environmental legislation and the potential for new technologies (as we have seen in the car sector), and the longer-term bunker market is certainly an interesting one. Based on the latest IEA report, the bunker market looks pretty robust in terms of volumes and, at least as a base case, we are looking at annual average Singapore VLSFO prices at around $600-650/mt over the next 5 years. As always, let’s see what happens!

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.