One story to push prices higher; Now a number of stories to bring them back down

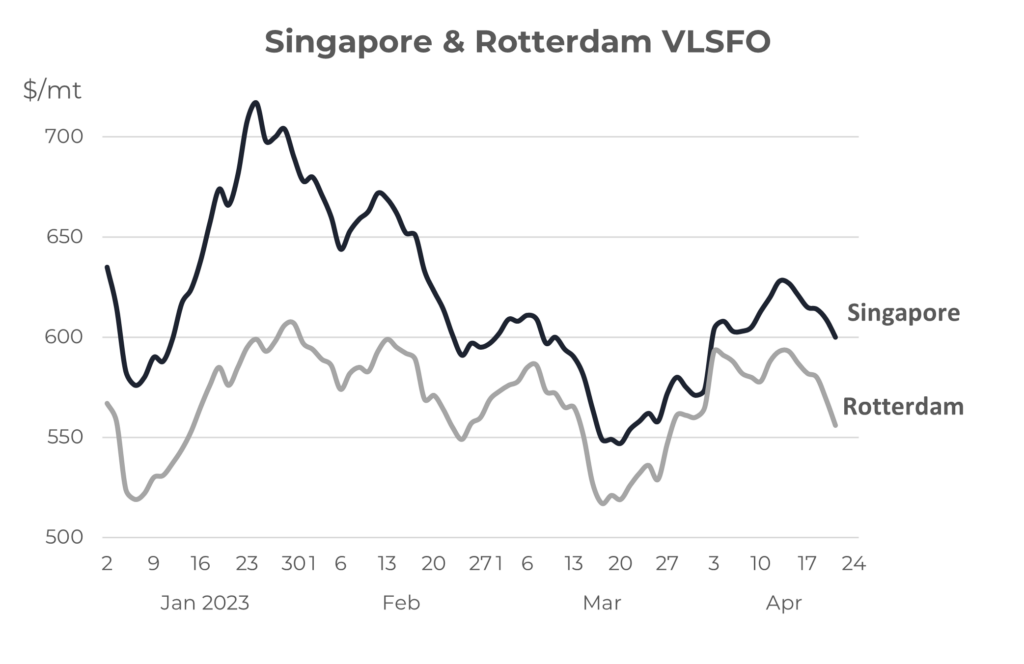

This time last month we wrote about the experts’ view that although prices had been falling for two months, their underlying outlook was still largely bullish. They were right, but perhaps for the wrong reasons; VLSFO was up around $75/mt (15%) over the last week of March and in to the first two weeks of April.

Source: Integr8 Fuels

OPEC+ cutbacks drove prices higher; not increases in oil demand

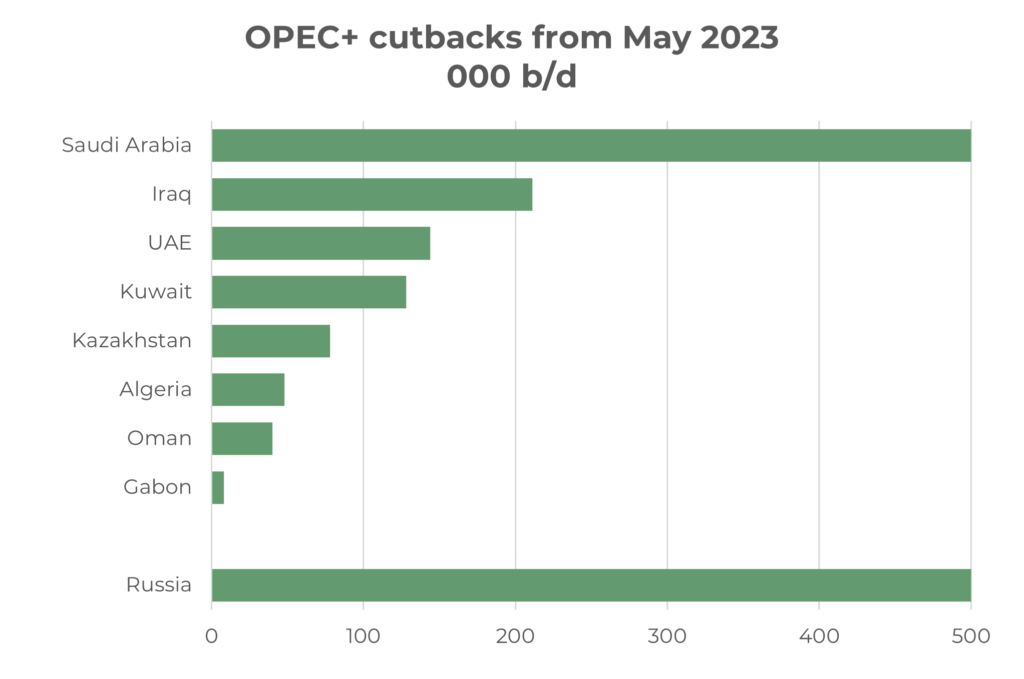

Expectations of prices moving higher have generally been based on forecasts of stronger economic activity in China and some other Asian countries, with this pulling up global oil demand. However, the main trigger to the recent price hike was the “precautionary measure” taken by some of the OPEC+ members, to make voluntary cuts in oil production amounting to 1.2 million b/d.

Source: Integr8 Fuels

This is on top of an announcement by Russia to cut its production by 0.5 million b/d. The impact of Russian statements like this are always questioned and more importantly, what does it mean for exports. If they maintain exports for revenue and cut supplies to domestic markets, it makes no difference at all to the oil balance and price projections.

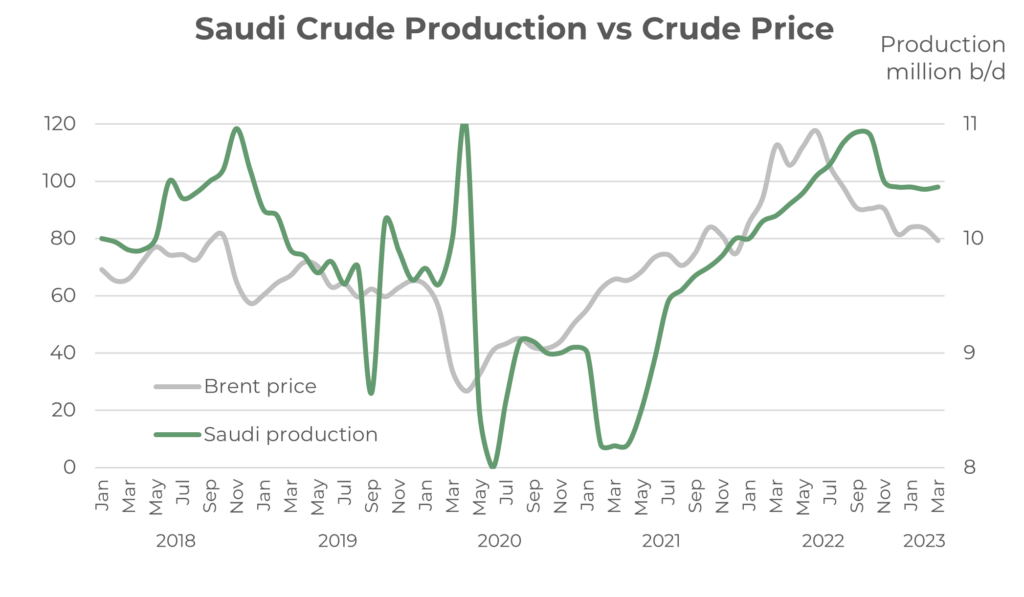

When prices have been ‘under threat’ OPEC has often made cuts

It is definitely worth understanding OPEC strategy, as this can have a major impact on prices, and there could well be increasing pressures on them to cut output again. One of key issues for the enlarged OPEC+ group is that production in many countries is already below their announced quota levels. This means that any agreed cutbacks by these members is meaningless in terms of impact on oil supplies. As with the latest announcement, it does therefore fall to the ‘big’ Middle East producers to set strategy and shifts in production, and of these Saudi Arabia is the principal player.

Russian exports stay the same; just going to different places

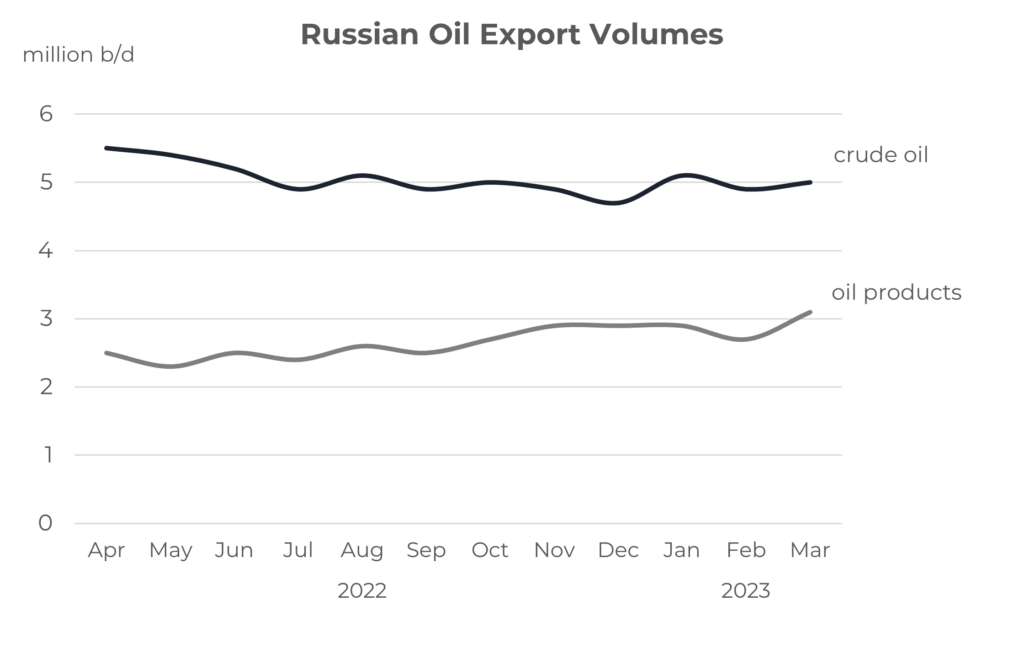

The dilemma for these Middle East producers is illustrated in the following two graphs. On the face of it, the first doesn’t appear to be very interesting, with two near straight lines. But what this does show is perhaps surprising, in that Russian crude exports have been maintained at around 5 million b/d throughout the past year. This is even with the political fallout from the war, and after the December 2022 EU ban on crude imports and the G7 imposed $60/bbl price cap on crude exports.

Source: Integr8 Fuels

On the products side, Russian export volumes are higher than a year ago.

Russia needs oil revenues

There is no doubt that Russian oil export revenues are down sharply since the start of the war, but perversely, oil revenues were boosted because of the war and the resulting surge in oil prices.

Today, maintaining oil export volumes (even under the G7 price cap), is still a way of Russia generating significant national revenue. To put this in context, Russian oil revenues were estimated at around $12 billion in March; this compares with average monthly revenues of around $15 billion in 2021. Perhaps not that big a fall in light of the political squeeze being imposed on Russia.

The challenge for the Middle East

The dilemma for the Middle East oil producers has been that Russia has been able to maintain oil export volumes, but has lost their biggest market outlet of Europe; down by 2.7 million b/d, from 3.5 million b/d in April 2022 to only 0.8 million b/d in March 2023. This has meant a swing of some 2-3 million b/d of Russian oil from Atlantic markets to Asian markets.

The known big gain has been in exports to India, which are up by 1 million b/d, but a lot of the 2 million b/d increase in other and unknown destinations is believed to be in the East.

Source: Integr8 Fuels

Middle East oil producers have responded

So, now there is a huge challenge for Middle East producers, and Saudi in particular. There has been the push from West to East on Russian crude sales and at the same time the G7 price cap has meant fob price discounts of $35-40/bbl on Urals sales to these Asian customers. Unfortunately, it’s not an easy, straight swap for Middle East exporters to fill to gap in Europe left by the loss of Russian crude, as the European refining sector is not as capable of running so much heavy and high sulphur crudes. Put simply, for the Middle East OPEC countries it is either discount to compete in Asia or cut production to defend prices. They are unlikely to compete; at the end of the day, it is all about national revenues and these are much better defended by supporting prices though ‘limited’ production cutbacks rather than aggressive pricing to maintain production.

For every action there is a reaction

The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. The war in Ukraine has triggered EU and US embargoes on Russian oil imports. Russia has sought to maintain oil exports to generate revenues and the only way to do this has been to sell more oil to Asian customers and at discounted prices. Middle East producers have felt the ramifications of increased competition in Asian markets and also looked to support prices by cutting production. Higher oil prices are likely to add to global inflationary pressures and higher inflation is then likely to create a government/central bank response by raising interest rates. This can then dent future oil demand growth and potentially put a more bearish sentiment on oil prices.

As always, the impact of an action or story only tends to lasts for so long, and then another story comes along. The announcement of cuts in OPEC+ production pushed prices higher for almost two weeks. But now the news stories are more on the bearish side. Current product markets are generally well supplied and refinery margins are typically falling (apart from Asian jet fuel). Economic forecasts continue to be revised downwards, with the IMF recently lowering their outlook for growth and with it, their outlook for oil prices. So, after the $7/bbl hike in Brent front month futures following the announced OPEC+ production cuts, prices have now fallen back by around $6/bbl and close to their earlier levels.

Sitting on the fence?

People are still talking about a tighter fundamental market in the second half of this year, but this is based on growth in the Chinese and Asian markets. For now, the sentiment and stories definitely feel more to the bearish side of things.

In terms of managing oil supply in the short term, Saudi Arabia is the main player. As shown in the graph below, they have been prepared to cut production when prices are ‘low’, and of course around the time of covid shutdowns. Before this, when Brent prices fell to around $60/bbl (which is equivalent to around $475/mt for Singapore VLSFO), Saudi cut output to as low as 9.5 million b/d; they are currently moving from a 10.5 to 10.0 million b/d target. On this basis Saudi Arabia could make further cuts to those already announced.

Source: Integr8 Fuels

Hence, understanding and watching OPEC+ (and Saudi Arabia in particular) is an important part of our market. We have to see if they are prepared to cut production again if expectations of economic growth fail and Brent prices fall towards $60/bbl.

Steve Christy

Research Contributor

E: steve.christy@integr8fuels.com

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.