Europe & Africa Market Update 18 Apr 2025

Bunker prices in most European and African ports have increased, and LSMGO supply is good in the ARA hub.

IMAGE: Oil refinery and storage tanks in the Port of Rotterdam, Netherlands. Getty Images

IMAGE: Oil refinery and storage tanks in the Port of Rotterdam, Netherlands. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($9/mt), Durban ($7/mt) and Rotterdam ($1/mt)

- LSMGO prices up in Rotterdam ($12/mt) and Gibraltar ($6/mt)

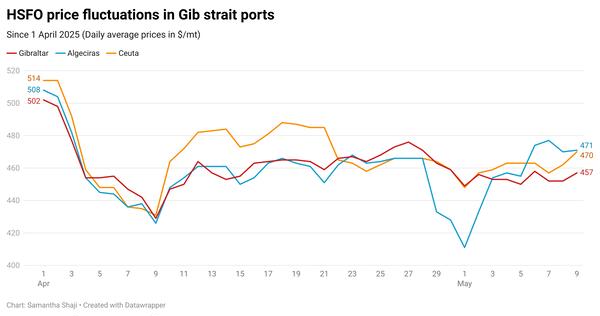

- HSFO prices up in Rotterdam ($9/mt) and Durban ($3/mt), and down in Gibraltar ($3/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $16/mt to $291/mt

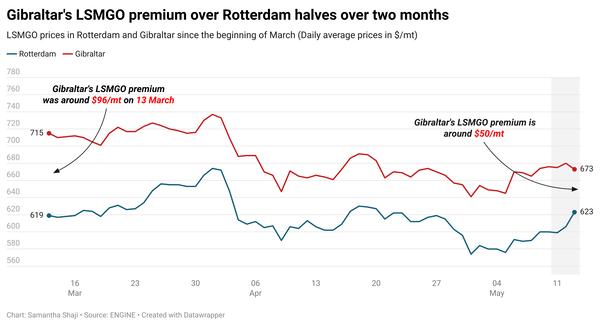

Bunker prices across all grades have risen in Rotterdam. LSMGO supply is good in the port and in the wider ARA hub, with recommended lead times of 3-5 days, a source says. Rotterdam’s LSMGO price is currently at a $61/mt discount to Gibraltar.

VLSFO and LSMGO prices in Gibraltar have increased some in the past day, while its HSFO price has edged down. A prompt lower priced HSFO stem fixed in Gibraltar in the past day has contributed to drag the benchmark down. The port’s HSFO price premium over Rotterdam has narrowed by $12/mt, to $33/mt now.

Bunker supply is good in Gibraltar, with recommended lead times of 4-8 days for all grades.

Bunker operations are running smoothly in Gibraltar and Algeciras today amid conducive weather conditions, according to port agent MH Bland.

Brent

The ICE Brent Futures market is closed for trading today on account of Good Friday holiday. Front-month ICE Brent closed at $67.96/bbl on Thursday, which was $1.56/bbl higher than the price at 09.00 GMT on the day.

Upward pressure:

Brent futures traded firm this week, drawing some support from recent geopolitical events that have rattled global markets.

Last week, the Donald Trump-led US government implemented a temporary pause on country-specific tariffs for most trade partners for 90 days. This development eased some demand concerns, with global investors’ focus fixed on trade talks between Washington and its allies.

“Crude oil edged higher on the prospects of a de-escalation in the trade war,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

On the supply side, Washington announced stricter sanctions on several companies and vessels responsible for facilitating Iranian oil shipments to China. Brent’s price moved higher following the announcement.

OPEC+ revealed revised compensation plans from seven members yesterday, aiming to make deeper production cuts in the coming months for previous overproduction.

The seven OPEC+ members will collectively cut production by a total of 4.6 million b/d through June 2026, the coalition said.

Downward pressure:

Brent crude felt some downward pressure from easing geopolitical tensions, following a high-level meeting between representatives from the US and Iran last week.

Both parties held "positive" and "constructive" talks in Oman, in an effort to address concerns over Tehran’s advancing nuclear programme, as President Trump warned earlier of a potential military action should negotiations fail to yield a deal, according to Reuters. Iran and the US are set to hold another round of talks in Rome this weekend.

Market analysts suggest that a favourable outcome could prompt Washington to ease its tough sanctions on Tehran’s oil exports, which in turn could put downward pressure on oil prices.

Earlier this week, OPEC released its monthly oil market report, which presented a subdued outlook for global oil demand.

Global oil consumption in 2025 is expected to average 105.05 million b/d, OPEC said. Previously, it expected consumption to average around 105.2 million b/d this year.

Commercial US crude oil inventories gained by 515,000 bbls to touch 443 million bbls for the week ending 11 April, according to data from the US Energy Information Administration (EIA).

A rise in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.