Europe & Africa Market Update 22 Nov 2024

Bunker benchmarks in European and African ports have followed Brent’s increase, and Rotterdam’s HSFO discount to Gibraltar has widened.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($5/mt), Rotterdam ($4/mt) and Durban ($1/mt)

- LSMGO prices up in Gibraltar ($10/mt) and Rotterdam ($6/mt)

- HSFO prices up in Gibraltar ($7/mt), and down in Rotterdam ($6/mt)

- Rotterdam B30-VLSFO at a $140/mt premium over VLSFO

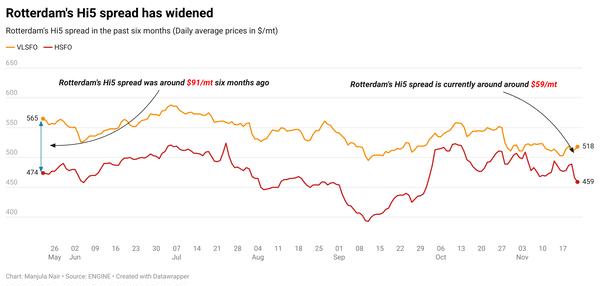

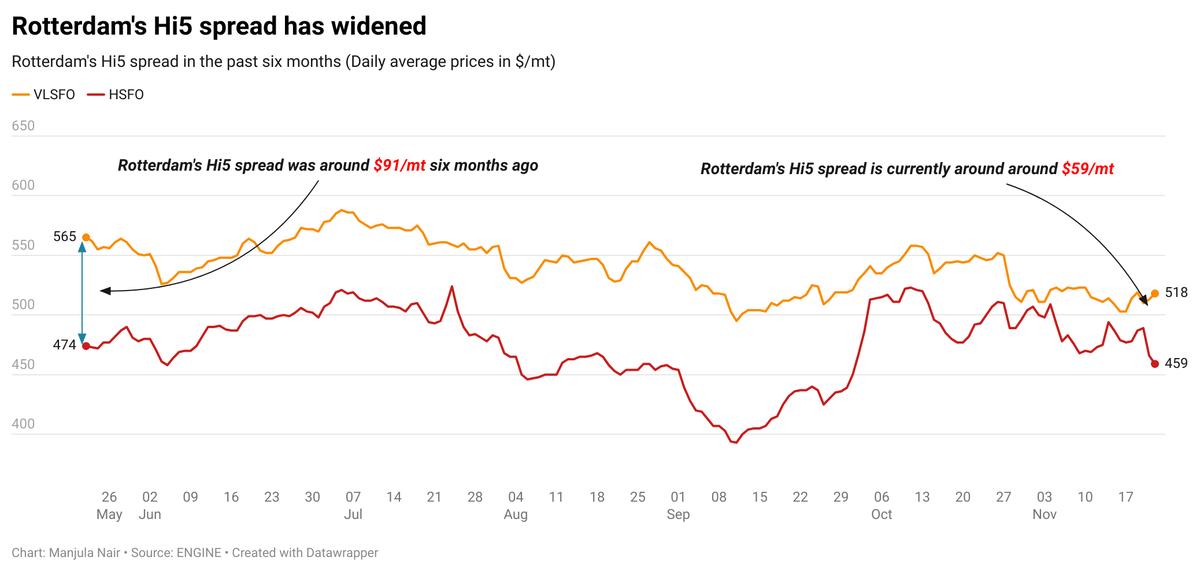

Rotterdam’s HSFO price has declined for the second consecutive day. The port's VLSFO price has gone up, widening Rotterdam's Hi5 spread to $59/mt.

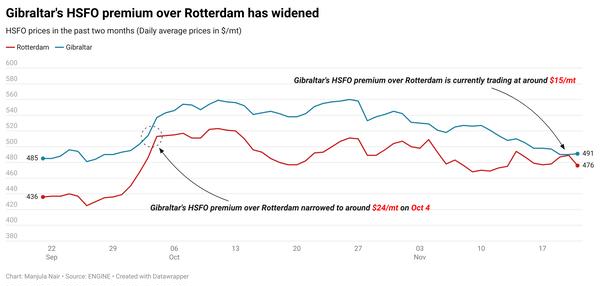

In contrast, Gibraltar’s HSFO price has gained in the past day. These price moves have widened Rotterdam’s HSFO discount to Gibraltar by $13/mt to $43/mt now, wider than last week when the discount was at $16/mt.

Six vessels are waiting for bunkers in Gibraltar today, up from five yesterday, according to a source. Rough weather is forecast in Gibraltar today and over the weekend, which could hamper bunkering in the port.

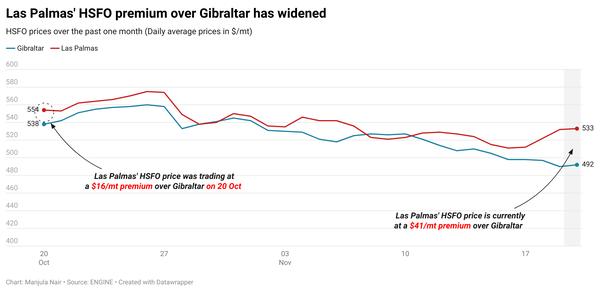

A lower-priced non-prompt HSFO stem booked in Las Palmas has contributed to keep the port's HSFO benchmark steady. HSFO remains in short supply for a few suppliers with lead times of 7-10 days advised. Las Palmas’ HSFO price is currently trading at a $18/mt premium over Gibraltar’s.

Brent

The front-month ICE Brent contract has gained $1.06/bbl on the day, to trade at $74.73/bbl at 09.00 GMT.

Upward pressure:

The escalating Russia-Ukraine war continues to drive up Brent crude prices.

Russia has intensified its offensive after Britain and the US permitted Ukraine to target Russia with their weapons.

On Thursday, Russian President Vladimir Putin announced that Russia had fired a ballistic missile at Ukraine and warned of a potential global conflict, increasing fears of oil supply disruptions, according to a Reuters report.

“This indicates the war has entered a new phase, raising concerns around disruptions to supply,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

Oil prices are “awaiting further developments in the tit-for-tat escalation in warfare between Kyiv and Moscow since last weekend,” Vandana Hari, founder and analyst at VANDA Insights, added.

Downward pressure:

Rising US crude stocks have exerted some downward pressure on Brent futures.

The US Energy Information Administration (EIA) reported a 545,000-bbl increase in commercial crude oil inventories, bringing the total to 430 million bbls for the week ending 15 November.

Market analysts are expecting the EIA to report another rise in US crude stocks next week.

By Manjula Nair and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.