Europe & Africa Market Update 21 Nov 2024

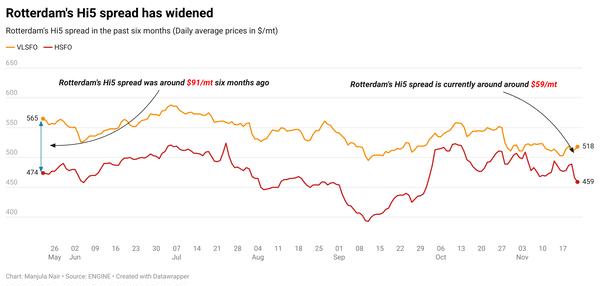

Regional bunker benchmarks have shown mixed market directions, and Rotterdam’s Hi5 spread has widened.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($2/mt), and down in Durban ($10/mt) and Gibraltar ($2/mt)

- LSMGO prices up in Rotterdam ($3/mt), and down in Gibraltar ($4/mt)

- HSFO prices up in Gibraltar ($3/mt), and down in Rotterdam ($25/mt)

- Rotterdam B30-VLSFO at a $122/mt premium over VLSFO

Rotterdam’s HSFO price has fallen by a steep $25/mt in the past day, while the port’s VLSFO price has gone up. These diverging price moves have doubled Rotterdam’s Hi5 spread from $21/mt yesterday to $48/mt now.

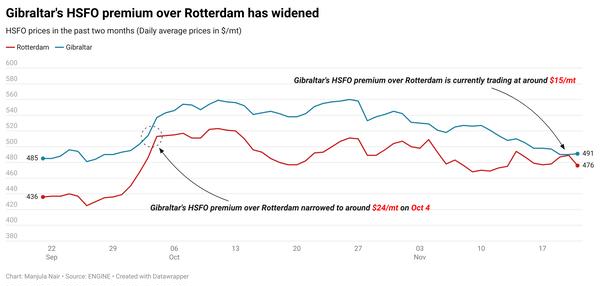

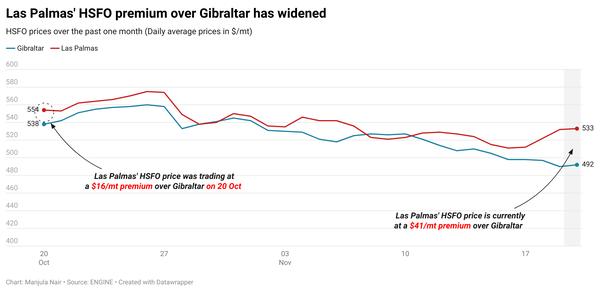

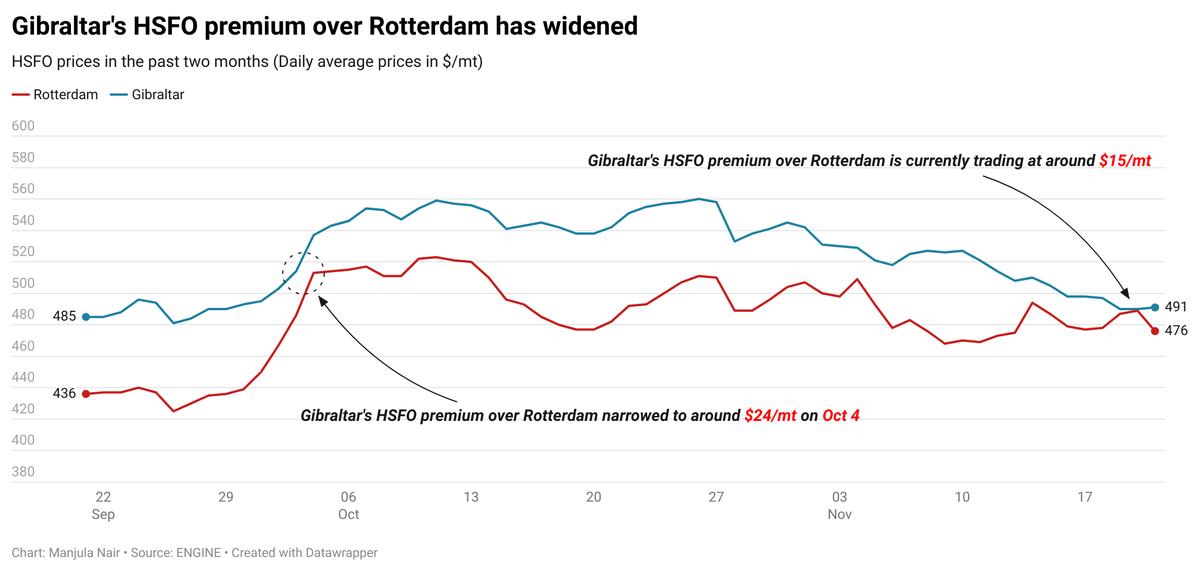

Gibraltar’s HSFO premium over Rotterdam has widened to $15/mt, after trading at near-parity with Rotterdam’s HSFO since Tuesday. HSFO supply is tight in Gibraltar, with some suppliers unable to accommodate stems for very prompt delivery dates, a trader said. A supplier is only able to supply the grade for delivery dates after 28 November.

Congestion has eased in Gibraltar, with five vessels waiting for bunkers today, down from 13 yesterday, a source said.

HSFO and VLSFO supply tightness has eased slightly in Spain’s Barcelona. Lead times have reduced from 7-10 days in the past week to 5-7 days now. Also, LSMGO supply remains good and lead times remain unchanged at 5-7 days. Wind gusts of 24-32 knots are forecast for today and tomorrow, which could complicate bunker deliveries there.

Brent

The front-month ICE Brent contract has dipped $0.13/bbl on the day, to trade at $73.67/bbl at 09.00 GMT.

Upward pressure:

Brent's price has risen amid renewed supply concerns stemming from escalating tensions between Russia and Ukraine.

On Wednesday, Ukraine fired British cruise missiles into Russia, following the use of US missiles the previous day. Russia warned the use of Western weapons to strike targets deep within its territory would represent a significant escalation in the conflict, Reuters reported.

“An escalation in the conflict in Ukraine lifted Brent crude oil prices due to concern about disruptions to oil supply,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“For oil, the risk is if Ukraine targets Russian energy infrastructure, while the other risk is uncertainty over how Russia responds to these attacks,” analysts from ING Bank added.

Downward pressure:

Brent futures felt some downward pressure after the release of weekly oil data from the US Energy Information Administration (EIA), which showed an increase in US crude inventories.

According to the EIA, commercial crude oil inventories rose by 545,000 bbls, reaching 430 million bbls for the week ending 15 November.

Brent’s gains were “reversed after a bearish inventory report from the EIA,” Hynes noted.

Norway's Equinor announced on Wednesday that it fully restored output capacity at the Johan Sverdrup oilfield in the North Sea after a power outage earlier this week, Reuters reported. The news added more downward pressure on Brent futures.

By Manjula Nair and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.